Bitcoin (BTC) is flashing a bullish signal based on one historical factor, according to market intelligence platform Santiment.

In a new thread, the crypto analytics firm says that it appears as if the top crypto asset by market cap is losing momentum after skyrocketing nearly 150% since October.

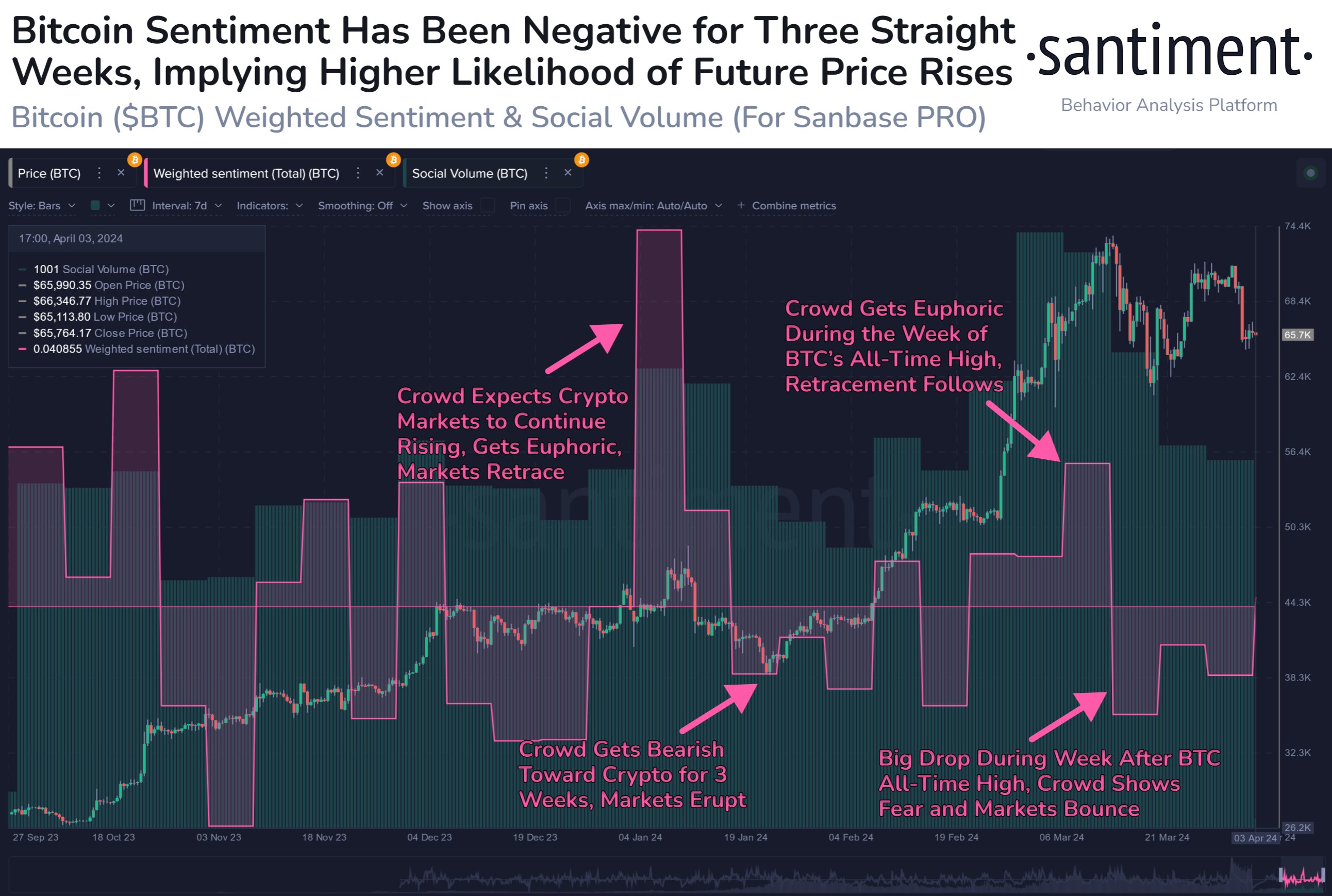

However, Santiment notes that historically, the more people are worried about BTC in the long term, the higher the chances are of a continued market rise.

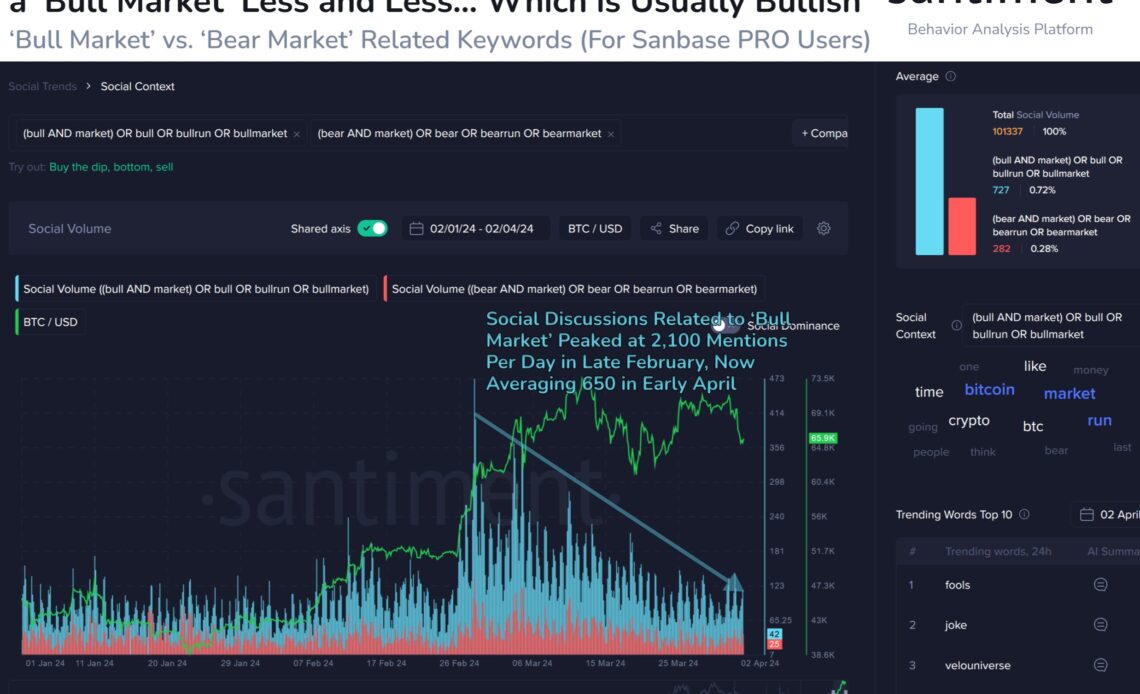

“Is crypto still in a bull market after Bitcoin’s +144% price return since October 15th? Well, according to the crowd, the belief has fizzled out significantly. Historically, less long-term optimism increases the probability of a continued market rise.”

Because of the crowd’s shifting BTC outlook, Santiment says that Bitcoin bulls should be rooting for market sentiment to remain bearish.

“The crowd’s sentiment toward Bitcoin and crypto markets in general has wavered ever since the big correction three weeks ago. Even with the BTC halving now just two weeks away, trader sentiment reflects FUD (fear, uncertainty and doubt) and bearish expectations.

With prices bouncing back to $69,000 temporarily on Thursday, bulls should be rooting for the general consensus to remain negative. Historically, markets move the opposite direction of the crowd’s expectation, so some of the best times to buy are during times in which most don’t believe a rally can start or continue.”

Santiment goes on to say that the market believes BTC’s latest dip was due to the government selling the 10,000 BTC seized from the defunct online black marketplace Silk Road. The crypto analytics firm says that spikes in BTC’s price tend to happen when the crowd becomes concerned about the seized Silk Road Bitcoin stack.

“Bitcoin has bounced all the way back above $69,000 after dropping below $65,000 just two days ago. The culprit of the fall, according to most of the crypto community, is attributed to the US government authorities’ admission to selling nearly 10,000 BTC from the Silk Road seizure.

There are expected to be four more similar-sized selloffs throughout 2024, which has evoked major fear from traders. As we can see, there have been two major spikes in crowd interest related to Silk Road in 2024, and both of them foreshadowed nearly instant crypto market spikes immediately afterward.

Markets typically move the opposite direction of the crowd’s expectation,…

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…