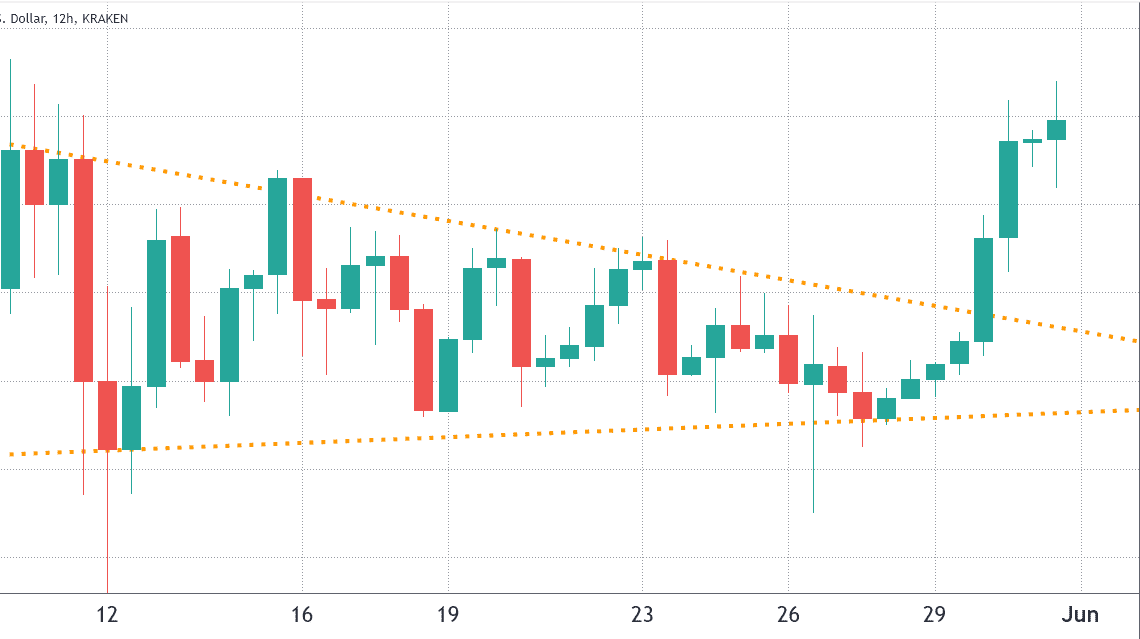

This week’s Bitcoin (BTC) chart leaves little doubt that the symmetrical triangle pattern is breaking to the upside after constricting the price for nearly 20 days. However, derivatives metrics tell a completely different story because professional traders are unwilling to add leveraged positions and are overcharging for downside protection.

Will BTC reverse course even as macroeconomic conditions crumble?

Whether or not BTC turns the $30,000 to $31,000 level into support depends to some degree on how global markets perform.

The last time U.S. stock markets faced a seven-week consecutive downtrend was over a decade ago. New home sales in the U.S. declined for the fourth straight month, which is also the longest streak since October 2010.

China saw a whopping 20% year-on-year decline for its on-demand services, the worst change on record. According to government data released on May 30, consumer spending for internet services from January to April stood at $17.7 billion.

The value of stock offerings in Europe also hit the worst level in 19 years after rising interest rates, inflation and macroeconomic uncertainties caused investors to seek shelter in cash positions. According to Bloomberg, initial public offerings and follow-on transactions raised a mere $30 billion throughout 2022.

All of the above make it easier to understand the discrepancy between the recent Bitcoin price recovery to $32,300 and weak derivatives data because investors are pricing higher odds of a downturn, primarily driven by worsening global macroeconomic conditions.

Derivatives metrics are neutral-to-bearish

Retail traders usually avoid quarterly futures due to their price difference from spot markets, but they are professional traders’ preferred instrument because they avoid the perpetual contracts fluctuating funding rate.

These fixed-month contracts usually trade at a slight premium to spot markets because investors demand more money to withhold…

Click Here to Read the Full Original Article at Cointelegraph.com News…