Bitcoin (BTC) held above $30,000 at the Oct. 23 Wall Street open as analysis said BTC price strength could cancel its “bearish fractal.”

BTC price preserves majority of early upside

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it hovered near $30,700, still up 2.5% on the day.

The largest cryptocurrency had made snap gains after the Oct. 22 weekly close, stopping just shy of $31,000 in what became its highest levels since July.

Now, popular trader and analyst Rekt Capital was keen to see the $31,000 level break.

“Bitcoin has Weekly Closed above the Lower High resistance to confirm the breakout,” he commented alongside the weekly chart.

Rekt Capital argued that BTC/USD could disregard the bearish chart fractal in play throughout 2023 next. This had involved the two year-to-date highs near $32,000 forming a double top formation, with downside due as a result.

Specifically, Bitcoin required a “breach” of $31,000 in order to do so.

Is Bitcoin on the cusp of invalidating the Bearish Fractal?

Here are the Bearish Fractal Invalidation Criteria:

a) Bull Market Support Band holds as support ✅

b) Weekly Close beyond Lower High resistance ✅

c) Breach of $31k yearly highs ❌$BTC #Crypto #Bitcoin https://t.co/4H3OMiDzFB pic.twitter.com/mjoO8OF1Qs

— Rekt Capital (@rektcapital) October 23, 2023

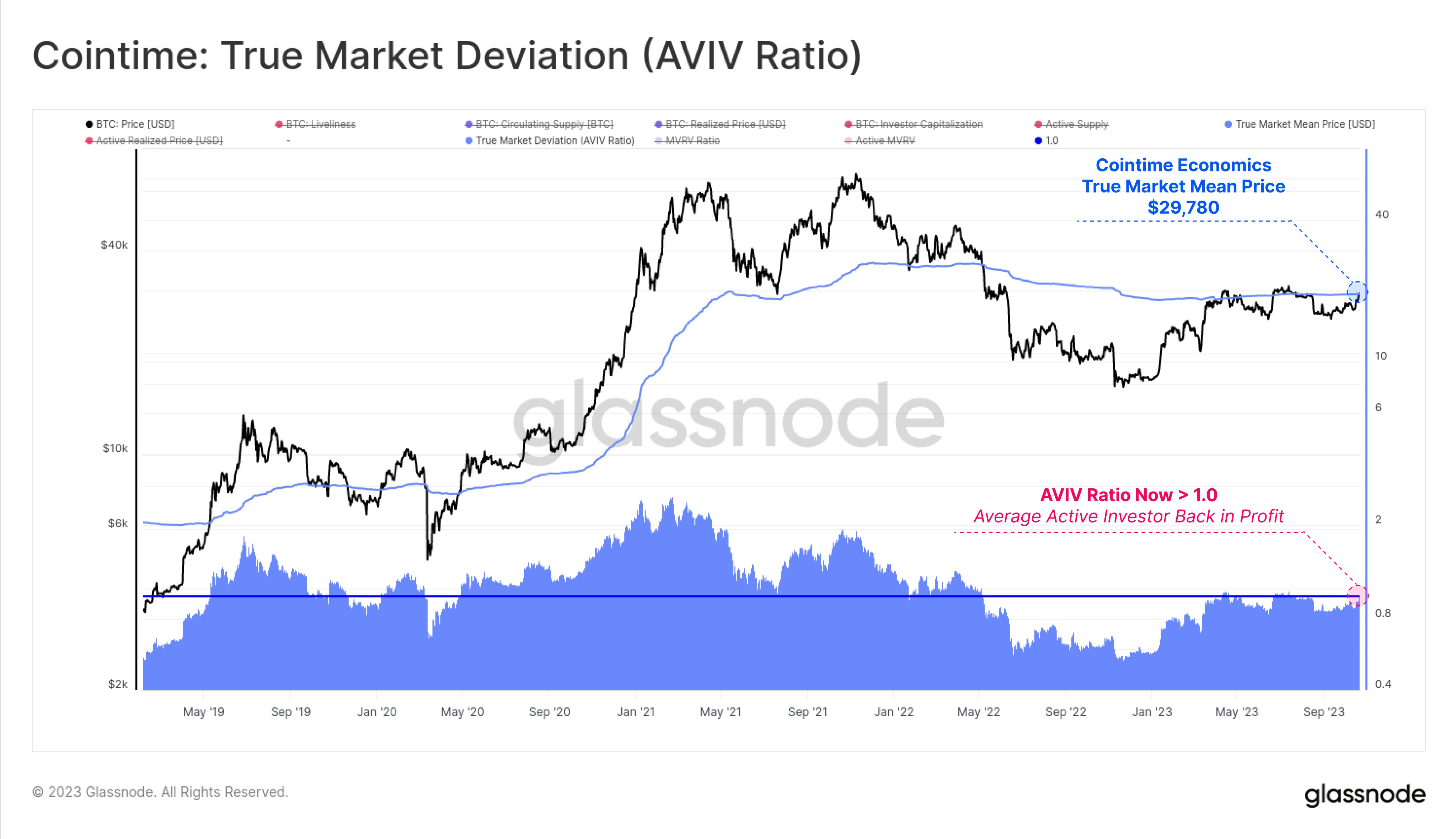

More encouraging cues came from the True Market Deviation indicator from on-chain analytics firm Glassnode.

As noted by its lead analyst Checkmate on the day, the metric, also known as the Average Active Investor (AVIV) profit ratio, has crossed a key level.

Bitcoin’s True Mean Market price (TMM) — the level that BTC/USD spends exactly 50% above or below — is now below spot price, at $29,780.

“Have we now paid our bear market dues?” Checkmate queried, describing TMM as Bitcoin’s “most accurate cost basis model.”

Institutions awaken in “Uptober”

Analyzing the potential drivers of the rally, meanwhile, James Van Straten, research and data analyst at crypto insights firm CryptoSlate, flagged the potential approval of the United States’ first Bitcoin spot-price based exchange-traded fund (ETF).

Related: BTC price nears 2023 highs — 5 things to know in Bitcoin this week

While not yet awarded the green light, a U.S. spot ETF is being treated as an inevitability after legal…

Click Here to Read the Full Original Article at Cointelegraph.com News…