The biggest news in the cryptoverse for Nov. 22 includes the increasing rate of miner sellouts, realized Bitcoin loss from FTX fallout surpassing the losses caused by the Terra collapse, and Digital Currency Group CEO Barry Silbert’s comments regarding the liquidity situation at Genesis.

CryptoSlate Top Stories

Bitcoin miners selling aggressively as crypto market continues to struggle

Selling pressure on Bitcoin (BTC) miners continues as the Bitcoin price struggles below the $16,000 mark.

It’s a Bitcoin miner bloodbath.

Most aggressive miner selling in almost 7 years now.

Up 400% in just 3 weeks!If price doesn’t go up soon, we are going to see a lot of Bitcoin miners out of business. pic.twitter.com/4ePh0TIPmZ

— Charles Edwards (@caprioleio) November 21, 2022

According to Capriole Fund’s founder Charles Edwards, miners are selling at their most aggressive levels in seven years, with a 400% increase in selling pressure over the last three weeks.

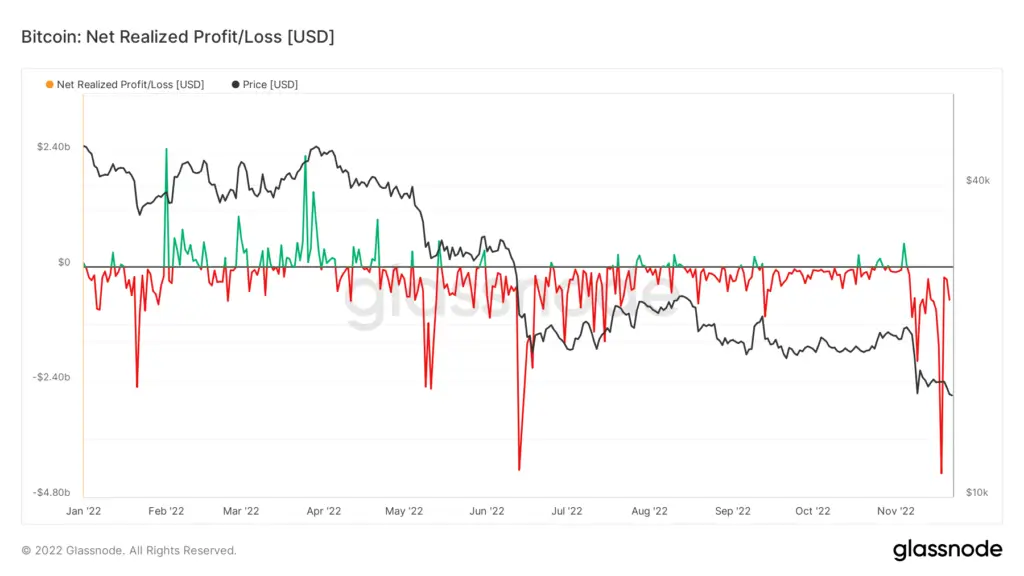

Realized Bitcoin loss from the FTX fallout surpasses LUNA collapse

Realized Bitcoin loss due to the FTX collapse has exceeded the losses caused by the Terra (Terra) collapse in May.

The first wave of selling pressure came in November and increased the realized loss to around $2 billion. According to data, realized Bitcoin losses reached their yearly high of $4.3 billion.

Digital Currency Group CEO Barry Silbert downplays FTX impact on Genesis, expects $800M revenue in 2022

Digital Currency Group‘s (DCG) CEO, Barry Silbert, sent a memo to the company shareholders to address the concerns regarding the liquidity of Genesis

Silbert explained that the suspension of withdrawals at Genesis’ lending arm is due to an issue of “liquidity and duration mismatch.” He continued to say that this issue has no significant impact on Genesis and expects the DCG to reach $800 million in revenue in 2022.

FTX bought $121M properties in Bahamas within 2 years

FTX, its senior executives, and Sam Bankman-Fried‘s…

Click Here to Read the Full Original Article at Ethereum (ETH) News | CryptoSlate…