The funding rate is a key mechanism in Bitcoin perpetual futures designed to keep the contract price as close as possible to BTC‘s spot price. It’s a periodic payment exchange between long and short traders, determined by the difference between the perpetual futures and spot prices. When the funding rate is positive, long positions pay shorts; when it’s negative, shorts pay longs.

Monitoring the funding rate is crucial for analyzing the market as it’s one of the best indicators of trader positioning, particularly in leveraged trading environments. A consistently high or positive funding rate indicates a bullish sentiment, as more traders are willing to pay a premium to hold long positions in a perpetual contract. Conversely, a negative funding rate shows a bearish sentiment, with traders more inclined to short the asset and, in turn, pay a premium.

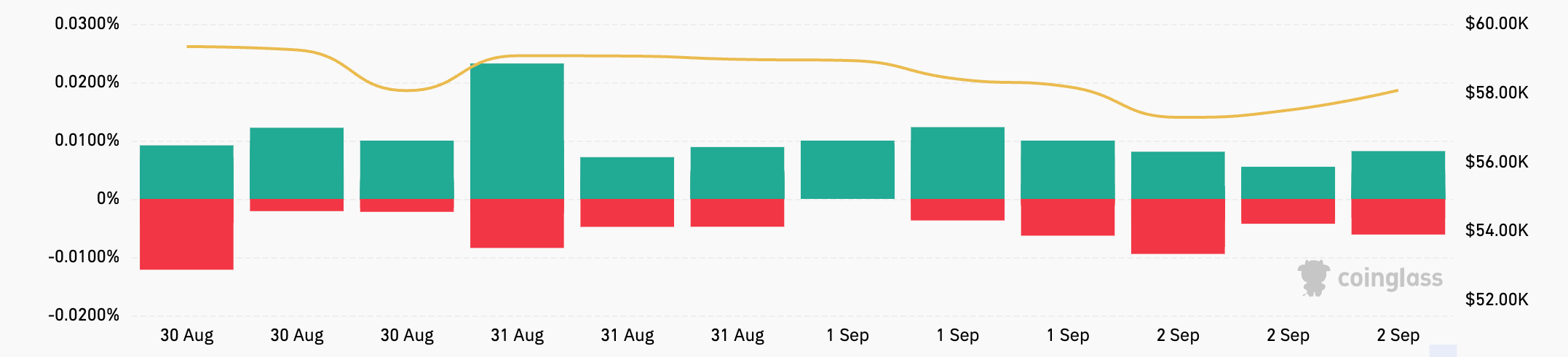

Throughout the weekend, the funding rates for USDT and USD-margined contracts fluctuated across exchanges. On Aug. 31, the rates were predominantly positive, showing a bullish sentiment, though varying in magnitude. Bitmex had the highest funding rate at 0.0089%, while OKX had the lowest at 0.0029%. On Sep. 1, there’s been a notable shift, particularly on Binance and Bybit, where the rates turned negative at -0.0004% and -0.0009%, respectively. This showed an increase in bearish sentiment on those exchanges.

This trend continued on Sep. 2 and became more pronounced on Bybit and OKX, with both platforms seeing negative funding rates of -0.0040%, indicating growing pressure from short positions. In contrast, Bitmex, which had the highest funding rate on Aug. 31, saw a significant drop to 0.0048% by Sep. 2, though it remained positive. HTX‘s funding rate also decreased but stayed positive at 0.0014%. Funding rates vary so much across exchanges due to the differences in trader sentiment and positioning on each platform, which are most likely influenced by liquidity, trading volume, and the specific trader base.

The funding rates for token-margined contracts during the same period were much different. By Sep. 1, most exchanges saw negative funding rates, with Bybit and OKX dropping to -0.0096% and -0.0044%, respectively. On Sep. 2, the divergence became more pronounced, with Bybit’s rate falling to -0.0191%, suggesting intense bearish pressure, while HTX saw a significant jump to…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…