Bitcoin has deepened its decline in the past day with its price now slipping below $63,000. Here’s where the next potential support is, according to on-chain data.

Bitcoin Could Find Support At These Price Levels

In a new post on X, analyst Ali has discussed how the Bitcoin support and resistance levels are looking like right now based on on-chain data from Glassnode.

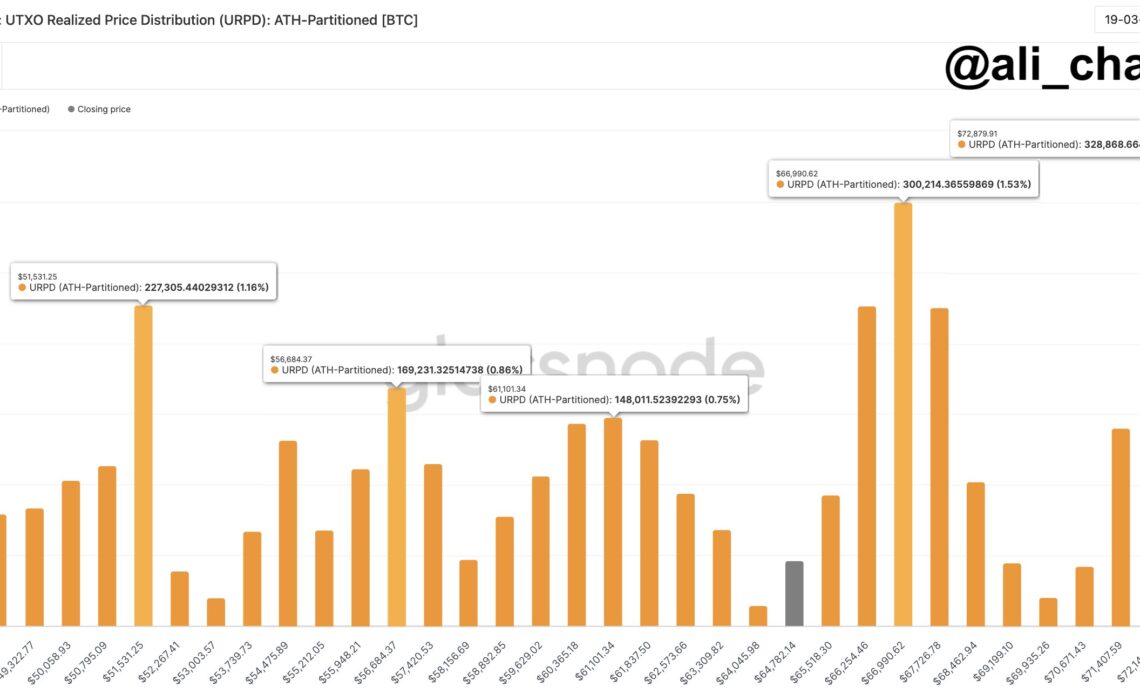

The indicator of relevance here is the “UTXO Realized Price Distribution” (URPD), which, in short, tells us about the amount of coins (or more precisely, UTXOs) that were last purchased at any given price level that the asset has visited in its history so far.

Below is the chart shared by the analyst that shows the data for this distribution for the price levels around the recent spot value of the cryptocurrency:

Looks like the $72,880 mark is the level with the richest amount of coins at the moment | Source: @ali_charts on X

From the graph, it’s visible that there are a few price levels not far from the current one that particularly stands out in terms of the amount of buying that took place at them.

In on-chain analysis, the potential for any level to act as support or resistance is based on the total number of coins that have their cost basis at the level in question.

Levels thick with coins that are situated under the current price would be probable to act as points of support, while those above the spot value could prove to be resistance walls.

As is apparent from the graph, the $61,100, $56,685, and $51,530 levels are the ones below the current price that hold the cost basis of a notable amount of the supply right now. Naturally, this means that should the decline continue further, these would be the levels to watch for a possible rebound.

Two levels above, however, are even larger than all three of these support levels: the cost basis centers around $66,990 and $72,880. Interestingly, the latter of these is the single largest acquisition level out of all the price levels listed in the chart, implying that a large amount of FOMO buying has occurred at the asset’s all-time high levels.

In the scenario that Bitcoin regains its upward momentum, these levels of high cost basis population would be where the asset could be most probable to find some trouble.

Now, as for why acquisition centers are considered relevant for support and resistance in on-chain analysis is the fact that investors are likely to show some kind of reaction when a retest of…

Click Here to Read the Full Original Article at NewsBTC…