The total market capitalization of the cryptocurrency market surged past $1.55 trillion on Dec. 5, driven by remarkable weekly gains of 14.5% for Bitcoin (BTC) and 11% for Ether (ETH). Notably, this milestone, marking the highest level in 19 months, propelled Bitcoin to become the world’s ninth-largest tradable asset, surpassing Meta’s $814 billion capitalization.

Despite the recent bullish momentum, analysts have observed that retail demand remains relatively stagnant. Some attribute this to the ripple effects of an inflationary environment and decreased interest in credit, given that interest rates continue to hover above 5.25%. While analyst Rajat Soni’s post may have dramatized the situation, the underlying, in essence, holds true.

Retail investors aren’t paying attention to #bitcoin.

They are more worried about whether or not they will be able to pay rent or put food on the table.

They will likely start paying attention near the next top (IMO sometime in 2025) and they will FOMO into a position before…

— Rajat Soni, CFA (@rajatsonifnance) December 2, 2023

Numerous U.S. economic indicators have surged to record highs, encompassing wages, salaries and household net worth. However, Ed Yardeni, an analyst, suggests that the “Santa Claus rally” might have already occurred earlier this year, with the S&P 500 gaining 8.9% in November.

This rise reflected diminishing inflationary pressures and robust employment data. Yet, investors remain cautious, with approximately $6 trillion in “dry powder” parked in money market funds, waiting on the sidelines.

Did retail traders miss Bitcoin and Ether’s recent gains?

With no dependable indicator to track retail participation in cryptocurrencies, a comprehensive data set is necessary for making conclusions, beyond relying solely on Google Trends and crypto-related app download rankings. To determine if retail traders have missed out on the rally, it’s essential that the indicators align across various sources.

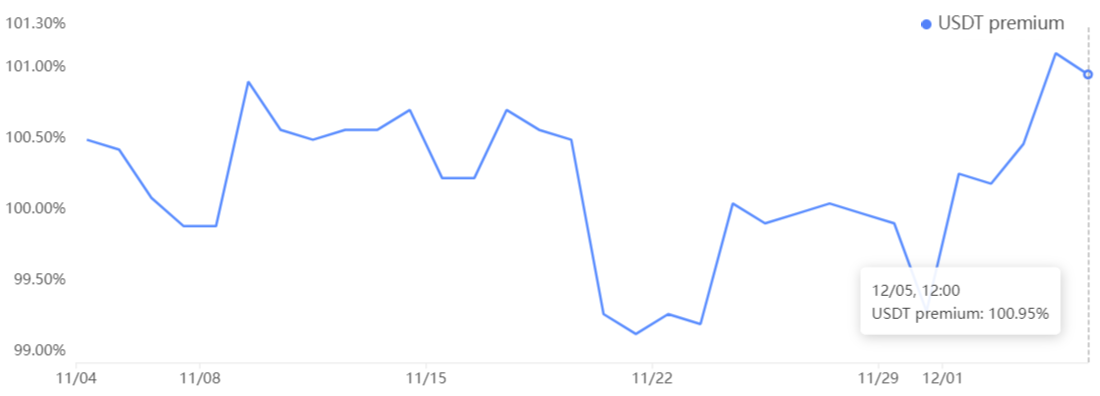

The premium of USD Tether (USDT) in China serves as a valuable gauge of retail demand in the crypto market. This premium quantifies the difference between peer-to-peer USDT trades based in Yuan and the value of the U.S. dollar. Excessive buying activity typically exerts upward pressure on the premium, while bearish markets often witness an influx of USDT into the market, resulting in a 3% or greater discount.

On Dec. 5, the USDT premium relative to the yuan reached…

Click Here to Read the Full Original Article at Cointelegraph.com News…