Data shows that the Bitcoin trader sentiment is currently neutral, a sign that investors are indecisive about the direction of the cryptocurrency.

Bitcoin Fear & Greed Index Is Right In The Balance Right Now

The “Fear & Greed Index” is an indicator created by Alternative that tells us about the average sentiment among the traders in the Bitcoin and wider cryptocurrency markets.

This index determines the sentiment by accounting for the data of the following five factors: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends. To represent the calculated sentiment, the indicator uses a scale that runs from zero to hundred.

When the metric’s value is greater than 53, it means the investors are sharing a sentiment of greed right now. On the other hand, the indicator being under 47 suggests the dominance of fear in the sector. Naturally, the region in-between these cutoffs corresponds to a neutral mentality.

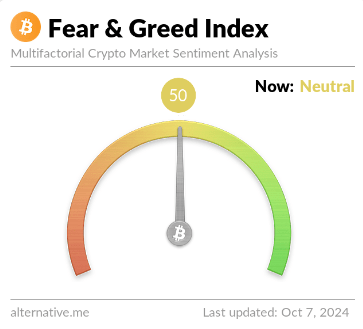

Now, here is how the latest value of the Bitcoin Fear & Greed Index has been like:

As is visible above, the indicator has a value of 50, which implies that the market sentiment is exactly in the balance at the moment. It’s also not just today that the metric has been in this zone, as it had in fact signaled a neutral market during the weekend as well.

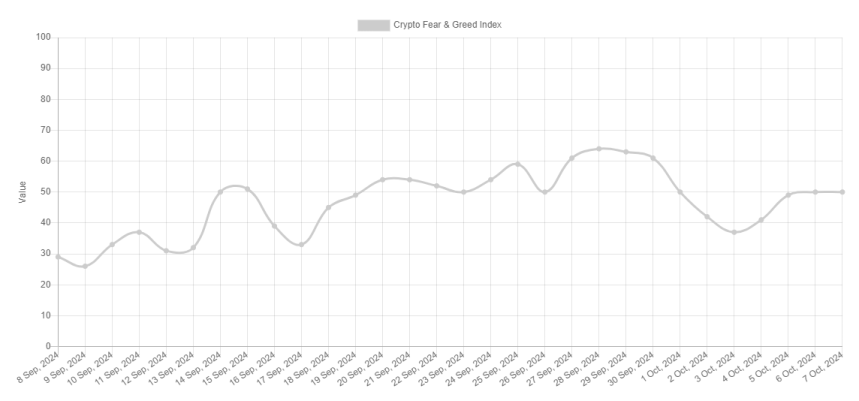

The below chart shows how the index’s value has changed over the past month.

From the graph, it’s apparent that the Bitcoin Fear & Greed Index had slipped into the fear region during the starting few days of this month, a result of the bearish action that the market as a whole had witnessed.

The traders hadn’t become too fearful in this drop, though, as the indicator had only reached a low of 37. With the price recovery that has followed since then, the sentiment has improved to the current 50 level.

Interestingly, however, despite the month of October being popularly dubbed ‘Uptober,’ a result of BTC historically performing well in this period, the market is yet to embrace greed.

The fact that the investors are still neutral despite a bullish wave seemingly starting with the recovery would suggest the investors are currently hesitant about getting excited over the prospect of a run.

Historically, Bitcoin has tended to move opposite to the expectations of the majority, so a highly bullish sentiment has usually been a bad sign for things to come. In this view, the fact that the investors are currently not displaying hype could actually turn out to be a boon for the…

Click Here to Read the Full Original Article at NewsBTC…