Bitcoin (BTC) has fallen by over 67% in 2022 and is now wobbling between a tight trading range defined by $28,000 as interim support and $30,500 as interim resistance.

The selloff appears in the wake of the Federal Reserve’s hawkish policy and the uncertainties in the crypto market led by Terra, an algorithmic stablecoin project whose native token LUNA fell by 99% earlier in the month.

Nonetheless, Bitcoin’s decline has somewhat cooled down as May draws to a close, leaving speculators with the hope that the token is in the process of bottoming out.

Something like this might play out for #Bitcoin. Notice the lower left corner we had a double bottom before getting a green wave. We’re currently sitting at the bottom of the wedge. We can go a little lower and form another double bottom before reversing. pic.twitter.com/feuzp5tiDZ

— BitcoinAlArab (@BitcoinAlArabx) May 23, 2022

Interestingly, Bitcoin’s Fear and Greed Index (F&G) also hints at the same scenario, notes Arcane Research in its latest weekly report.

Bitcoin F&G readings hit March 2020 lows

In detail, Bitcoin’s F&G reached the score 8 on May 17, indicating “extreme fear,” a first since March 2020.

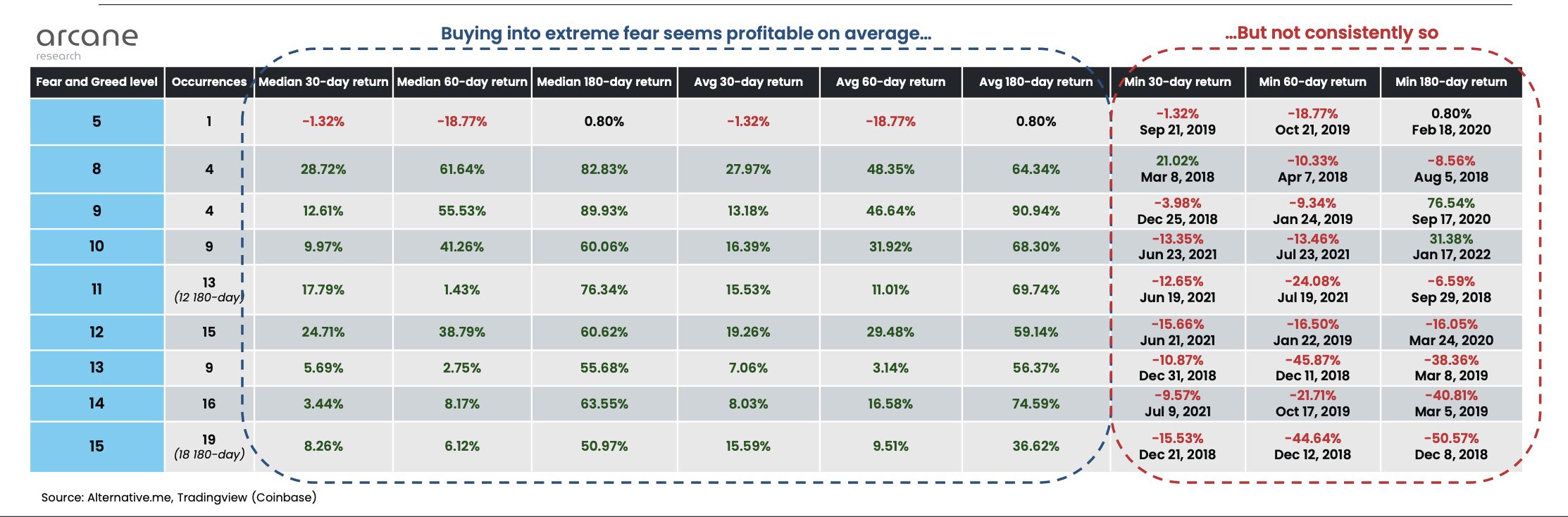

“We see that buying fear has previously been a profitable strategy when measuring median and average returns of previous extreme fear periods,” Arcane wrote while citing the four instances wherein Bitcoin’s F&G had dropped to 8.

Meanwhile, Ben Lilly, market researcher at Jarvis Labs, added that Bitcoin’s F&G index falling below ten signals the extreme possibility of the market bottoming out. He also noted that buying Bitcoin when its F&G score is below 10 is a good short-term strategy, saying:

“Turns out the strategy where you hold it for less time produced greater results. Meaning the strategy where you sold after F&G rose above 35 (yellow line in the chart [below]) produced better results than a reading of 50 (orange) and 80…

Click Here to Read the Full Original Article at Cointelegraph.com News…