This week the stock markets began to flash a little green and Bitcoin (BTC) is decoupling from traditional markets but not in a good way. The cryptocurrency is down 3% while the Nasdaq Composite tech-heavy stock market index is up 3.1%.

May 27 data from the United States Commerce Department shows that the personal savings rate fell to 4.4% in April to reach the lowest level since 2008 and crypto traders are worried that worsening global macroeconomic conditions could add to investors’ aversion to risky assets.

For example, Invesco QQQ Trust, a $160 billion tech company-based U.S. exchange-traded fund, is down 23% year-to-date. Meanwhile the iShares MSCI China ETF, a $6.1 billion tracker of the Chinese shares, has declined 20% in 2022.

To get a clearer picture of how crypto traders are positioned, traders should analyze Bitcoin derivatives metrics.

Margin traders are becoming more bullish

Margin trading allows investors to borrow cryptocurrency and leverage their trading position to potentially increase returns. For example, one can buy cryptocurrencies by borrowing Tether (USDT) to enlarge exposure.

Bitcoin borrowers can only short the cryptocurrency if they bet on its price decline and unlike futures contracts, the balance between margin longs and shorts isn‘t always matched.

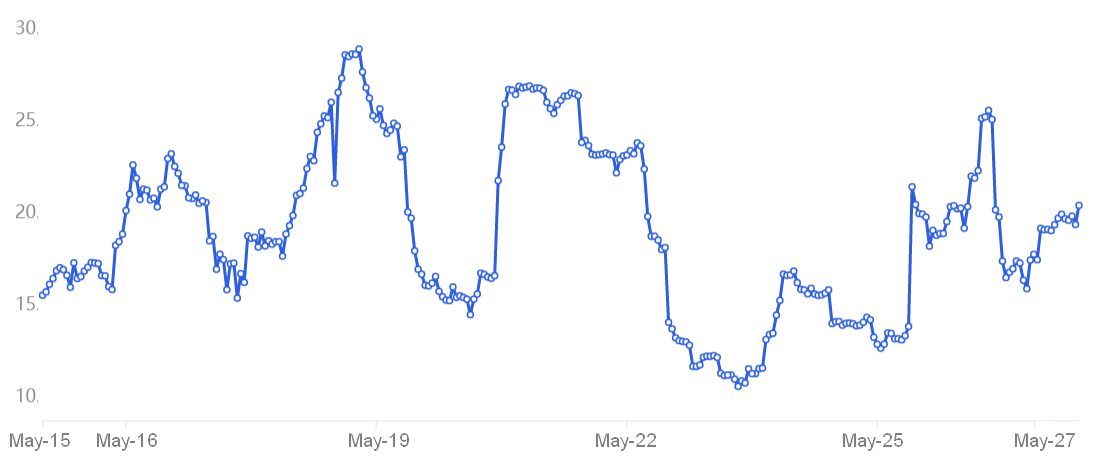

The above chart shows that traders have been borrowing more USD Tether recently, because the ratio increased from 13 on May 25 to the current 20. The higher the indicator, the more confident professional traders are with Bitcoin’s price.

It is worth noting that the 29 margin lending ratio reached on May 18 was the highest level in more than six months and it reflected bullish sentiment. On the other hand, a USDT/BTC margin lending ratio below 5 usually is a bearish sign.

Options markets entered “extreme fear”

To exclude externalities specific to the margin markets, traders should also analyze the Bitcoin options pricing. The 25%…

Click Here to Read the Full Original Article at Cointelegraph.com News…