Altcoins offer diverse, innovative features, promising technological advancements and potentially lucrative investment opportunities.

Various altcoins can post handsome gains that surpass those of Bitcoin (BTC), particularly during times of increased popularity, known as altcoin seasons. However, analysis from K33 Research shows that over the long term, a “Bitcoin-only” investment strategy has been more profitable than an altcoin portfolio.

Altcoin portfolio underperformed Bitcoin over the long run

Bitcoin has had three consecutive bull and bear market cycles since 2013, with the latest coming in 2021. In each cycle, Bitcoin’s price rose parabolically in a concise span, usually a few months, after surpassing the peak of its previous cycle.

In 2013, BTC peaked at around $1,175, followed by a downtrend for two years. At the time, the altcoin market was in its nascent stage. The fiat on-ramps to Bitcoin were limited, and exchanges on which investors could convert to altcoins were rare.

However, by the end of 2015, a number of altcoins had arrived, including the launch of Ethereum and its native Ether (ETH) coin. A few exchanges had also been formed that supported the conversion of Bitcoin to other cryptocurrencies, paving the way for an altcoin market.

It was not until April 2017, when Bitcoin’s price broke above its 2013 top, that a bullish run occurred among altcoins. During the second half of 2017, the initial coin offering boom on Ethereum and retail investment hype around Ripple’s XRP (XRP) led to an altcoin season, with many tokens outperforming Bitcoin until January 2018.

Nevertheless, in the aftermath of the bull market, altcoins generally suffered greater losses than Bitcoin, suggesting the surge resulted from users buying them during Bitcoin bull markets with the hope of capturing higher returns.

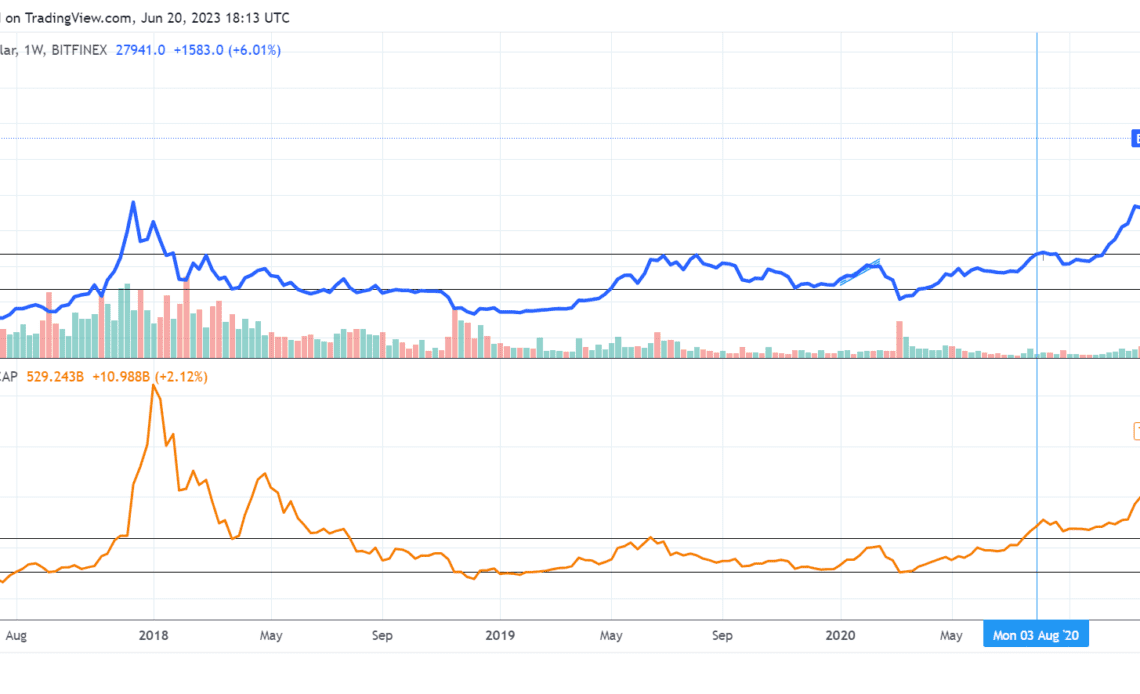

The chart below shows that Bitcoin found support around $6,500 during the bear market of 2018 to 2019 after recovering from lows of $3,250 in late 2018. However, the total market capitalization of altcoins continued to hover around its lows for most of the duration of the bear market, only reversing the trend after Bitcoin broke above its previous peak of $20,000.

K33 Research calculated the performance of investing $1 each in 1,009 altcoins since 2015 as they entered the top 100 by market capitalization on CoinMarketCap versus the same amount invested in…

Click Here to Read the Full Original Article at Cointelegraph.com News…