On-chain data shows the Bitcoin NUL indicator is still below a value of 0.5, a sign that more downtrend could be in store for the crypto before the bottom is in.

Bitcoin Net Unrealized Loss Surges Up, But Still Remains Below 0.5

As pointed out by an analyst in a CryptoQuant post, the cryptocurrency’s price may still be nowhere near a bottom.

The relevant indicator here is the “net unrealized loss” (or NUL in brief), which tells us about the total number of coins that are currently holding an unrealized loss.

The metric works by comparing the last selling price of each coin on the chain to the current value of Bitcoin. If the previous previous of any coin was more than the current one, then that coin is holding a loss right now.

On the other hand, the current price being more than the last selling value would imply that the coin is in profit at the moment.

Related Reading | Bitcoin Falls Below $30k As 10k BTC Flow Into Gemini

The NUL metric only takes into account the former type of coins. Another indicator, the net unrealized profit (NUP), measures the latter category.

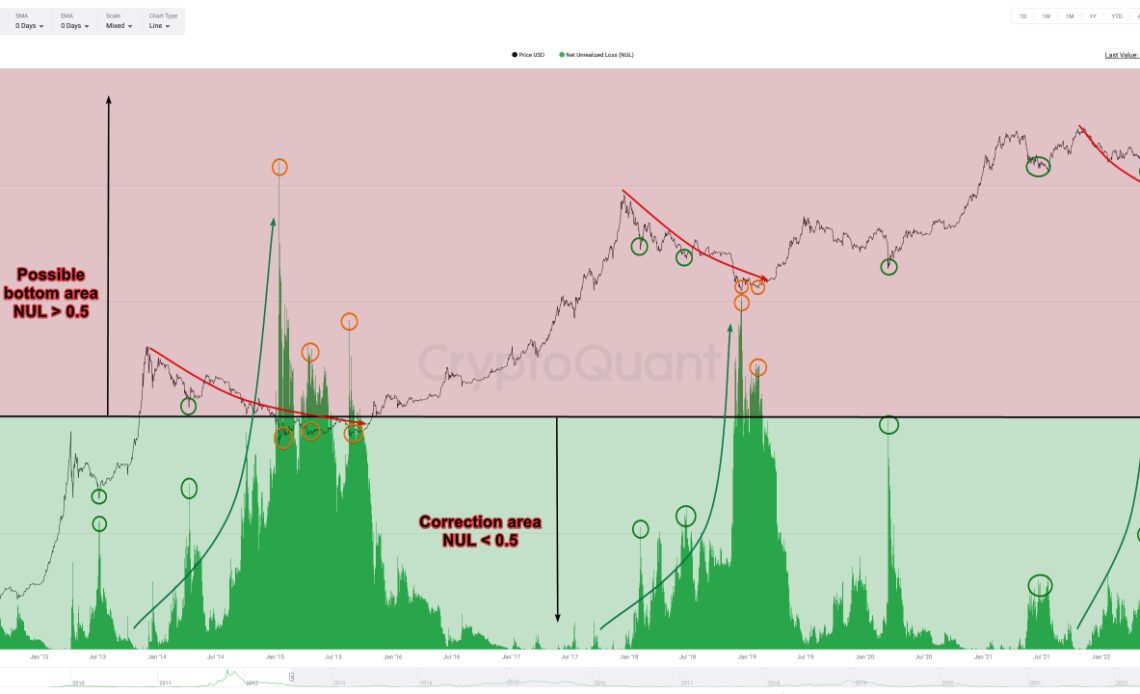

Now, here is a chart that shows the trend in the Bitcoin NUL over the history of the coin:

The value of the indicator seems to have been rising recently | Source: CryptoQuant

In the above graph, the quant has marked the two different zones of the Bitcoin NUL, with the metric value equal to 0.5 line being the divider between them.

It looks like historically, the price of the crypto has tended to observe the major bottoms when the indicator’s value has been greater than 0.5

Related Reading | Can FTX Token (FTT) And Parody Coin (PARO) Join Bitcoin (BTC) As The Biggest Cryptocurrency In 2022?

As you can see in the chart, the NUL metric has observed some uptrend in recent months. This is because the value of Bitcoin has been declining during this period, leading to more coins going underwater.

However, despite this recent rise, it seems like the net unrealized loss’ current value is still…

Click Here to Read the Full Original Article at NewsBTC…