The Bitcoin price has surged past the $71,000 mark today. Over the past five days, Bitcoin’s price has rallied by more than 8.5%, climbing from $65,600 to as high as $71,118 on October 29. In the last 24 hours alone, the BTC price has increased by 3.8%. This upward momentum can be attributed to four key factors:

#1 Bitcoin ETFs Attract Massive Inflows

The surge in Bitcoin’s price is closely linked to substantial inflows into Bitcoin Exchange-Traded Funds (ETFs). Yesterday witnessed massive ETF flows totaling $479.4 million. BlackRock led the inflows with $315.2 million, followed by Fidelity at $44.1 million, Ark with $59.8 million, and Bitwise at $38.7 million. These significant investments coincided with Bitcoin’s price movement from $68,000 to over $71,000.

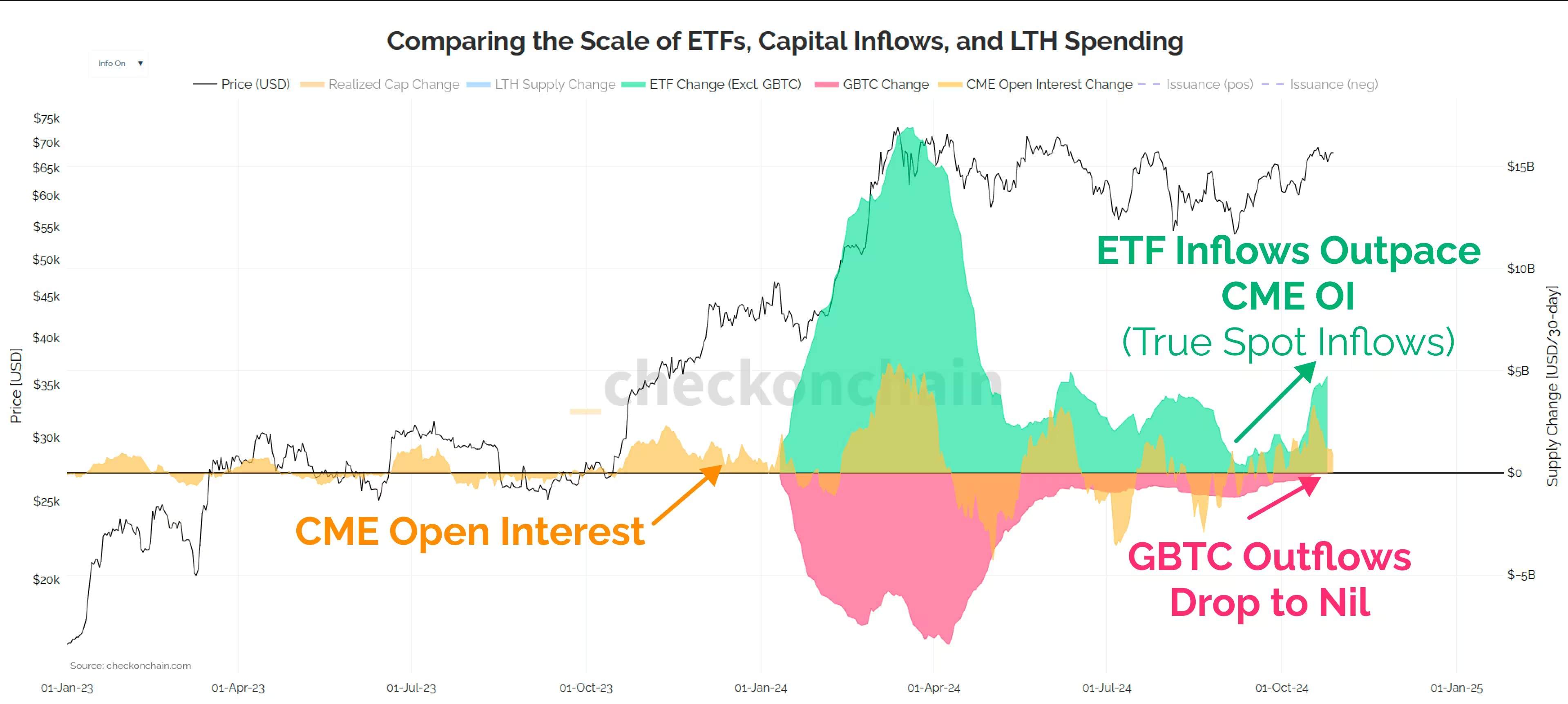

Leading on-chain analyst James “Checkmate” Check highlighted a divergence between Bitcoin ETF inflows and CME Open Interest. He noted “We have a divergence between Bitcoin ETF Inflows and CME Open Interest. ETF Inflows are ticking meaningfully higher, CME Open Interest is up, but not as much GBTC outflows are also minimal. We’re seeing true directional ETF inflows, and less so cash and carry trades.”

The divergence suggests that investors are favoring direct exposure to Bitcoin through ETFs rather than engaging in cash and carry trades involving futures contracts. The carry trade strategy in the context of US spot Bitcoin ETFs and CME futures involves buying the ETF (tracking the spot price of Bitcoin) and simultaneously shorting Bitcoin futures on the CME.

This approach aims to capitalize on price differences when futures trade at a premium to the spot price (contango). The notable shift toward ETFs indicates a bullish sentiment among investors, anticipating further price appreciation.

#2 The “Trump Trade”

Political developments are also influencing Bitcoin’s recent rally. Singapore-based QCP Capital commented on the impact of former President Donald Trump’s interview on the Joe Rogan Experience podcast, which has gained over 32 million views and driven his Polymarket odds above 66%. Despite “crypto” being touted as the “Trump Trade,” Bitcoin’s correlation with Trump’s potential election victory seems to fuel the Bitcoin price rally.

QCP Capital also noted that Bitcoin is up only 8% this “Uptober,” compared to an…

Click Here to Read the Full Original Article at NewsBTC…