Bitcoin (BTC) might have displayed strength by quickly recovering from the $25,500 support level on June 6, but that doesn’t mean that breaking above $27,500 will be an easy task.

Investors still expect stricter regulatory scrutiny after FTX’s bankruptcy in Nov. 2022, including the recent ones against Coinbase and Binance.

A total of 8 cryptocurrency-related enforcement actions have been undertaken by the U.S. Securities and Exchange Commission (SEC) over the past 6 months. Some analysts suggested the SEC is attempting to redeem itself for failing to police FTX by taking action against the two leading exchanges.

Additionally, looking at a wider angle, investors fear that a global recession is imminent, which limits the upside of risk-on assets such as stocks, cryptocurrencies, and emerging markets.

The Euro zone entered a recession in the first quarter of this year, according to revised estimates from the region’s statistics office, Eurostat, on June 8. A poor economic performance might limit the European Central Bank’s ability to further increase interest rates to tackle inflation.

Billionaire Ray Dalio, founder of Bridgewater Associates, said the U.S. is seeing stubbornly high inflation along with elevated real interest rates. Dalio warned of an excess debt offer amid a shortage of buyers, which is especially concerning since the U.S. government is desperate to raise cash after the debt ceiling was hit.

Recent macroeconomic data has been mostly negative, especially after China announced a 4.5% decline in imports year-over-year on June 6. Furthermore, Japan posted a 0.30% quarter-over-quarter gross domestic product contraction on June 7.

Let’s look at Bitcoin derivatives metrics to better understand how professional traders are positioned amid the weaker global environment.

Bitcoin margin and futures favor bullish momentum

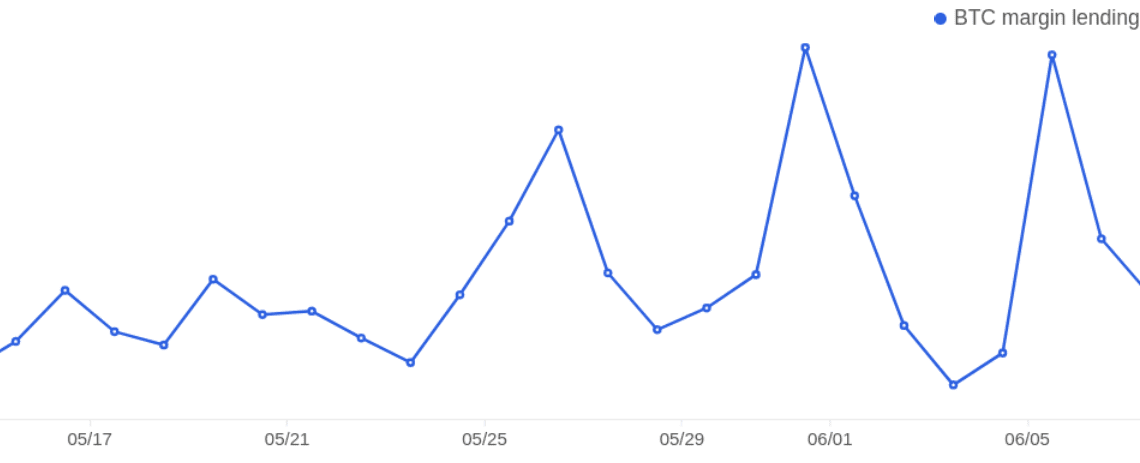

Margin markets provide insight into how professional traders are positioned because they allow investors to borrow cryptocurrency to leverage their positions.

OKX, for instance, provides a margin-lending indicator based on the stablecoin/BTC ratio. Traders can increase their exposure by borrowing stablecoins to buy Bitcoin. On the other hand, Bitcoin borrowers can only bet on the decline of a cryptocurrency’s price.

The above chart shows that OKX traders’ margin-lending ratio spiked on June 5 after Bitcoin crashed by 7% to $25,500. Those traders were likely caught by surprise as…

Click Here to Read the Full Original Article at Cointelegraph.com News…