The price of Bitcoin (BTC) has notched new all-time highs against some of the world’s most inflationary fiat currencies.

Across 30 hours over Oct. 23 to 24, the cost of buying one Bitcoin has reached all time-highs when using the Argentine peso (ARS), Nigerian naira (NGN), Turkish lira (TRY), Laotian kip (LAK) and the Egyptian pound (EGT).

#Bitcoin just hit an all-time high in Argentina, Turkey and Nigeria. pic.twitter.com/sKRNUaBMX8

— Miles Deutscher (@milesdeutscher) October 26, 2023

However, it should be noted that the result is due to the ongoing devaluation of the currencies, exacerbated by Bitcoin’s recent 16% price increase.

NGN and TRY fell to their lowest points against the U.S. dollar on Oct. 24 and Oct.25, while ARS is only 0.85% off its all-time low (against the U.S. dollar).

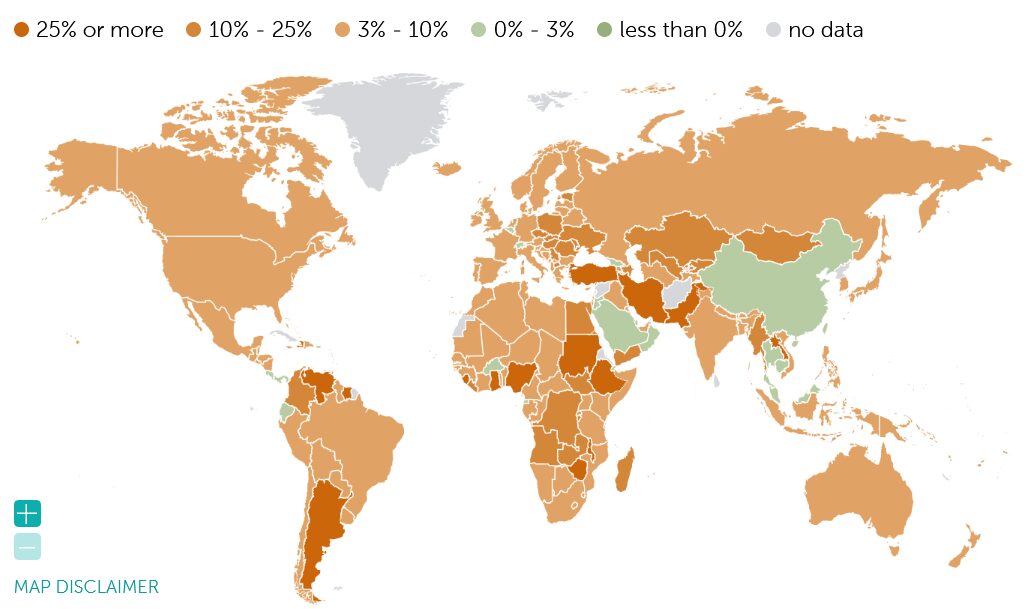

According to the International Monetary Fund, the Venezuelan bolivar currently has the highest annual inflation rate at 360%, followed by Zimbabwean dollar (314%), Sudanese pound (256%) and ARS (122%).

The Turkish lira and Nigerian naira came in sixth and 15th with annual inflation rates of 51% and 25% respectively, IMF’s data shows.

Crypto observers have long seen digital assets, such as Bitcoin and stablecoins, as a hedge against rocketing inflation, the recent figures could bolster that narrative.

Nigeria, Turkey and Argentina boast the 2nd, 12th and 15th highest rates of cryptocurrency adoption in the world, according to a Sept. 12 report by Chainalysis.

With inflation at 99% in #Argentina, it’s 99% likely that the citizens of that beautiful country would benefit from #Bitcoin.

— Michael Saylor⚡️ (@saylor) February 15, 2023

However, the governments of these countries haven’t always seen eye-to-eye with the cryptocurrency industry.

Nigeria is finally becoming more welcoming to cryptocurrencies after its central bank banned local banks from providing services to cryptocurrency exchanges in Feb. 2021.

Progress was made in December 2022 when Nigeria announced its intention to pass a bill recognizing cryptocurrencies as “capital for investment” — citing the need to keep up with “global practices” as one of the main reasons behind its change in stance.

And while Turkey is home to some of the most crypto-curious people, its central bank banned cryptocurrency payments for goods and services in April 2021. It has also working on a central bank digital currency

Click Here to Read the Full Original Article at Cointelegraph.com News…