Unspent transaction outputs (UTXOs) are an integral component of Bitcoin’s structure, essentially serving as the building blocks of the blockchain. As its name suggests, each unspent transaction output represents a discrete unit of Bitcoin that hasn’t been spent, originating from the conclusion of a previous transaction. They form the foundation of Bitcoin’s ledger, tracking the specific outputs of transactions until they’re used in a new one.

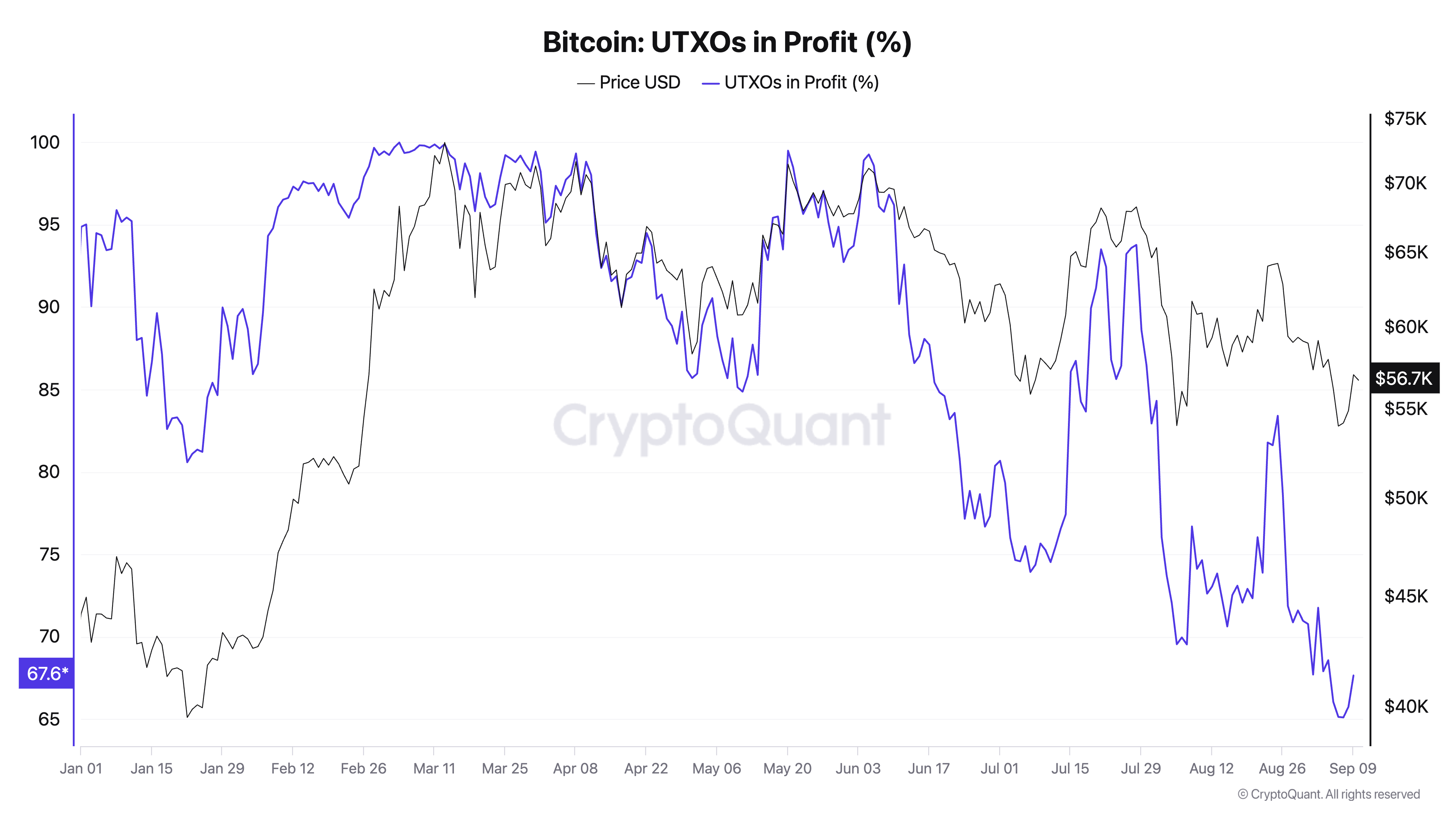

Analyzing UTXOs usually involves tracking whether they’re in profit, meaning the BTC associated with them was acquired at a price lower than its current value. Thus, the percentage of UTXOs in profit is a crucial indicator of market sentiment and the overall profitability of Bitcoin holders. A high percentage signals a strong market where most investors see gains, while a lower percentage points to losses and reflects a more bearish environment.

UTXOs differ from Bitcoin’s total supply in a critical way. While the percent of UTXOs in profit tracks individual transaction outputs, the percent of Bitcoin’s supply in profit looks at the total Bitcoin supply and whether the coins are currently above or below their acquisition cost. UTXOs can be numerous and reflect various sizes of Bitcoin holdings, from small fractions to larger amounts.

Conversely, when measuring supply in profit, the focus is on the aggregate volume of Bitcoin, treating the total supply as a whole rather than individual pieces of the blockchain ledger. This difference explains why the percent of UTXOs in profit can diverge from the percent of supply in profit—UTXOs, as smaller units, might be skewed by the activity of smaller traders. In contrast, supply in profit gives a broader picture of the overall state of the market.

For example, when Bitcoin’s price surged at the beginning of March, both UTXOs in profit and the supply in profit hit their year-to-date highs, with both metrics nearing 100%. At this point, nearly all Bitcoin, regardless of how it was distributed across UTXOs or in total supply, was in profit, reflecting the bullish environment that came with Bitcoin nearing $73,000. This period represents an optimal state for holders, with minimal losses and maximum market confidence.

Meanwhile, drops in Bitcoin’s price led to a drop in the percentage of UTXOs and supply in profit. The percentage of UTXOs in profit hit a YTD low of…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…