Bitcoin (BTC) is keeping everyone on their toes when it comes to price trajectory — where will it go next?

BTC price down 10% after bad week

After a week in which BTC/USD fell by 10%, sentiment is getting a reset and traders are eyeing key support levels closer to $25,000.

At the same time, consensus is far from unanimous over market health — some believe that the next phase of upside is around the corner.

As macro markets gear up for a new period of crucial data and moves from the United States Federal Reserve, volatility catalysts are waiting in the wings, with Bitcoin potentially not staying calm for long.

Cointelegraph takes a look at the upcoming scenarios that could cause BTC/USD to quit its short-term sideways trading pattern.

Will the Fed call the market’s bluff?

It may be all quiet so far when it comes to macroeconomic triggers this week, but that is about to change.

Beginning April 27, new data will emerge from the U.S. which could deliver a burst of volatility for currently lackluster risk assets.

U.S. GDP and jobless claims will precede the March print of the Personal Consumption Expenditures (PCE) Index, the latter keenly eyed by the Fed for cues on inflation.

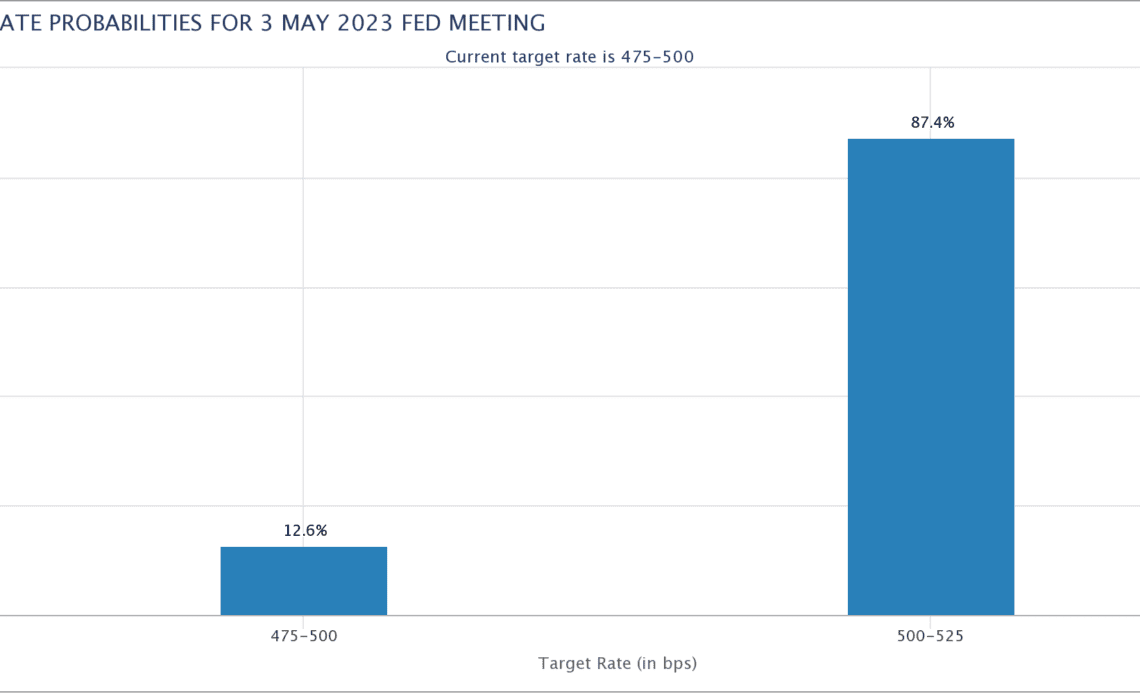

This month’s timing is important — a week later, the Fed will decide on how much, if at all, to raise benchmark interest rates. While the market already believes it knows the answer, this allows any surprises to have an even more pronounced impact on sentiment and price action.

According to CME Group’s FedWatch Tool, as of April 25, there is an 87% chance that the Fed raises rates by 0.25% in early May.

Cold feet emerge over U.S. stocks

Bitcoin remains correlated with U.S. equities into the end of the month, and concerns beyond crypto are focusing on indices’ inability to print new highs.

For trading firm Mosaic Asset, caution is warranted for several reasons going forward.

“First, the rally since mid-March is leading to a sharp increase in bullish sentiment, signaling too much greed among investors. There’s also a big negative breadth divergence across multiple time frames in the stock market’s rally since mid-March,” it warned in the latest edition of its regular newsletter, “The Market Mosaic,” released on April 23.

An accompanying chart showed declining bullishness across S&P 500 stocks, marking a potential change of environment compared to Q1.

“Just take a look at the percent of stocks trading above their 50-day…

Click Here to Read the Full Original Article at Cointelegraph.com News…