The ongoing legal battle between the Binance cryptocurrency exchange and the U.S. Securities and Exchange Commission (SEC) took a surprising turn on Sep. 18.

Magistrate Judge Zia M. Faruqui rejected the SEC’s request for access to Binance.US’s systems. Instead, the Federal Magistrate suggested that the SEC should formulate specific discovery requests.

While this decision only temporarily postponed the need for Binance to demonstrate the separation between Binance.US’s custody solution and Binance International, the market responded positively.

Bitcoin (BTC) surged to its highest level in three weeks, breaking above the $27,000 resistance. Traders are now wondering whether the rally has been supported by leverage or genuine spot buying demand.

This is where metrics related to Bitcoin derivatives could potentially provide the solution.

Investors must wait three weeks for further rulings

Judge Faruqui scheduled a follow-up hearing for Oct. 12 and called upon the involved parties to submit a status report before the event, as reported by Yahoo Finance. What might have seemed like a setback for the SEC, at least for the time being, could potentially increase the risks for Binance.

Binance’s founder and CEO, Changpeng “CZ” Zhao, remains steadfast in asserting that Binance.US has never utilized Binance International’s custody solutions, despite a document from Binance.US on Sep. 15 suggesting otherwise. Nevertheless, the SEC has yet to produce clear evidence of Binance attempting to mislead the court.

Regardless of the current evidence, or more accurately, the absence of reliable information provided by Binance, the outlook for Bitcoin bulls has significantly improved for the next three weeks, with no anticipated changes until the upcoming court hearing.

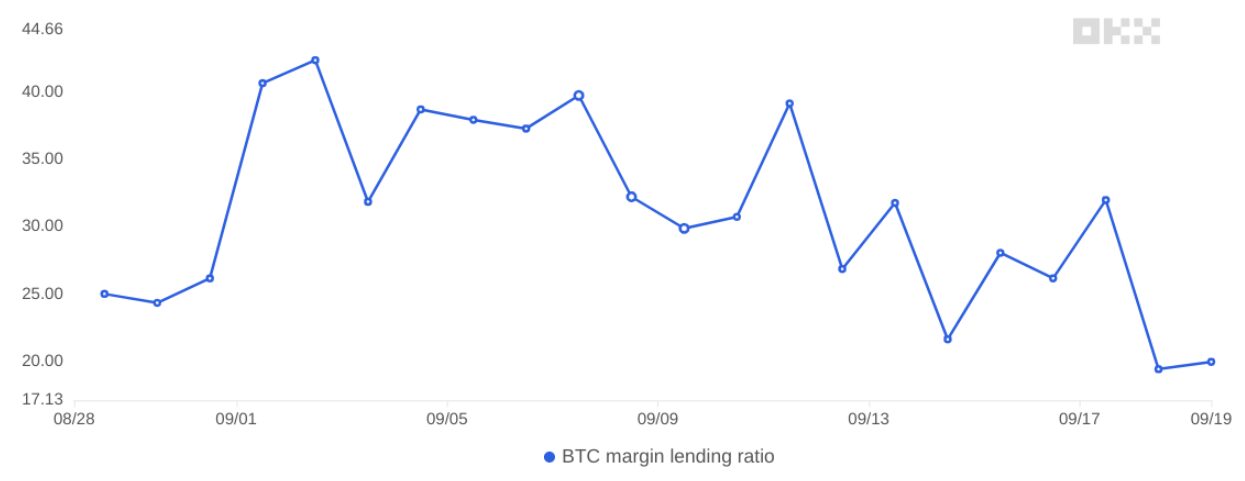

To gauge the increasing optimism among professional traders, let’s examine Bitcoin’s margin and derivatives metrics.

Bitcoin margin, options show clear path toward $28,000

Margin markets offer valuable insights into the positioning of professional traders as they enable investors to increase their exposure through stablecoin borrowing.

Conversely, Bitcoin borrowers can speculate on a cryptocurrency’s price decline. A declining indicator suggests that traders are becoming less bullish, while a ratio exceeding 30 typically indicates excessive confidence.

Recent data reveals that the margin-lending ratio for OKX traders has dropped to its lowest point in three…

Click Here to Read the Full Original Article at Cointelegraph.com News…