Crypto analyst Benjamin Cowen says that Bitcoin (BTC) has a good chance of printing a significant correction soon based on historical price action.

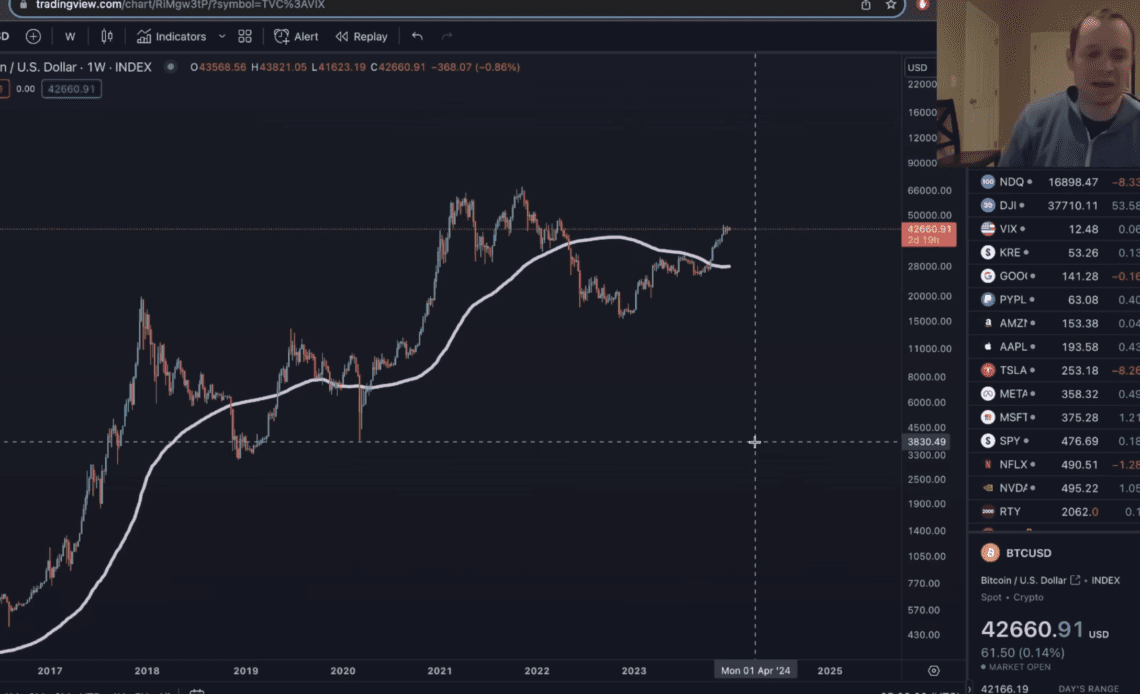

In a new strategy session, Cowen tells his 788,000 YouTube subscribers that he’s keeping an eye on Bitcoin’s 100-week simple moving average (SMA).

According to Cowen, each time Bitcoin has crossed above its 100-week SMA, BTC tends to go back down to retest it before continuing upward. Since BTC crossed above the 100-week SMA several months ago, Cowen says that there’s a risk to the downside if history is any indication.

The analyst also says that the actions of the Federal Reserve might determine whether Bitcoin will hold the 100-week SMA as support.

“Historically, sometime around this point in the cycle – and actually it’s occurred even later in the cycle as well – we’ve sort of retested that 100-week moving average.

It’s just something that we sort of acknowledge that does seem to be something that comes in at a phase in the cycle. In 2016, we didn’t have a hard landing. I guess you could argue that it was a soft landing. We didn’t even have a recession back then but we did have a recession scare where a lot of people thought there was going to be a recession.

We didn’t really have an inverted yield curve or anything like that but there were other parts of the world where their economies were slowing down and I think there were some arguments that it could happen in the United States. [But] it didn’t, and Bitcoin basically retested that 100-week SMA and continued to move higher. Whereas last cycle, we retested it, got a bounce, but then ultimately fell through.

So I do think that at some point, probably within the first few months of 2024, we’ll see some type of back test of that 100-week moving average, and then the question of whether it holds or not will probably be dependent on whether the Fed achieves a soft landing or, if it’s a hard landing like the last cycle.”

At time of writing, Bitcoin is trading at $42,297, about 36% above its 100-week SMA.

I

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…