Delving into the unique financial ecosystem of Bitcoin involves unpacking the concept of Unspent Transaction Outputs (UTXOs), a distinct characteristic that sets Bitcoin transactions apart from traditional financial transactions and offers a unique lens through which to analyze market behavior and investor sentiment.

Unlike traditional financial transactions where balances are tracked, Bitcoin uses a system of UTXOs, which represent the unspent value from Bitcoin transactions. A UTXO is the amount of digital currency remaining after a cryptocurrency transaction is executed. This output waits to be used as an input in a future transaction.

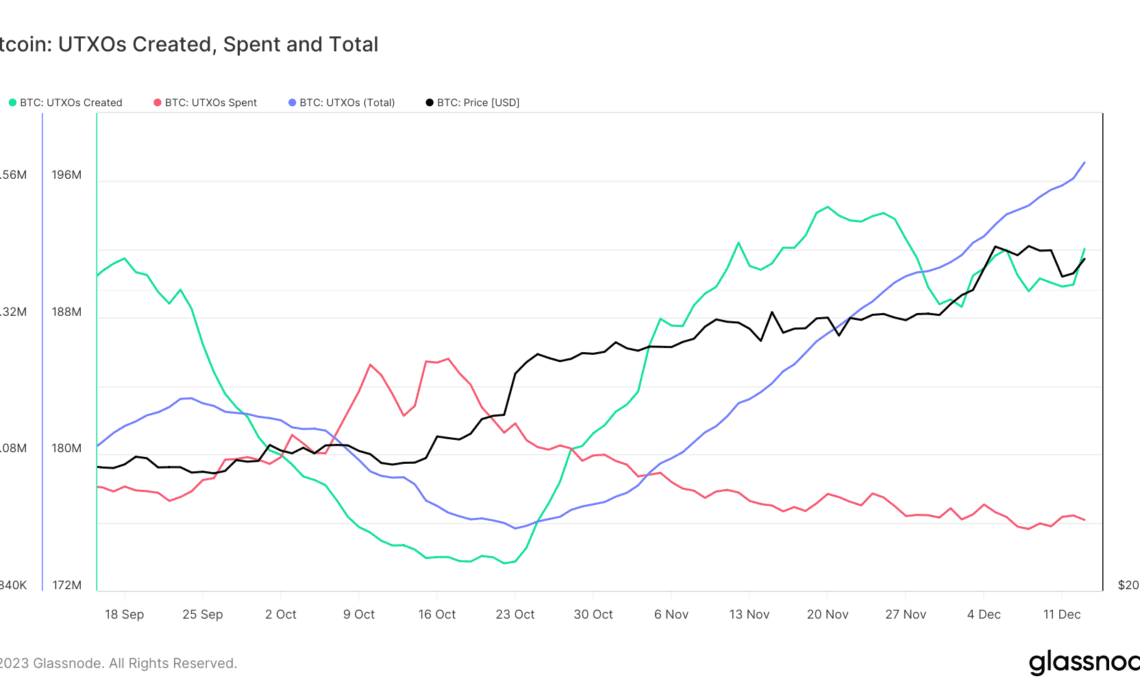

Bitcoin’s surge past the $40,000 mark has led to a notable trend in UTXOs. Since Oct. 28, the creation of UTXOs has consistently outpaced their spending. A ‘created UTXO’ refers to the output of a new transaction that hasn’t been spent, while a ‘spent UTXO’ is an input used in a transaction and is thus no longer available. The distinction between these two types of UTXOs reveals insights into how Bitcoin is used and stored.

This indicates a growing trend of Bitcoin accumulation, as new UTXOs represent new Bitcoin holdings that have not yet been spent. In contrast, spent UTXOs indicate Bitcoins that have been transferred or used in transactions. This distinction between created and spent UTXOs is pivotal in understanding market sentiment and behavior.

Between Oct. 28 and Dec.14, 2023, the daily average of created UTXOs was approximately 1.43 million, significantly higher than the 984,000 UTXOs spent on average per day. This resulted in a net increase in UTXOs, averaging around 442,000 daily. Despite some variability in the daily figures, as indicated by the standard deviation for UTXO creation and spending, the overall trend remained consistent. This trend signifies not only an increase in network activity but also a potential expansion in Bitcoin ownership, as indicated by the growing total count of UTXOs.

Concurrently, the percentage of Bitcoin UTXOs in profit rose from 88% to 92% during the same period. A UTXO is considered ‘in profit’ if the current market price of Bitcoin exceeds the price at which the Bitcoin in that UTXO was last transacted. This increase suggests that if these UTXOs were to be transacted or sold at the current market price, a profit would be realized, indicating a bullish…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…