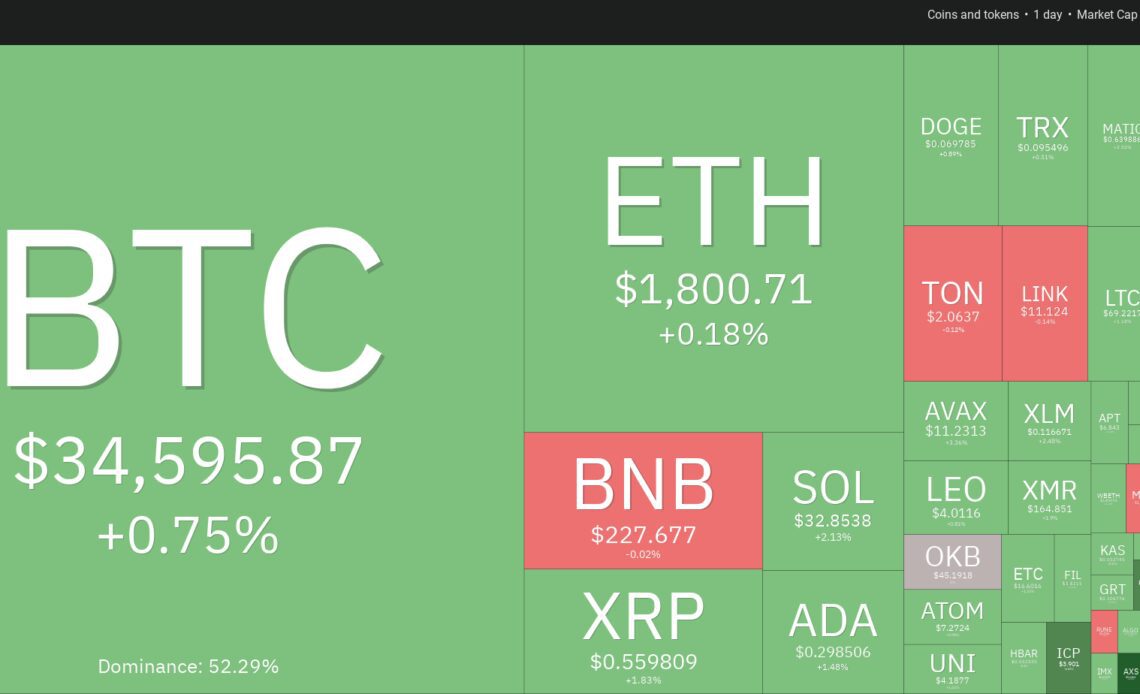

Hopes of approval for a spot Bitcoin (BTC) exchange-traded fund by the United States Securities and Exchange Commission boosted Bitcoin’s price by 27% in October. This improved sentiment, attracting aggressive buying by crypto investors.

Bloomberg senior ETF analyst Eric Balchunas highlighted in a post on X (formerly Twitter) that ProShares Bitcoin Strategy ETF (BITO), the first futures-based ETF to get regulatory consent in the U.S. in 2021, saw its second biggest trading week ever at $1.7 billion. Similarly, Grayscale Bitcoin Trust (GBTC) recorded a volume of $800 million. The sharp uptick in volume in the existing instruments shows that spot Bitcoin ETFs are likely to witness huge volumes when they see the light of the day.

When the leader starts performing, it generally lifts the entire sector. That is seen in the strong performance of altcoins, which have risen sharply from their multi-year lows.

However, after the initial rally, some altcoins will struggle to maintain their up-move while a few will lead the markets higher. It is better to stick with the leaders as they are most likely to outperform during the next crypto bull phase.

Let’s look at the charts of the top-5 cryptocurrencies that may extend their rally in the next few days.

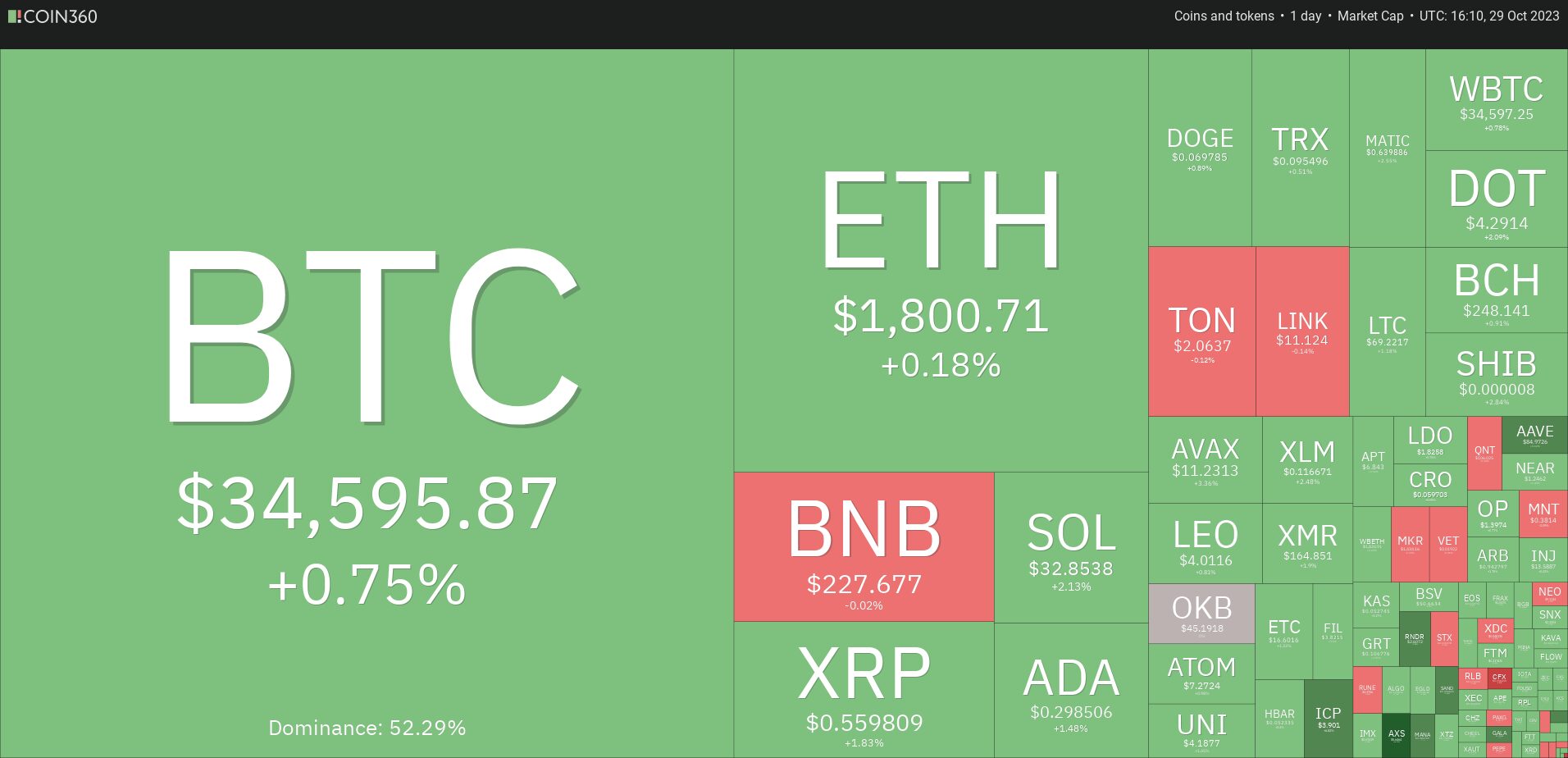

Bitcoin price analysis

Bitcoin pulled back from $35,280 on Oct. 24, indicating that higher levels are attracting selling by traders. The bears tried to start a deeper pullback on Oct. 27 but the long tail on the candlestick shows solid buying at lower levels.

Although the rising moving averages indicate advantage to buyers, the overbought levels on the relative strength index (RSI) suggest that the BTC/USDT pair may spend some more time in consolidation.

The important level to watch out for on the downside is $32,400 and then $31,000. Sellers will have to pull the price below this zone to seize control.

Conversely, if the price turns up from the current level and breaks above $35,280, it will indicate the bulls are back in the driver’s seat. The pair may then surge to the next target objective at $40,000.

The 20-EMA is gradually flattening out, indicating that the bulls are losing their grip in the near term. That could keep the pair range-bound between $35,280 and $33,200 for some time. If the bears yank the price below $33,200, the pair may tumble to $32,400.

On the contrary, if the…

Click Here to Read the Full Original Article at Cointelegraph.com News…