Bitwise chief investment officer Matt Hougan is unveiling the catalysts that he believes will push Bitcoin (BTC) to $100,000 and beyond.

Hougan says on the social media platform X that macroeconomic conditions and on-chain data appear to be suggesting that Bitcoin is poised to spark huge rallies.

According to the Bitwise executive, major central banks are adopting loose monetary policies as Bitcoin supply dwindles following this year’s halving event when BTC miner rewards were slashed in half.

“We’re heading to six-figure Bitcoin.

* ETF flows reaccelerating

* Election approaching

* Infinite deficits (bipartisan agreement!)

* Economic stimulus in China

* Global rate cuts (Fed, ECB)

* Halving supply shock starting to bite

* Whales accumulating.”

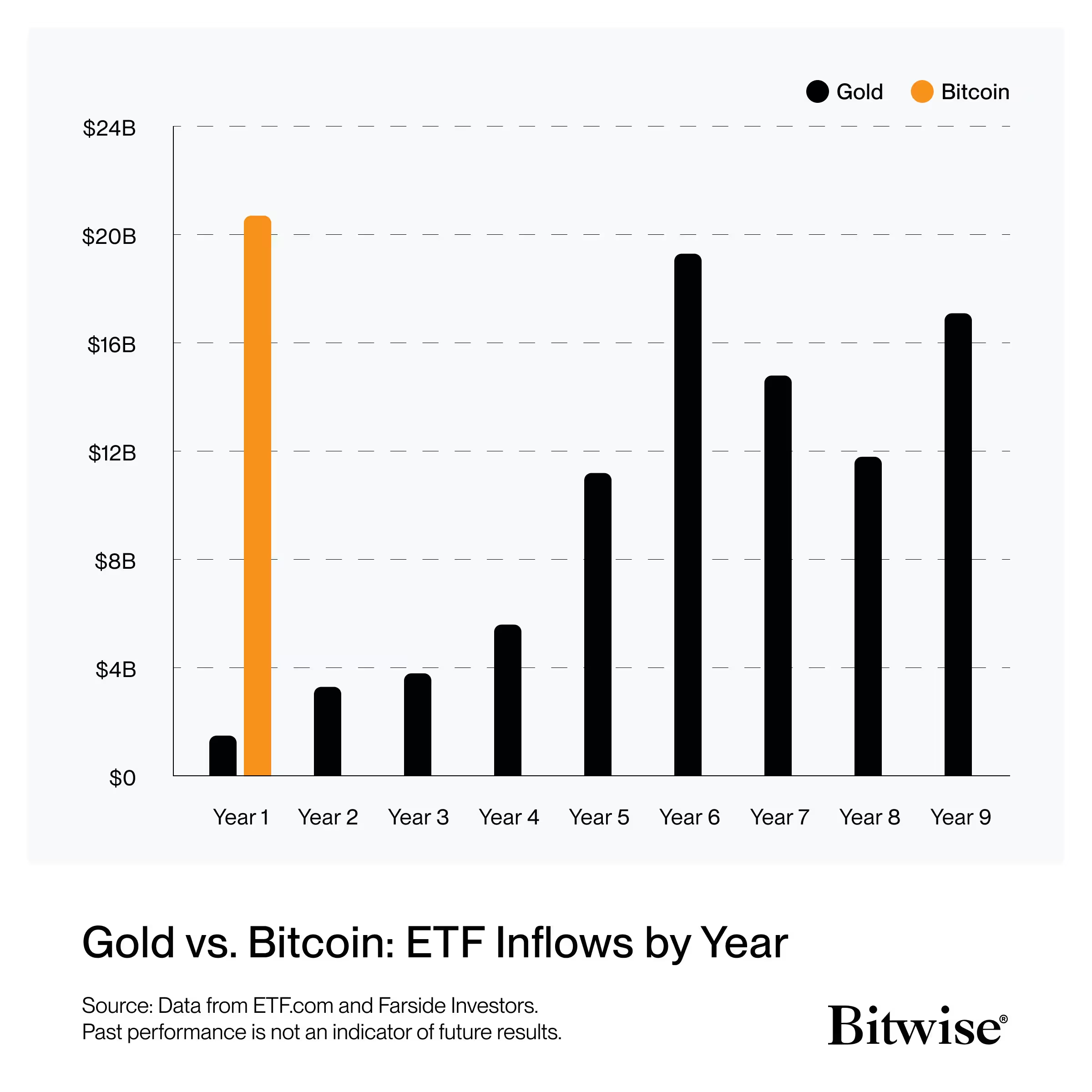

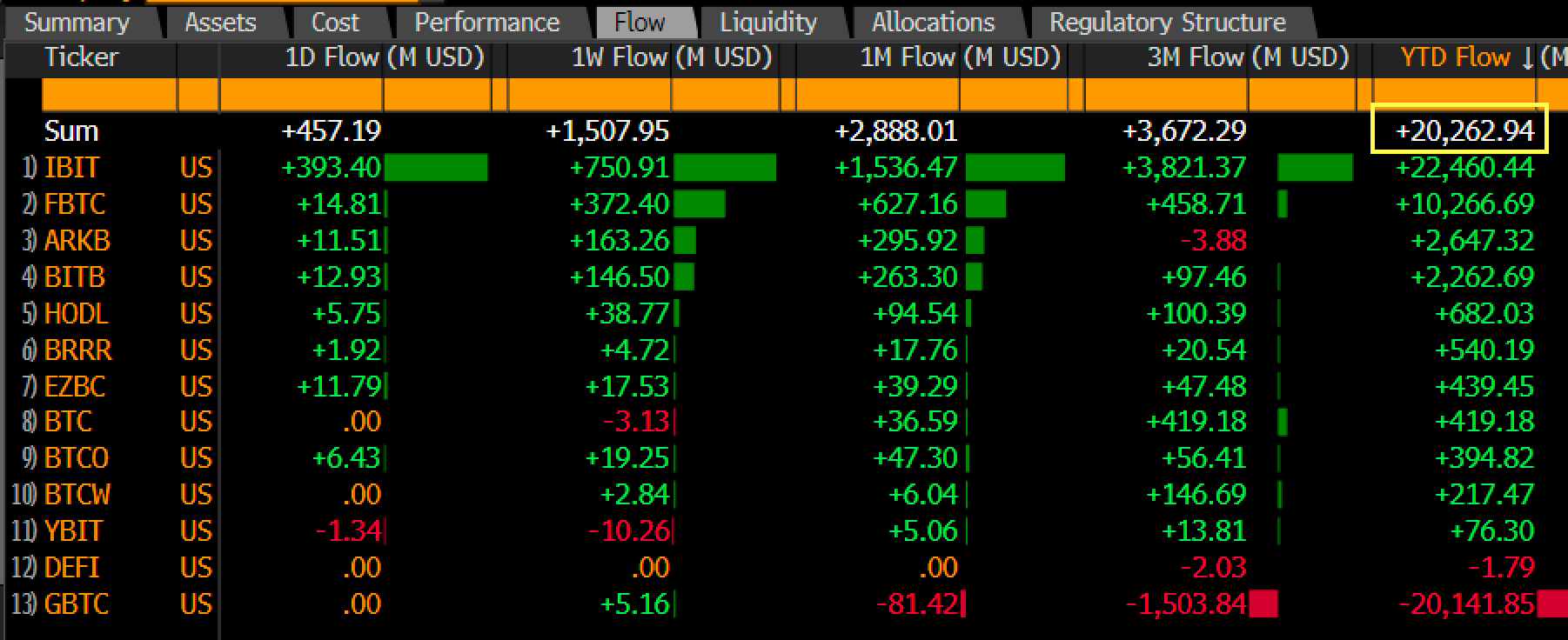

Hougan also highlights Bitwise’s data on Bitcoin exchange-traded funds (ETFs), showing that inflows have exceeded $20 billion just this year. The chart reveals that BTC ETFs have massively outperformed their gold counterparts in terms of inflows during the first year of existence.

“This.”

Bloomberg senior ETF analyst Erich Balchunas explains the significance of the massive inflows witnessed by Bitcoin ETFs this year. According to Balchunas, gold ETFs had to wait for half a decade before seeing a comparable capital allocation.

“Bitcoin ETFs have crossed $20 billion in total net flows (the most important number, and most difficult metric to grow in ETF world) for the first time after a huge week of $1.5 billion.

For context, it took gold ETFs about five years to reach the same number. Total assets are now $65 billion, also a high water mark.”

At time of writing, Bitcoin is trading for $68,172.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image:…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…