On-chain data shows around 95% of all Bitcoin holders are in profit following the latest bullish action that the asset’s price has seen.

Very Few Bitcoin Addresses Are Still Underwater

In a new post on X, the market intelligence platform IntoTheBlock has shared an update on how the Bitcoin holder’s profitability is currently looking. The analytics firm has made use of on-chain data to determine this.

IntoTheBlock has gone through the transaction history of each address on the network to check the average price at which it acquired its coins. Wallets with a cost basis below the current price are assumed to carry some net unrealized profit.

Similarly, addresses of the opposite type are considered to be loss holders. The analytics firm terms the former investors “in the money,” while the latter are “out of the money.”

Naturally, the wallets with their average acquisition price equal to the latest spot price of the cryptocurrency would be just breaking even on their investment. They would be said to be “at the money.”

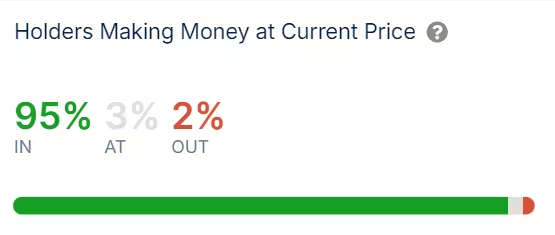

Now, here is how the address distribution on the Bitcoin network is like right now across these three categories:

As is visible above, around 95% of the existing Bitcoin holders currently have a net profit. About 3% of the remaining are at their break-even level, while the rest 2% are underwater.

Thus, the market distribution is currently overwhelmingly skewed towards profit holders. The reason behind this is the recent price rally the asset has gone through.

“With 95% of Bitcoin addresses now in profit, market sentiment is booming,” notes IntoTheBlock. “Historically, such levels have signaled strong bullish momentum but can also indicate a potential overextension.”

Generally, investors in profit are more likely to sell their coins at any point, so a large amount of them being in the green can raise the chances of a mass selloff occurring with the motive of profit-taking. This is why a high profitability ratio can suggest potential overheated conditions.

A huge amount of addresses are in the money right now, so it’s possible that another profit-taking event could happen. It remains to be seen whether demand would be enough to absorb the selling or if a top would take place for Bitcoin.

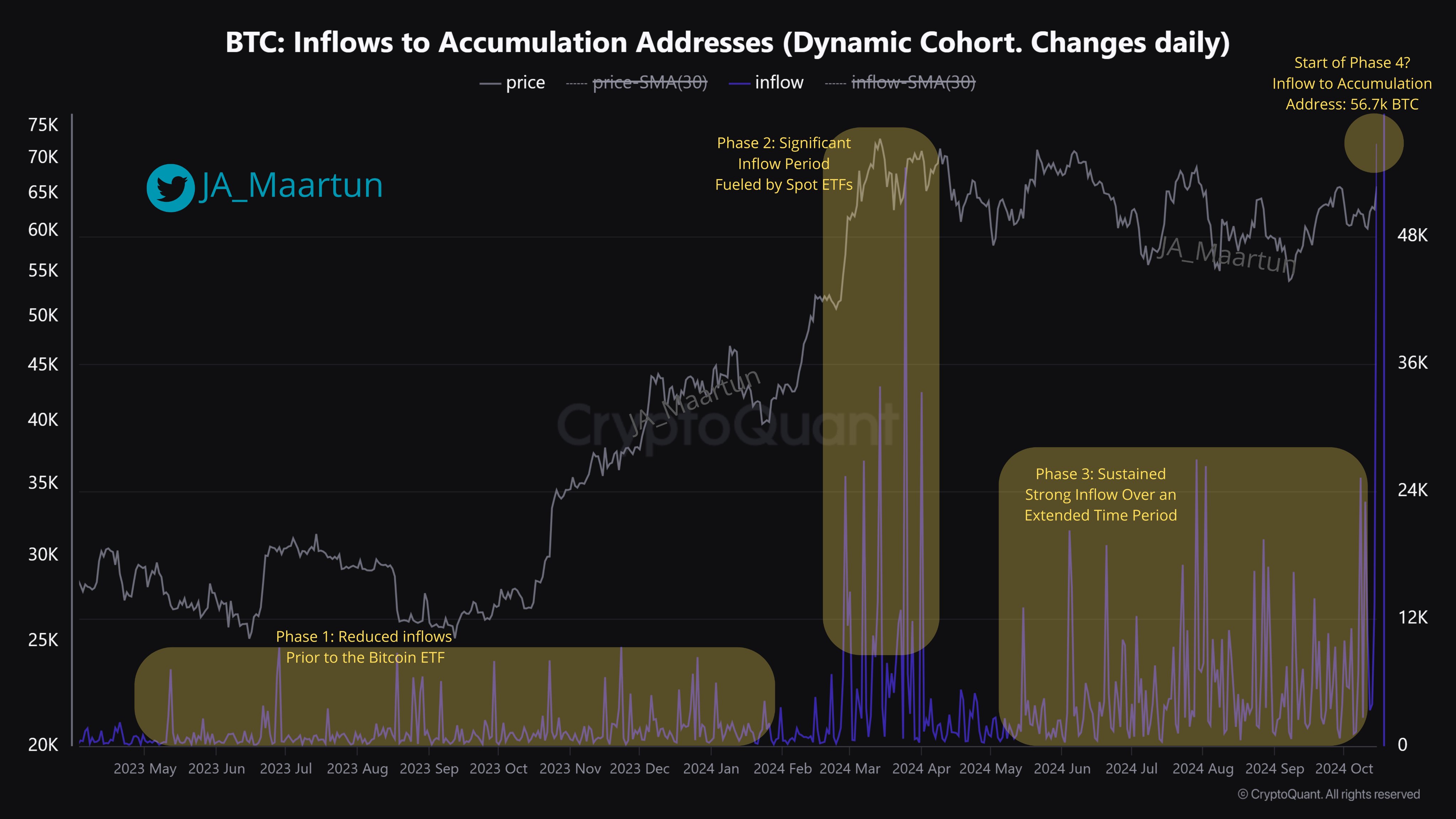

On a more bullish note, the Bitcoin inflows to “accumulation addresses” have spiked recently, as CryptoQuant community manager Maartunn has pointed out in an X post.

The accumulation addresses refer to the wallets that have no history of selling on the…

Click Here to Read the Full Original Article at NewsBTC…