CryptoQuant has revealed in its latest report that the Bitcoin market cap could rise by as much as $1 trillion after launching the spot ETFs.

Bitcoin Could See A 165% Rise When The Spot ETFs Launch

Yesterday, fake news of the approved iShares Bitcoin spot ETF took the sector by storm, as all cryptocurrencies observed sharp rallies. At the peak of this surge, BTC had approached the $30,000 level.

However, when the market realized the truth about the announcement, the asset quickly retraced to the levels it was at before the rally. While the gains were only brief, the rally nonetheless provided a glimpse into the strong reaction that the market could see to the launch of a real ETF.

This was just one spot ETF; however, several others are waiting in line to be approved. How would the market look like when all these ETFs have launched? In its new report, the on-chain analytics firm CryptoQuant has discussed precisely that.

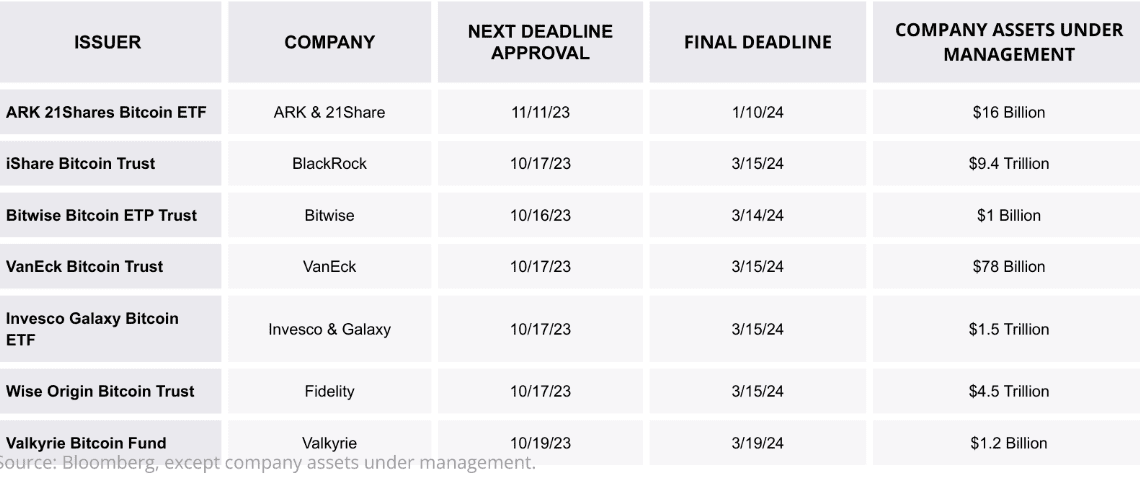

The assets under management of the various companies waiting for ETF approval | Source: CryptoQuant

The above table shows information about the various companies waiting to be approved for the Bitcoin spot ETF, including the total size of their assets under management (AUM).

“Although these ETFs are not expected to be approved this year, the probability that they will be approved by the final deadline (March 2024) has been growing as a result of favorable court rulings for Grayscale (GBTC Fund) and XRP in their respective legal fight against the SEC,” says the firm.

In total, these companies’ AUM are around $15.6 trillion. If they put just 1% of this amount towards BTC, it would mean inflows of a whopping $155 billion for the asset. “To put it in context, these amounts represent almost a third of the current market capitalization of Bitcoin,” notes CryptoQuant.

Now, how this capital inflow could affect the market cap of BTC isn’t exactly simple to say. Generally, the market cap increases by more than just the raw capital entering the cryptocurrency.

The firm has used the “realized cap” metric to assess this relationship. The realized cap is a capitalization method for BTC that calculates its total value by assuming that the value of each coin is the same as the price at which it was last transacted on the blockchain.

The realized cap can be imagined as the total investment made by the investors, accounting for the prices at which each bought their coins. The chart below shows how this…

Click Here to Read the Full Original Article at NewsBTC…