On-chain data shows Bitcoin miners have always sold as Halvings have occurred. With the next one just around the corner, how are miners behaving this time?

Next Bitcoin Halving Is Less Than Two Days Away Now

In a CryptoQuant Quicktake post, an analyst discussed Bitcoin miners’ behavior in the build-up to the next Halving.

The “Halving” is a periodic event on the Bitcoin network where the cryptocurrency’s block rewards (the compensation miners receive for solving blocks) are permanently slashed in half.

This event occurs approximately every four years, and according to NiceHash’s countdown, the next one will occur in just over 32 hours.

The countdown to the next halving event | Source: NiceHash

Bitcoin miners earn revenue from two sources: transaction fees and block rewards. Historically, the former has been quite low on the BTC network, so the miners primarily depend on the latter to pay off their running costs.

Since the block rewards are cut in half during Halvings, these events naturally deal a significant blow to the miner’s revenues. As such, it’s not surprising that the miners have generally shown a reaction to the event in the past cycles.

“One of the common dynamics that occur in every cycle of cutting the issuance of new BTC is the significant selling pressure exerted by miners,” says the quant. One way to gauge the degree of selling pressure coming from these chain validators is via the Miner to Exchange Flow metric.

This indicator tracks the total amount of Bitcoin moving from miner-associated addresses to wallets connected to centralized exchanges. As miners usually deposit Bitcoin to these platforms for selling, this flow can provide hints about their selling behavior.

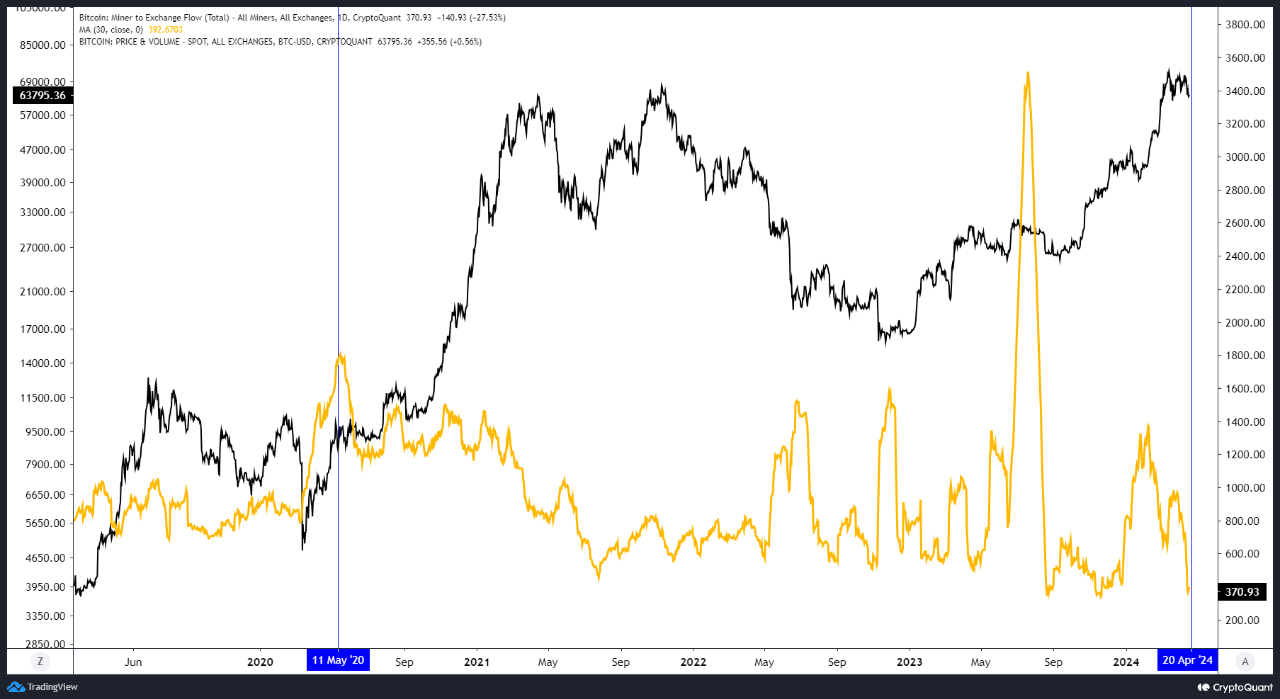

Now, here is a chart that shows the trend in the 30-day moving average (MA) BTC Miner to Exchange Flow over the last few years:

Looks like the 30-day MA value of the metric has observed a steep plunge in recent days | Source: CryptoQuant

As displayed in the above graph, the 30-day MA Bitcoin Miner to Exchange Flow had surged to high levels in the 2020 Halving event, implying that this group had potentially been participating in a selloff.

This selling push may have come from the miners planning to exit, given the sharp revenue reduction that was set to occur. The graph, though, clearly shows that no such selling pressure has emerged this time around despite the event being just around the corner.

So, what’s going on here?…

Click Here to Read the Full Original Article at NewsBTC…