Bitcoin (BTC) miners are reportedly hedging against the recent downturn in prices by mining other cryptocurrencies, according to the CEO of CryptoQuant.

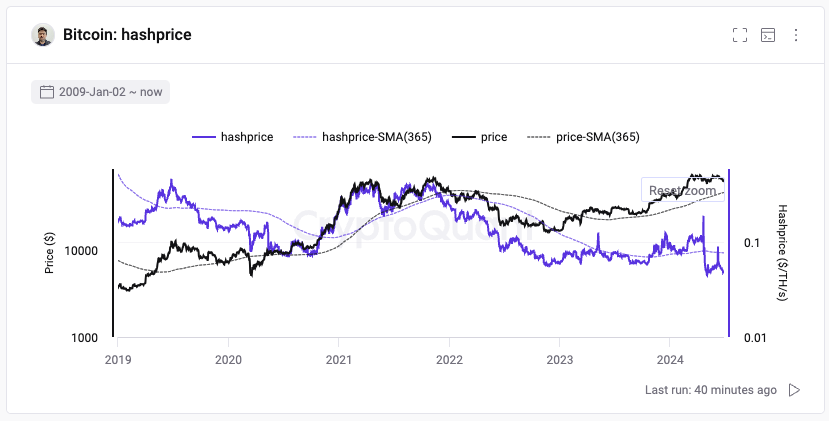

Ki Young Ju says that Bitcoin’s hashprice is now at an all-time low, potentially causing a slowdown in investments for mining companies and prompting them to look to other, cheaper proof-of-work (PoW) coins to mine for the time being.

Hashprice refers to the expected value of 1 TH/s of hashing power per day and aims to quantify how much a miner can expect to earn from a given amount of hashrate.

Says Ju,

“Bitcoin hashprice hit an all-time low. Many mining companies slowed mining rig investments, with some switching to other PoW coins to hedge against market uncertainty…

This doesn’t mean the end of the cycle. And they’re not long-term bearish; they’re just hedging and waiting for buy-side liquidity to recover, in my opinion.”

However, Ju agrees that the trend signifies a capitulation in miners, which is generally a characteristic of a pre-Bitcoin bull run.

At time of writing, BTC is trading at $60,681.

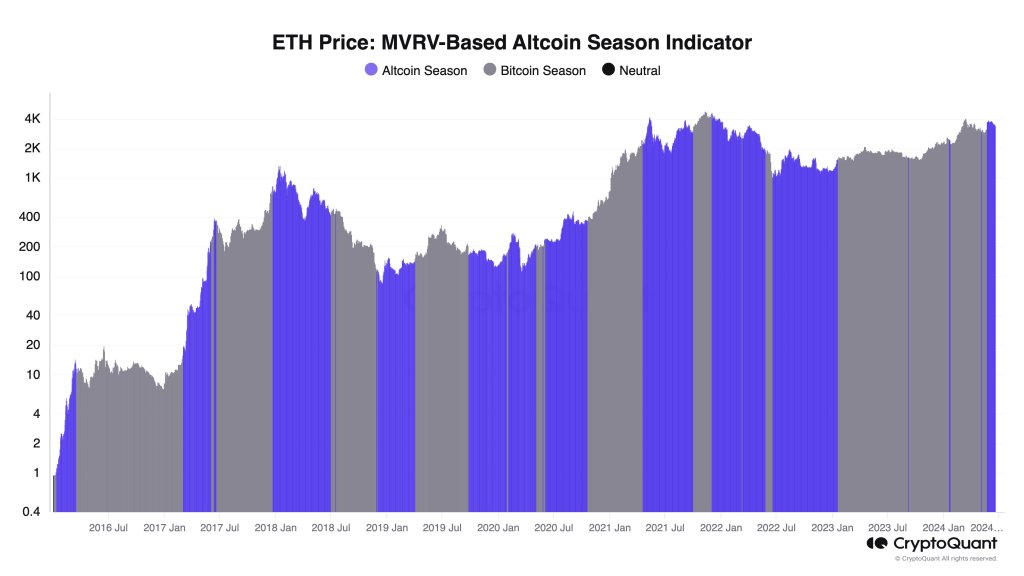

Recently, Ju said that Ethereum’s (ETH) Market Value to Realized Value (MVRV) indicator was signaling the beginning of an altseason.

The MVRV indicator, which is used to assess whether a particular crypto asset is undervalued or overvalued, is the ratio of the market capitalization of Ethereum, or any other crypto asset, relative to its realized capitalization (the value of all ETH at the price they were bought).

“We’re entering early altcoin season.

ETH MVRV is rising faster than Bitcoin (BTC) MVRV, suggesting ETH market is heating up relative to its on-chain fundamentals.

Given the current ETF situation, this might be an ETH-only season. Historically, when ETH surges, other altcoins tend to follow.”

ETH is trading at $3,360 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check

Click Here to Read the Full Original Article at Ethereum News – The Daily Hodl…