After a whirlwind November for Bitcoin (BTC), certain on-chain and Bitcoin price metrics are suggesting that BTC’s bottom could occur in December. In Capriole Investments’ latest report, they provided analysis on Bitcoin finding the bottom. When taking into realized value, miner capitulation, mining electrical costs, downdraw and record hodler numbers, a BTC floor of $16,600-$16,950 seems formed.

Here are five reasons why Edwards believes Bitcoin price is coming closer to a cycle bottom.

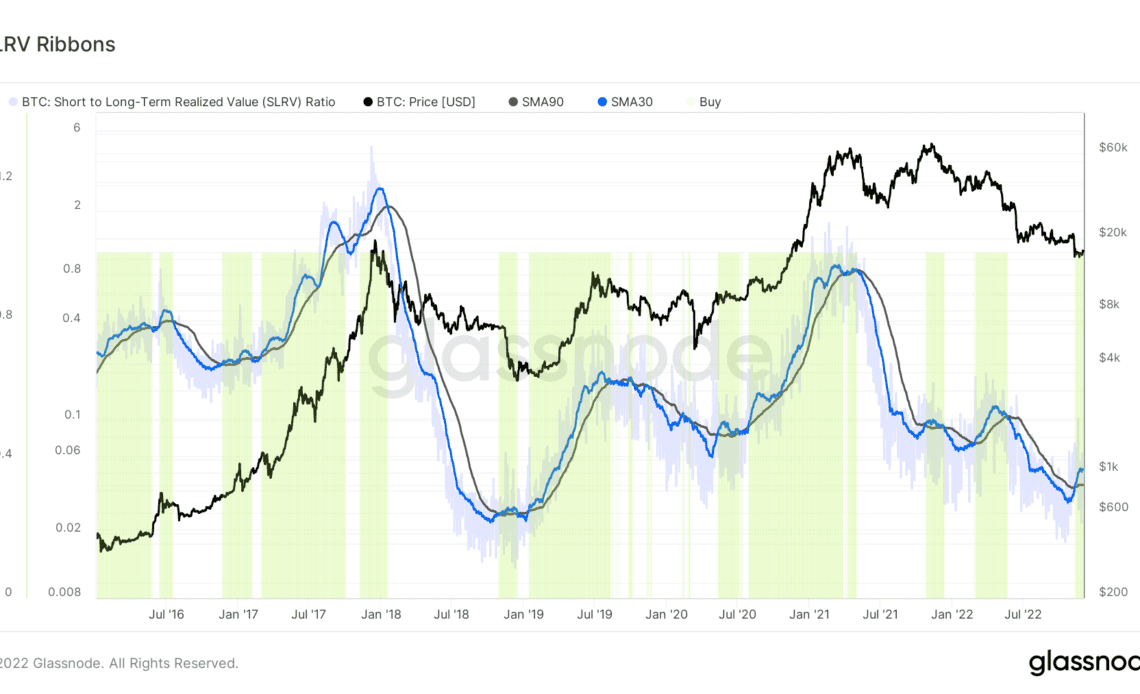

SLRV Ribbons flash a buy signal

The SLRV Ribbons track investment flows by combining the 30-day and 150-day moving averages to the SLRV Ratio, which is a percentage of the Bitcoin moved in 24 hours divided by BTC held for 6-12 months.

According to Charles Edwards, the SLRV Ribbons outperform the BTC hodl strategy, making it a strong indicator of where BTC price might be headed.

While the SLRV Ribbons have been bearish throughout 2022, the recent move to $16,600 flipped the indicator to bullish. According to Edwards, the change creates a buy signal for investors and institutional funds still in the market, thus building a strong case for Bitcoin’s price floor.

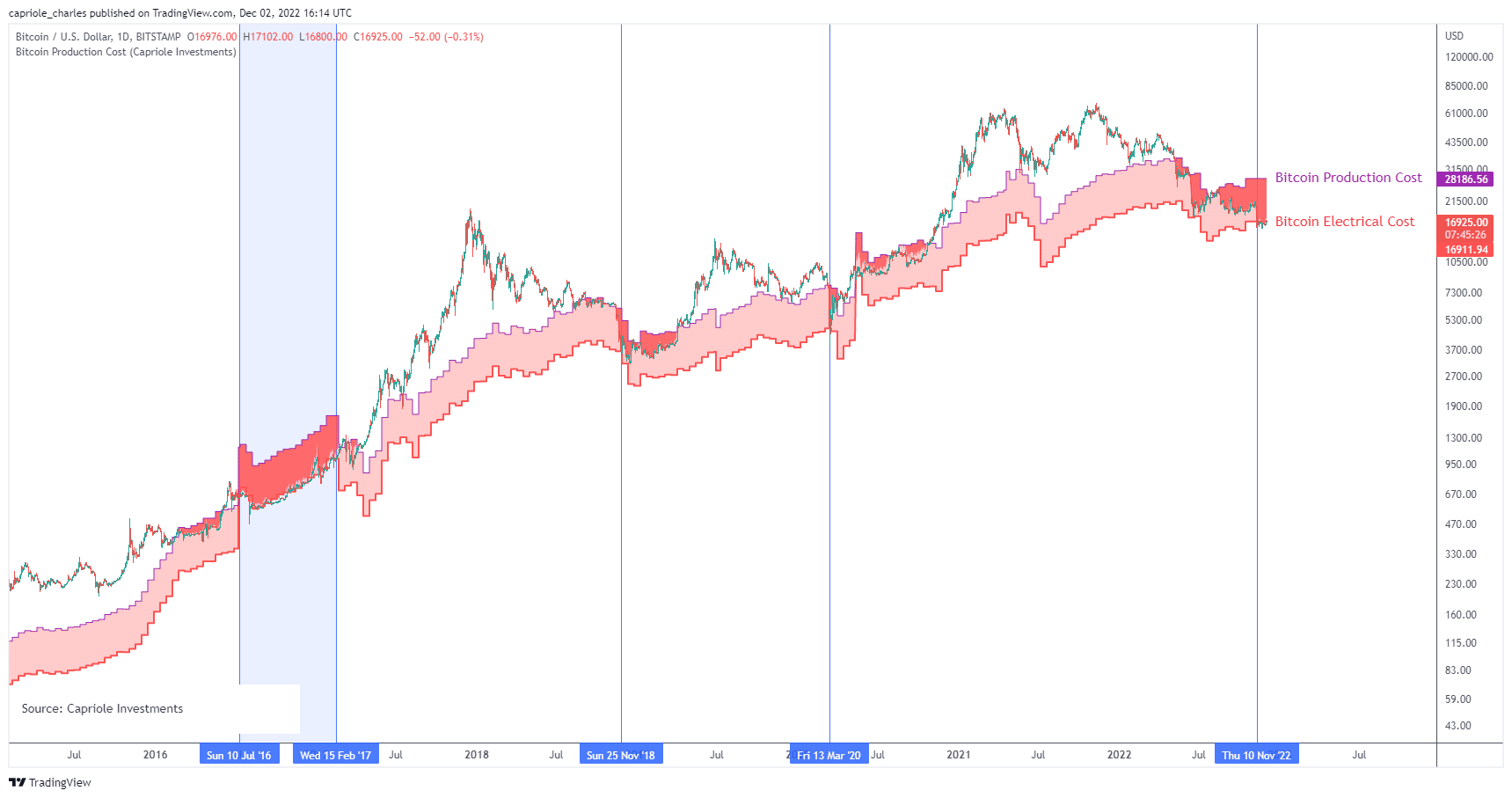

BTC price slips under its global electrical cost

While it is well known that a large swath of Bitcoin miners is currently operating at a loss, this is not a rare phenomenon throughout BTC’s history.

Bitcoin miners’ total production cost includes mining hardware, operational costs, capital costs, variable-rate power contracts and other factors, whereas the electrical cost considers only the raw electricity used to mine BTC.

The raw electrical cost has historically been a Bitcoin floor because it is rare for BTC to trade below this price point. Historically, Bitcoin has only traded below the electrical cost four times, the most recent being Nov. 10, when Bitcoin’s electrical cost hit $16,925.

BTC miner selling hits a peak

Miners are still losing money with production costs above the spot price of Bitcoin. This dichotomy forces miners to sell Bitcoin to stay afloat.

The current level of Bitcoin miner selling is the third largest in history, with the other two events happening when BTC was $2.10 in 2011 and $290 in 2015.

In hindsight, investors would love to have those prices back and Edwards suggests that the current BTC price may represent a…

Click Here to Read the Full Original Article at Cointelegraph.com News…