Data shows the Bitcoin market sentiment has plunged into fear as the cryptocurrency’s price has observed a crash to the $26,500 level.

Bitcoin Fear & Greed Index Points At “Fear” In The Market

The “Fear & Greed Index” is an indicator that tells us about the general sentiment among investors in the Bitcoin and wider cryptocurrency market. This metric uses a numeric scale that runs from 0-100 for displaying the sentiment.

All values above the 54 mark suggest the presence of greed among the investors, while those below 46 imply a majority mentality of fear. The region between these cutoffs reflects the neutral sentiment.

As for how the index calculates the sentiment, Alternative.me, the creator of the metric, explains that it takes into account several different factors. Namely; volatility, trading volume, social media sentiment, market cap dominance, and Google Trends are what the indicator currently makes use of to pinpoint the market mentality.

Now, here is what the Bitcoin Fear & Greed Index’s value looks like right now:

The value of the metric seems to be inside the fear territory at the moment | Source: Alternative

As you can see above, the index’s value is 37 currently, which suggests that the majority of the investors are fearful. This latest value of the indicator reflects a new shift in the sector, as prior to today, the indicator had been stuck inside the neutral territory for more than three weeks straight.

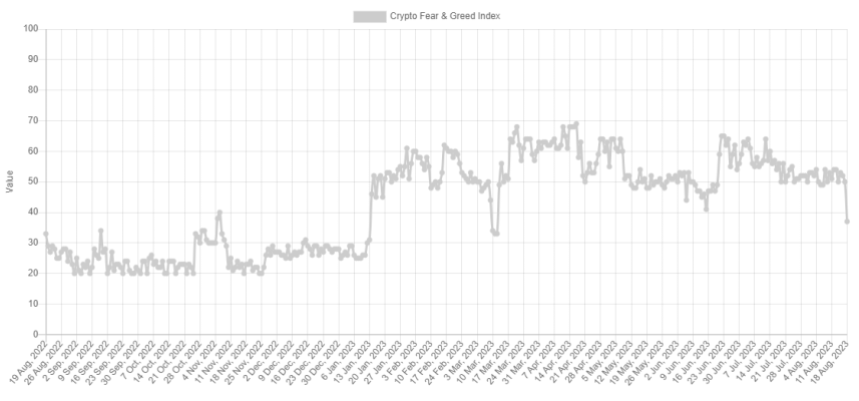

The below chart displays the trend in the fear and greed index over the past year.

Looks like the value of the metric has taken a plunge recently | Source: Alternative

From the graph, it’s visible how sharp this latest drop in the metric has been. In a flash, the market sentiment went from being completely neutral (50), to firmly inside the fear territory (37).

The reason behind this hit to the investor mentality has been the sharp crash that Bitcoin has observed during the past day, as the cryptocurrency’s price has now slumped below $26,500.

Earlier, when the index was consolidating in neutral territory, investors had been hesitant and undecided. But with this price action, it would appear that their mind has been made up, and they think that the asset would go down even lower.

Historically, the market has actually tended to make moves that the majority of the holders aren’t expecting. The harder investors lean toward any one direction (fear or greed), the more probable price action of…

Click Here to Read the Full Original Article at NewsBTC…