The upcoming $1.9 billion Bitcoin (BTC) monthly options expiry on Aug. 25 is key to defining whether the $26,000 support level will hold. One could pin the recent cryptocurrency market sell-off to the U.S. Securities Exchange Commission decision to delay the spot Bitcoin exchange-traded funds (ETF), but there’s also the macroeconomic perspective.

If the U.S. Federal Reserve’s efforts to curb inflation work, it’s probable that the trend of a stronger U.S. dollar will persist. This was evident as the Dollar Strength Index (DXY), a measure of the dollar against other currencies, reached its highest level in 76 days by August 22.

To prevent a potential loss of $380 million due to the monthly BTC options expiry, Bitcoin bulls must ensure Bitcoin’s price trades above $27,000 by August 25.

Bitcoin bears will benefit from the threat of harsh regulation

Cryptocurrency bulls have encountered regulatory challenges lately. This is evident as the top two cryptocurrency exchanges, Binance and Coinbase, are currently entangled in lawsuits with the SEC. Additionally, the initial victory celebrated by Ripple against the SEC is now under appeal by the regulatory body.

Adding to these developments, Bitstamp exchange recently revealed its decision to halt staking services for U.S.-based clients. A pivotal concern within the ongoing U.S. regulatory landscape revolves around the classification of ETH as either a commodity or a security.

Furthermore, Binance exchange has communicated the suspension of its crypto debit card offerings across Latin America and the Middle East. This decision follows allegations of Binance also suspending Euro withdrawals and deposits through SEPA on August 20. The exchange clarified that there is no definite timeline for reinstating the service.

Data shows bulls were excessively optimistic on Bitcoin price

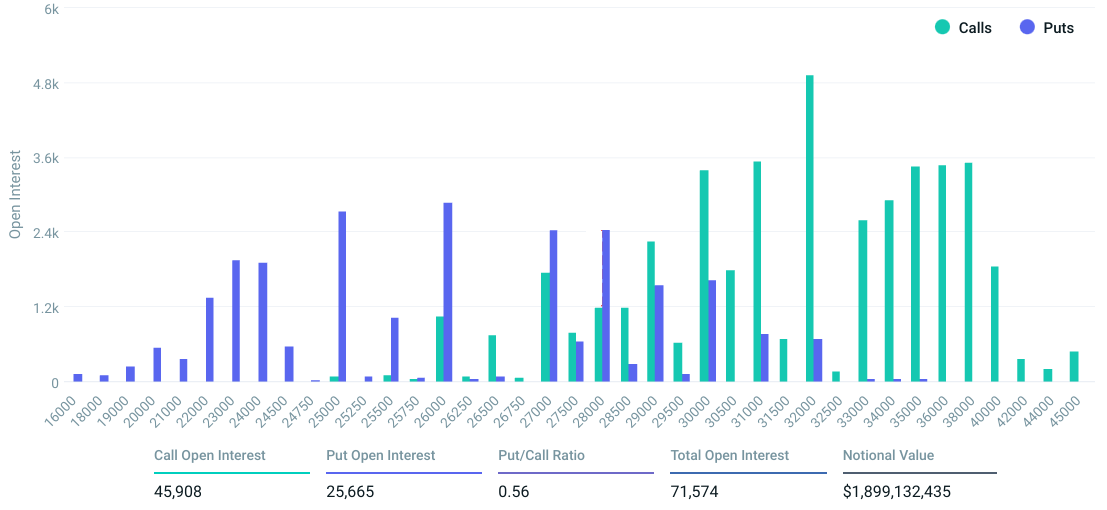

The open interest for the options expiry on August 25 stands at $1.9 billion. However, it’s projected that the final amount will be less due to certain traders foreseeing price levels reaching $29,000 or even higher. The unexpected 12% correction in Bitcoin’s price from August 14 to August 19 certainly took bullish investors off guard, as evident from the Deribit Bitcoin options interest chart.

The 0.56 put-to-call ratio reflects the imbalance between the $1.2 billion in call (buy) open interest and the $685 million in put (sell) options. However, if Bitcoin’s price remains…

Click Here to Read the Full Original Article at Cointelegraph.com News…