Bitcoin (BTC) Ordinals are boosting miner profits, but “income stress” is looming, new research warns.

In the latest edition of its weekly newsletter, “The Week On-Chain,” analytics firm Glassnode predicted fresh problems for miners after Bitcoin’s next block subsidy halving.

Bitcoin halving impact on miners could be “severe”

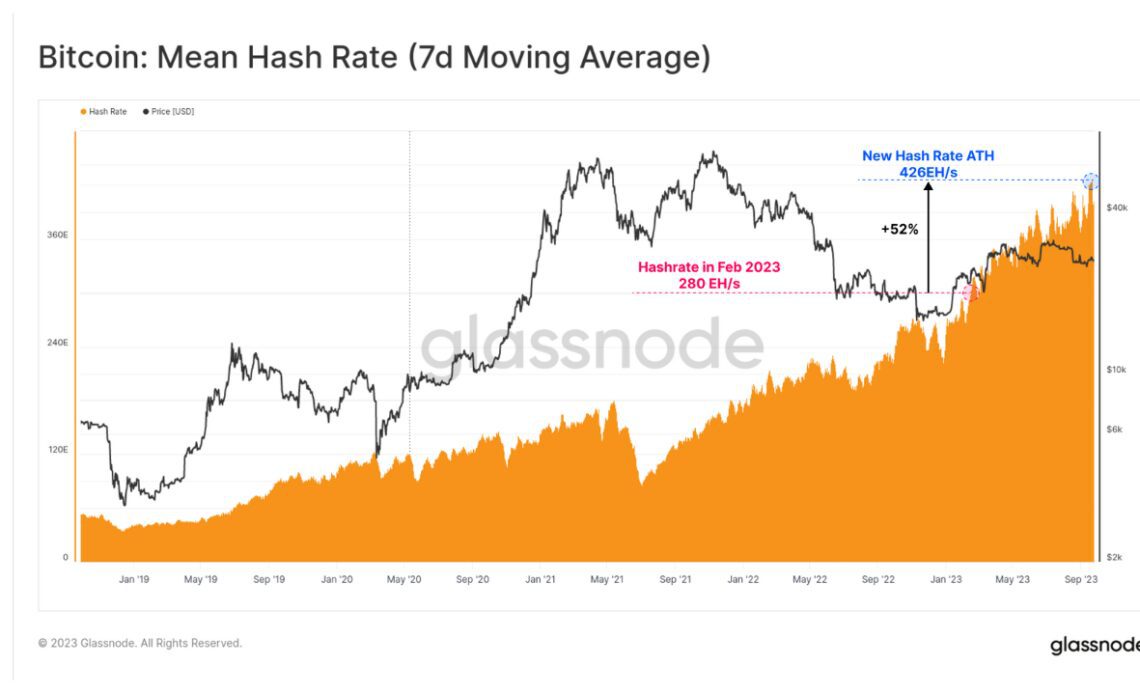

Bitcoin miner competition is exploding, with hash rate — the estimated combined processing power deployed to the blockchain — at record highs.

For Glassnode, this indicates unprecedented conditions for miners trying to eke out a living at current BTC price levels.

Ordinal inscriptions are helping, with these acting as “packing-filler” which turns empty blockspace into a source of revenue for miners.

“Naturally, as blockspace demand increases, miner revenues will be positively affected,” it wrote.

The proportion of income received from fees has increased between 1% and 4% compared to lows seen during Bitcoin bear markets, but by historical standards remains modest.

“Meanwhile, the amount of hashrate competing for these rewards has increased by 50% since February, as more miners, and newer ASIC rigs are established and come online,” “The Week On-Chain” notes.

This hash rate spike is laying the foundation for an upcoming showdown. In April 2024, miner rewards per block will drop 50%, doubling the so-called “production cost” per BTC. Currently around $15,000, this will pass $30,000 — above the current spot price.

Glassnode presented two models for estimating the price at which miners, on aggregate, fall into the red, with the above comparing issuance to mining difficulty.

“By this model, we estimate that the most efficient miners on the network have an acquisition price of around $15.1k,” researchers explained.

“However, the purple curve shows the post-halving ‘doubling’ of this level to $30.2k, which would likely put the majority of the mining market into severe income stress.”

A previous model put the average miner acquisition price at $24,300 per Bitcoin — around 8% below spot as of Sept. 28.

BTC price incentives

Others are more optimistic about how miners will handle the build-up to the halving.

Related: Bitcoin exchange volume tracks 5-year lows as Fed inspires BTC…

Click Here to Read the Full Original Article at Cointelegraph.com News…