This week the $20,000 resistance is proving to be stronger than expected and even after Bitcoin price rejected at this level on Sept. 27, BTC bulls still have reasons to not give up.

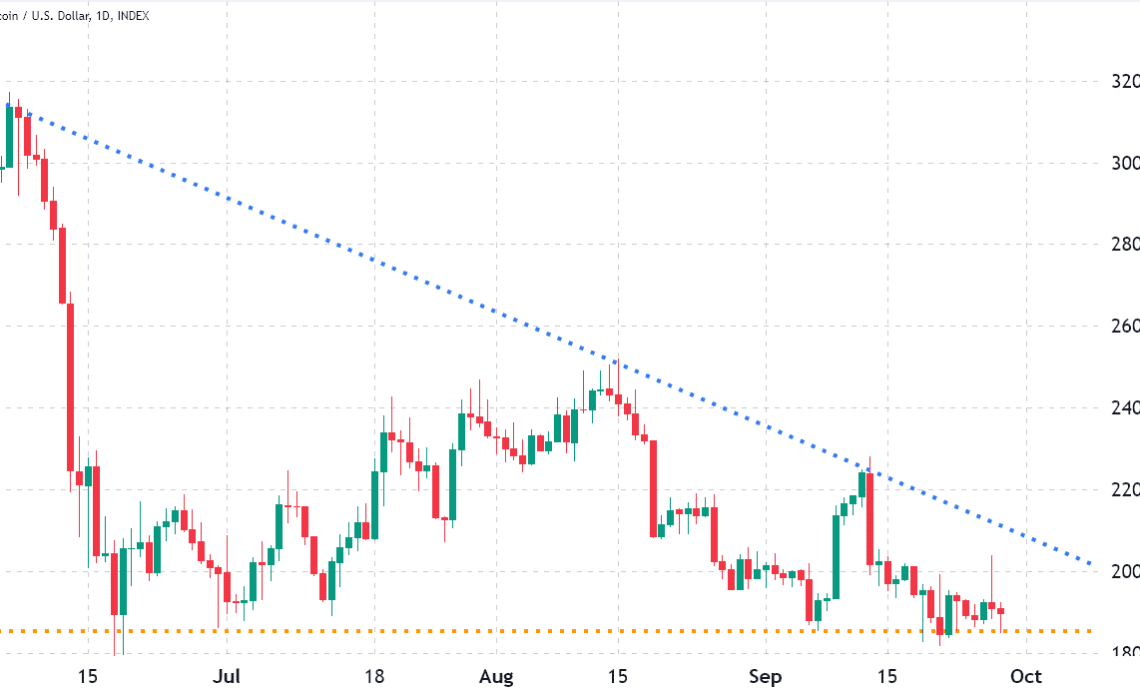

According to the 4-month-long descending triangle, as long as the $18,500 support holds, Bitcoin price has until late October to determine whether the downtrend will continue.

Bitcoin bulls might have been disappointed by the lackluster price performance as BTC has failed multiple times to break above $20,000, but macroeconomic events might trigger a rally sooner than expected.

Some analysts point to the United Kingdom’s unexpected intervention in the bond market as the breaking point of the government’s debt credibility. On Sept. 28, the Bank of England announced that it would begin the temporary purchase of long-dated bonds to calm investors after a sharp yield increase, the highest since 1957.

To justify the intervention, the Bank of England stated, “were dysfunction in this market to continue or worsen, there would be a material risk to U.K. financial stability.” Taking this measure is diametrically opposite to the promise of selling $85 billion in bond holdings within 12 months. In short, the government’s credibility is being questioned and as a result investors are demanding much higher returns to hold U.K. debt.

The impact of the government’s efforts to curb inflation are beginning to impair corporate revenues and according to Bloomberg, Apple recently backed off plans to increase production on Sept. 27. Amazon, the world’s biggest retailer, is also estimated to have shuttered plans to open 42 facilities, as per MWPVL International Inc.

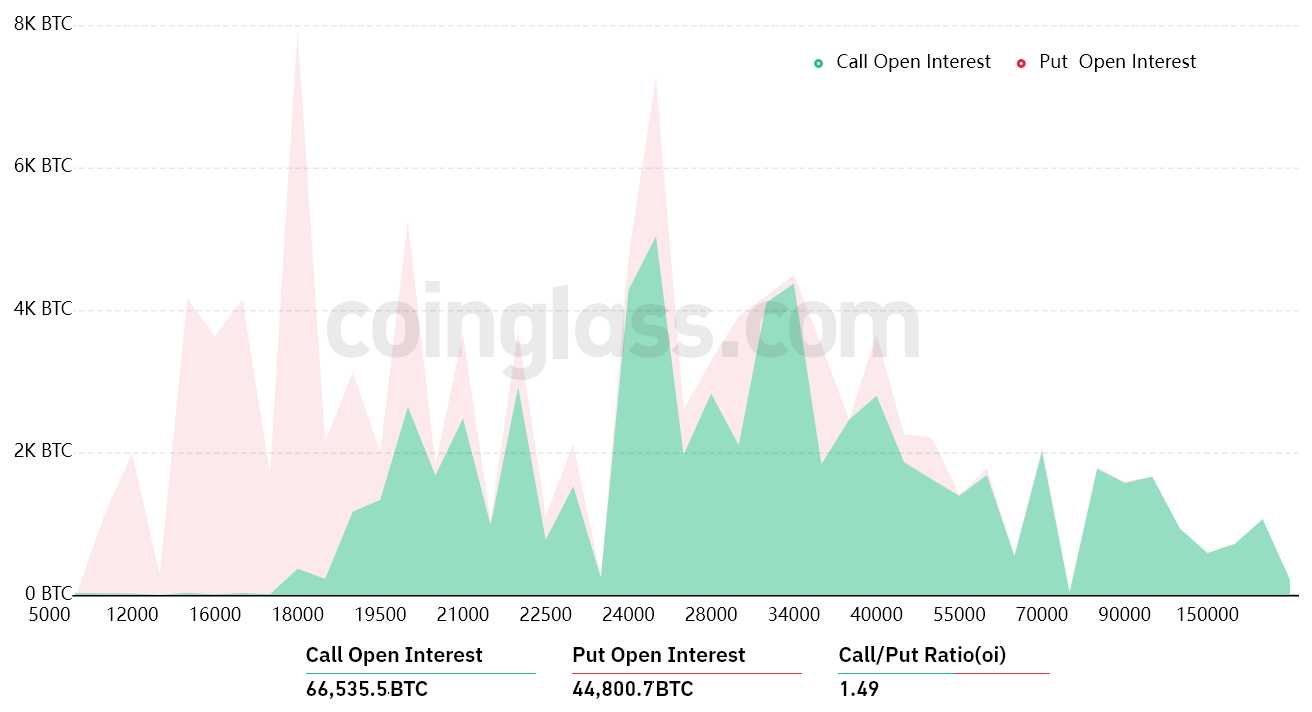

That is why the $2.2 billion Bitcoin (BTC) monthly options expiry on Sept. 30 will put a lot of price pressure on the bulls, even though bears seem slightly better positioned as Bitcoin attempts to hold on to $19,000.

Most of the bullish bets were placed above $21,000

Bitcoin’s rally toward the $22,500 resistance on Sept. 12 gave the bulls the signal to expect a continuation of the uptrend. This becomes evident because only 15% of the call (buy) options for Sept. 30 have been placed at $21,000 or lower. This means Bitcoin bears are better positioned for the expiry of the $2.2 billion in monthly options.

A broader view using the 1.49 call-to-put ratio shows a skewed situation with bullish bets (calls) open interest at…

Click Here to Read the Full Original Article at Cointelegraph.com News…