Bitcoin (BTC) price crashed to $15,500 on Nov. 21, driving the price to its lowest level in two years. The 2-day-long correction totaled an 8% downtrend and wiped out $230 million worth of leverage long (buy) futures contracts.

The price move gave the false impression to bears that a sub-$15,500 expiry on the Dec. 9 options expiry was feasible, but those bets are unlikely to pay off as the deadline approaches.

Year-to-date, Bitcoin price is 65% down for 2022, but the leading cryptocurrency remains a top 30 global tradable asset class ahead of tech giants like Meta Platforms (META), Samsung (005930.KS), and Coca-Cola (KO).

Investors’ main concern is still the possibility of a recession if the U.S. Federal Reserve raises rates for longer than expected. Proof of this comes from Dec. 2 data, which showed that 263,000 jobs were created in November, signaling the Fed’s effort to slow the economy and bring down inflation remains a work in progress.

On Dec. 7, Wells Fargo director Azhar Iqbal wrote in a note to clients that “all told, financial indicators point to a recession on the horizon.” Iqbal added, “taken together with the inverted yield curve, markets are clearly braced for a recession in 2023.”

Bears were overly pessimistic and will suffer the consequences

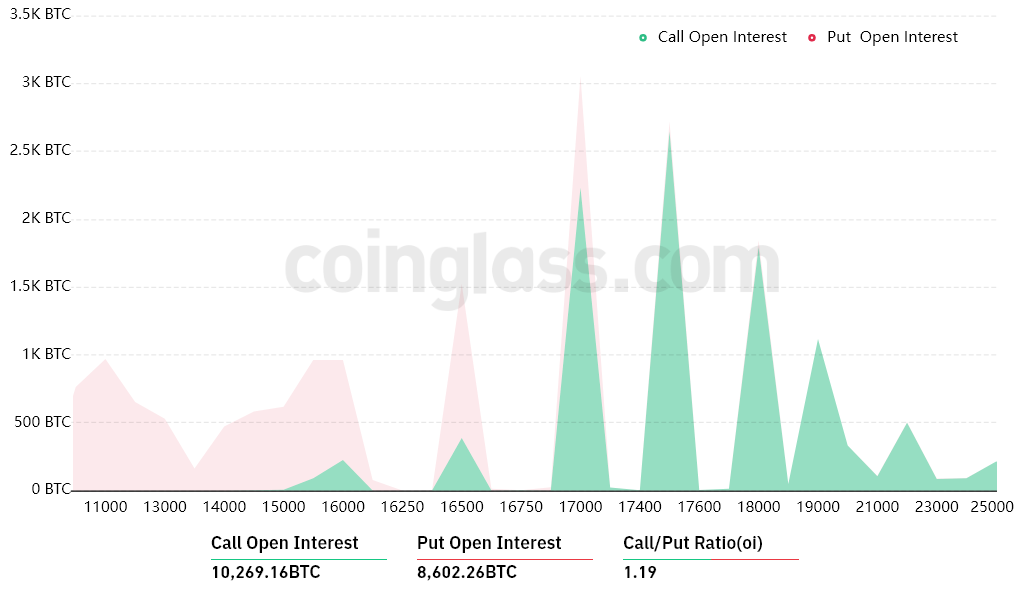

The open interest for the Dec. 9 options expiry is $320 million, but the actual figure will be lower since bears were expecting sub-$15,500 price levels. These traders became overconfident after Bitcoin traded below $16,000 on Nov. 22.

The 1.19 call-to-put ratio reflects the imbalance between the $175 million call (buy) open interest and the $145 million put (sell) options. Currently, Bitcoin stands at $16,900, meaning most bearish bets will likely become worthless.

If Bitcoin’s price remains near $17,000 at 8:00 am UTC on Dec. 9, only $16 million worth of these put (sell) options will be available. This difference happens because the right to sell Bitcoin at $16,500 or $15,500 is useless if BTC trades above that level on expiry.

Bulls aim for $18k to secure a $130 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Dec. 9 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $15,500 and $16,500: 200 calls vs. 2,100 puts. The net result…

Click Here to Read the Full Original Article at Cointelegraph.com News…