Bitcoin’s (BTC) month-to-date chart is very bearish and the sub-$18,000 level seen over the weekend was the lowest price seen since December 2020. Bull’s current hope depends on turning $20,000 to support, but derivatives metrics tell a completely different story because professional traders are still extremely skeptical.

It’s important to remember that the S&P 500 index dropped 11% in June and even multi-billion companies like Netflix, PayPal and Caesars Entertainment have corrected with 71%, 61% and 57% losses respectively.

The U.S. Central Bank raised its benchmark interest rate by 75 basis points on June 15 and Federal Reserve Chairman Jerome Powell hinted that more aggressive tightening could be in store because the monetary authority continues to struggle to curb inflation. However, investors and analysts fear this move increases the recession risk. According to a Bank of America note to clients issued on June 17:

“Our worst fears around the Fed have been confirmed: they fell way behind the curve and are now playing a dangerous game of catch up.”

Furthermore, according to analysts at the global investment bank JPMorgan Chase, the record-high total stablecoin market share within cryptos is “pointing to oversold conditions and significant upside for crypto markets from here.” According to the analysts, the lower percentage of stablecoins in the total crypto market capitalization is associated with a limited crypto potential.

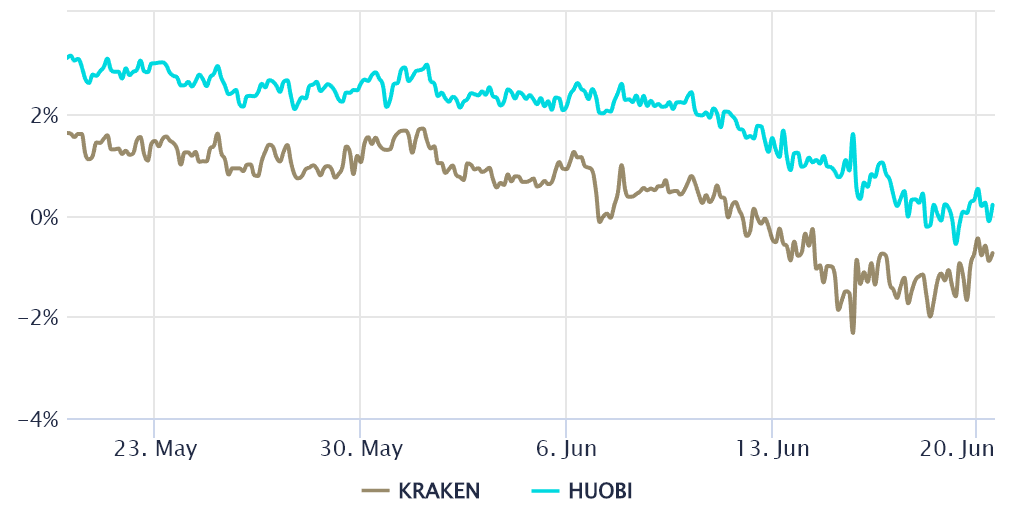

Currently, crypto investors face mixed sentiment from recession fears and optimism toward the $20,000 support gaining strength as stablecoins could eventually flow into Bitcoin and other cryptocurrencies. For this reason, analysis of derivatives data is valuable in understanding whether investors are pricing higher odds of a downturn.

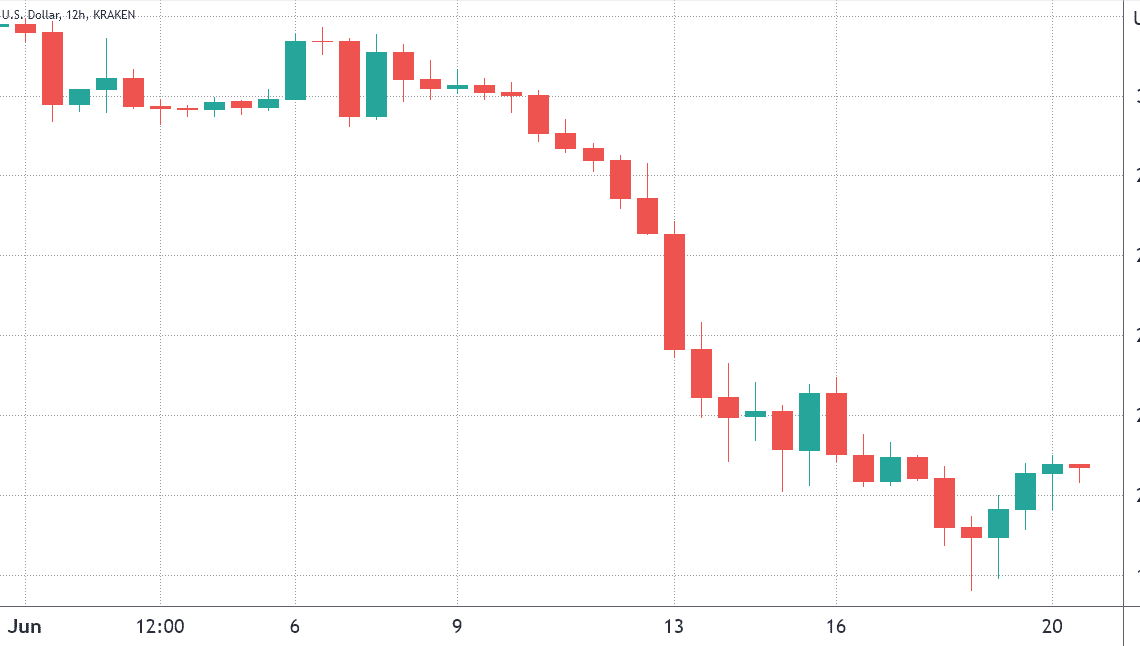

The Bitcoin futures premium turns negative for the first time in a year

Retail traders usually avoid quarterly futures due to their price difference from spot markets, but they are professional traders’ preferred instrument because they avoid the perpetual contracts fluctuating funding rate.

These fixed-month contracts usually trade at a slight premium to spot markets because investors demand more money to withhold the settlement. This situation is not exclusive to crypto markets. Consequently, futures should trade at a 5% to 12% annualized premium in healthy markets.

Bitcoin’s…

Click Here to Read the Full Original Article at Cointelegraph.com News…