Bitcoin’s on-chain data provides evidence that Bitcoin miners are offloading their holdings. The factors influencing the selling pressure could be reduced earnings from a cooldown in Ordinals activity as well as mining difficulty and hash rate reaching an all-time high.

According to on-chain analytics firm Glassnode, “Miners have been sending a significant amount of coins to exchanges.”

Glassnode data shows Bitcoin (BTC) miners’ inflows to exchanges spiked to a three-year high on June 3 to levels last seen during the bull market of early 2021.

Across the past week, #Bitcoin Miners have been sending a significant amount of coins to Exchanges, with the largest inflow equal to $70.8M.

This is the 3rd largest inflow on record, -$30.2M less than the peak inflow of $101M recorded during the primary bull market of 2021. pic.twitter.com/w4fNFMcxr4

— glassnode (@glassnode) June 11, 2023

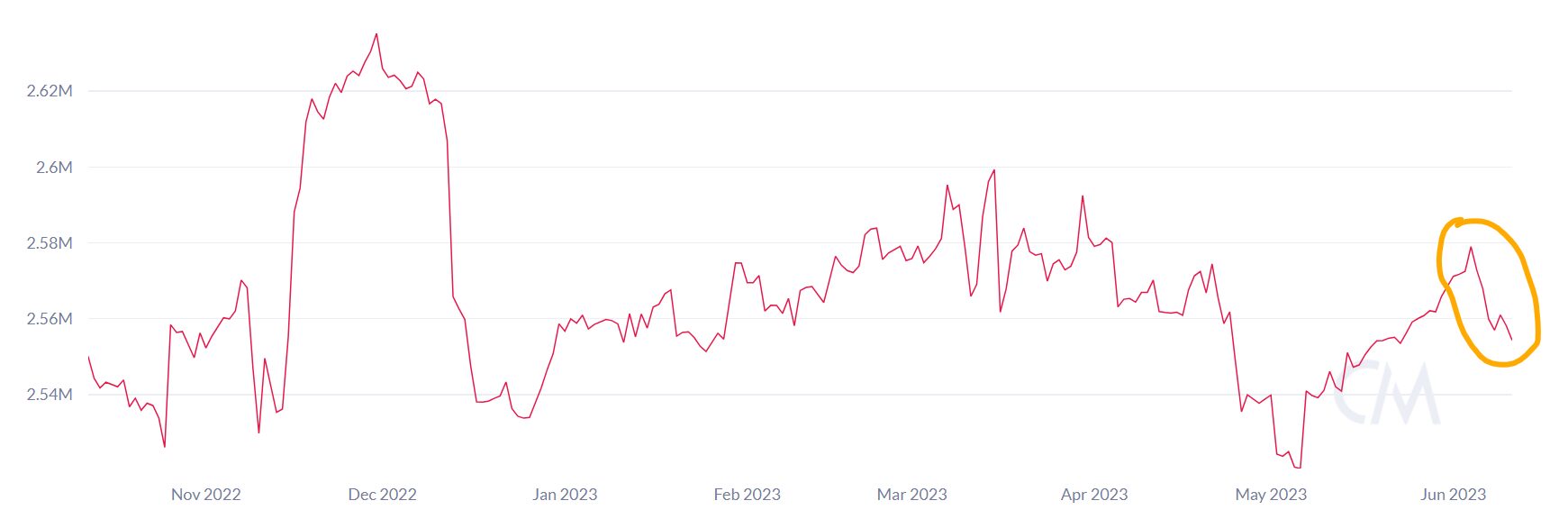

Coin Metrics data also shows a decline in the one-hop supply metric of miners, which measures the quantity of Bitcoin stored in addresses that receive coins from mining pools.

The metric recorded a consistent uptrend in miner holdings since May 2023; however, the miners reversed their accumulation trend in the second week of June.

Increase in mining difficulty and reduced Ordinals activity

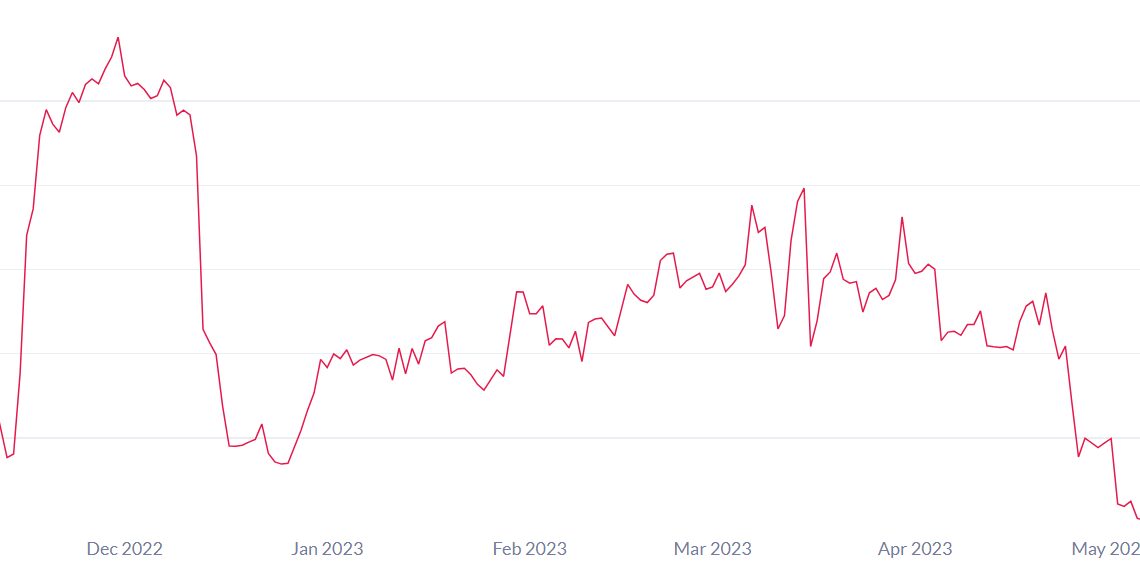

Bitcoin mining difficulty, which refers to a measure of how difficult it is to find a new block in the Bitcoin blockchain network, reached an all-time high at the start of June.

Bitcoin difficulty adjusts periodically to ensure that new blocks are added to the blockchain approximately every 10 minutes on average. When the network’s computation capacity increases, it readjusts to make mining more difficult and vice versa.

The difficulty is adjusted every 2,016 blocks, which is roughly every two weeks, and is based on the total computational power, or hash rate, of the network. The last adjustment occurred on May 31, with a 3.39% increase in total difficulty.

The increase in Bitcoin difficulty reduces the earnings of miners, eating into their profitability and possibly increasing their losses.

Moreover, the competition among miners has increased since the last difficulty adjustment, with the network’s hash rate rising to a new all-time high of 381 exahashes per second on June 11. The next difficulty adjustment due this week will likely add to the selling pressure.

Bitcoin Ordinals…

Click Here to Read the Full Original Article at Cointelegraph.com News…