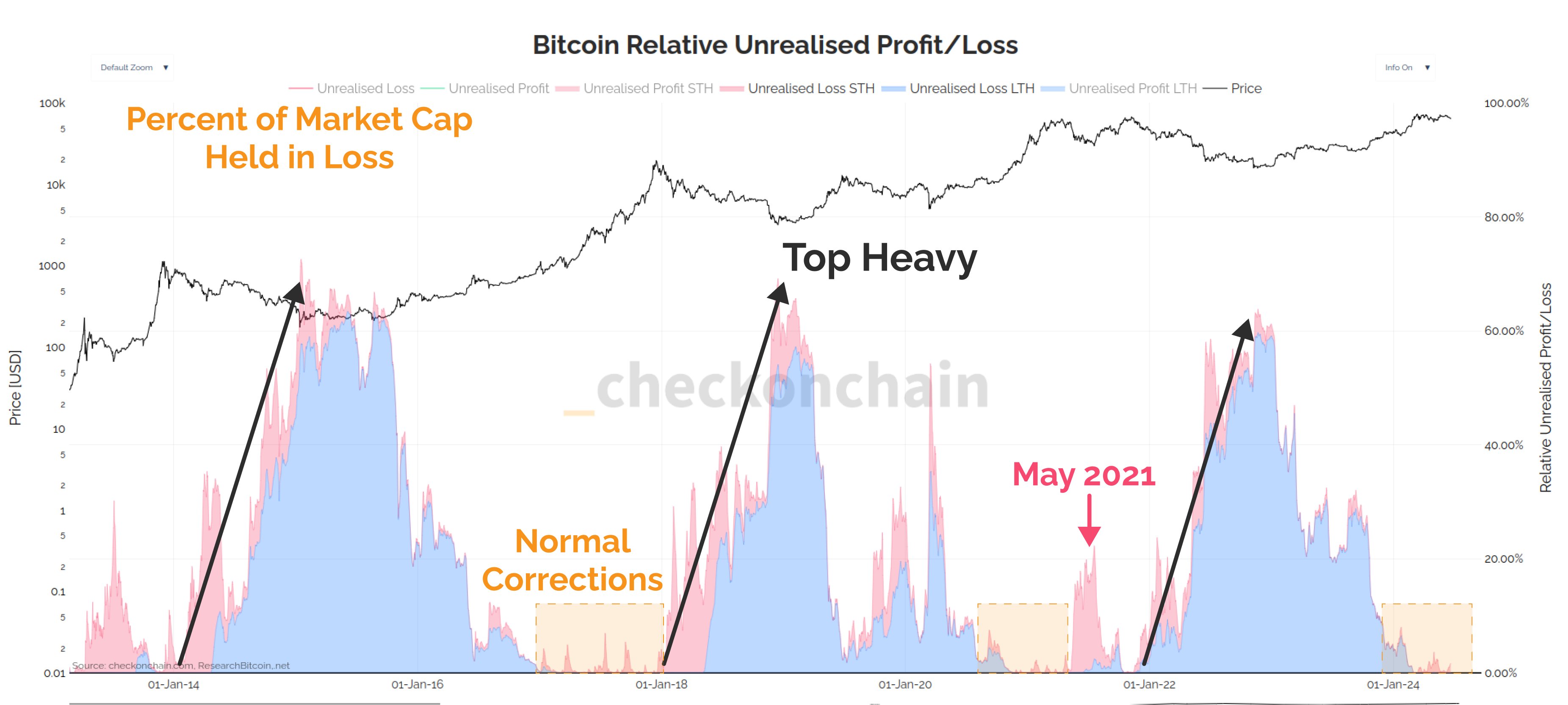

Bitcoin (BTC) is at risk of witnessing more corrections as it is on the verge of hitting a “top-heavy” zone, says a popular on-chain analyst.

The pseudonymous crypto trader known as Checkmate tells his 94,500 followers on the social media platform X that top-heavy zones happen when “too many people buy too many coins at too high of a price.”

“A critical question in these scenarios is ‘Ok, they are underwater, but by how much? How bad is it?’ Being underwater by -1% is very different to -20%.

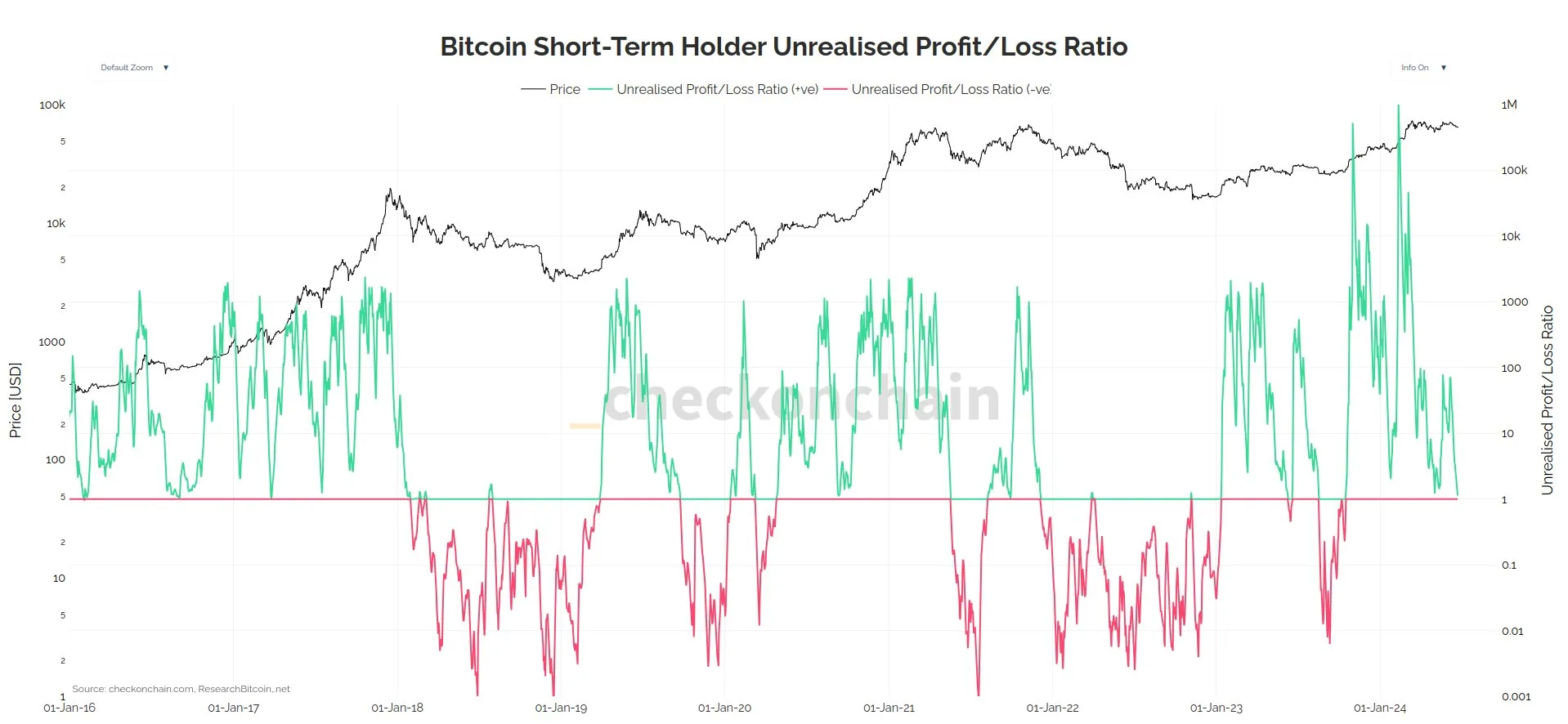

On an Unrealised profit basis, Bitcoin short-term holders are at a key decision point. We’d expect a bounce here… but also a phase shift.”

Checkmate encourages traders to pay attention to potential trigger points that could suggest a shift in sentiment.

“Whilst we’re not ‘Top Heavy’ yet, we’re on the cusp of moving into it. Chop-solidation remains my base case, and markets often have to go down before they go up again.

After 18 months of pure up-only price action, a period of several months of consolidating and correcting is not only expected but required. Don’t get shaken out folks, but that often requires managing near-term expectations.

Keep things in perspective. Stay Humble and stack sats.”

BTC is trading at $60,541 at time of writing and is down nearly 5% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Click Here to Read the Full Original Article at The Daily Hodl…