On-chain data shows that the Bitcoin short-term holder whales have a cost base above $64,000, which could be a potential resistance point for BTC.

Bitcoin Is Not Far From Realized Price Of Short-Term Holder Whales After Rally

As pointed out by an analyst in a CryptoQuant Quicktake post, the BTC price had slipped below the Realized Price of the short-term holder whales earlier. The “Realized Price” here refers to an indicator that keeps track of the average cost basis that the investors of a particular group currently share.

When the asset’s spot price is under this metric, the holders belonging to the cohort are in a state of net unrealized loss. Similarly, it being above the indicator implies the group is enjoying profits.

In the context of the current topic, there are two market segments of interest: the short-term holder and long-term holder whales. The short-term and long-term holders are the two main divisions of the Bitcoin sector based on holding time.

The short-term holders (STHs) are the investors who bought their coins within the past 155 days, while the long-term holders (LTHs) include the hands who have kept their coins dormant for longer than this period.

The “whales” generally refer to the entities that carry at least 1,000 BTC in their wallets, so the STH and LTH whales would naturally correspond to the large members of the respective cohorts.

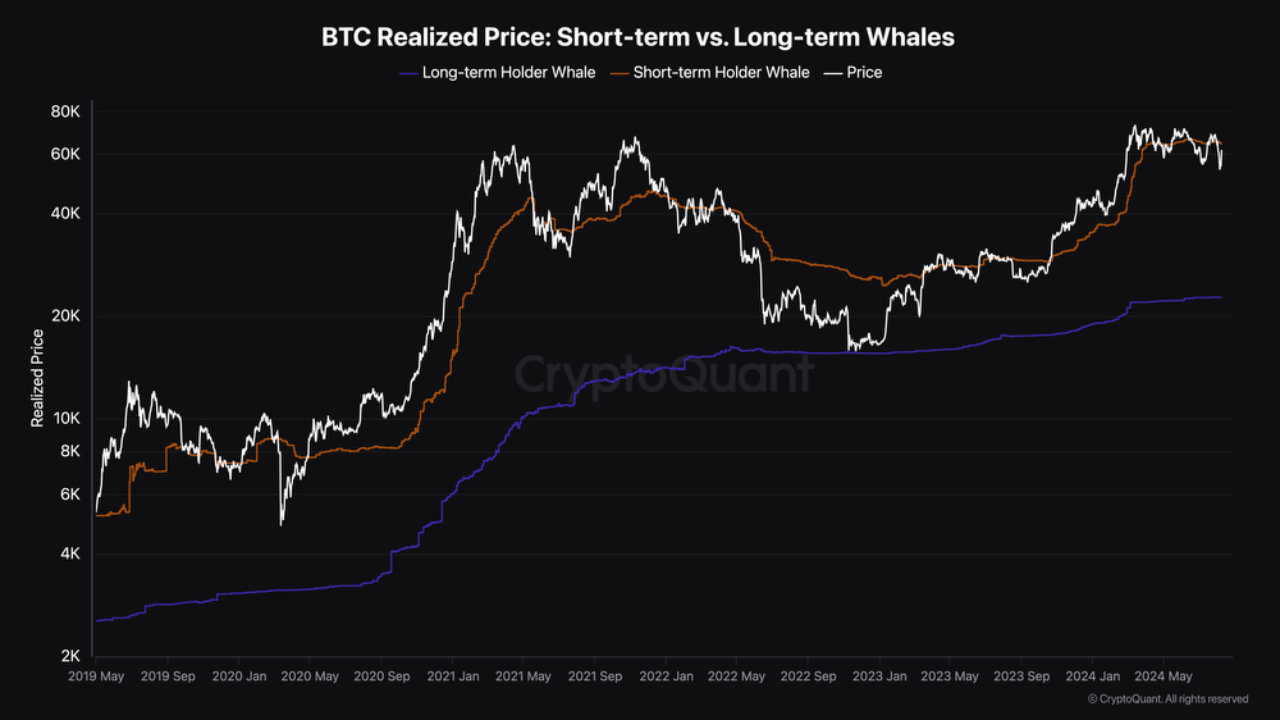

Now, here is a chart that shows the trend in the Realized Price for these two Bitcoin groups over the past few years:

As displayed in the above graph, the Bitcoin spot price had slipped considerably below the Realized Price of the STH whales during the recent market downturn. However, with the price observing recovery, it has now neared back to that level.

The average cost basis of the STH whales is between $64,000 and $65,000, so a retest of it could be coming soon. However, Such a retest could prove difficult for the cryptocurrency.

The STHs represent the weak hands of the market, which can be sensitive to changes in the market. The cost basis is naturally an important level for any investor, but this cohort especially can be likely to react when such a retest happens.

Since most STH whales have been at a loss recently, some may be desperately looking forward to a retest taking place so they can exit from the market at their break-even level. It remains to be seen whether Bitcoin will overcome this obstacle if the current recovery rally continues that far.

While the STH whales suffer…

Click Here to Read the Full Original Article at NewsBTC…