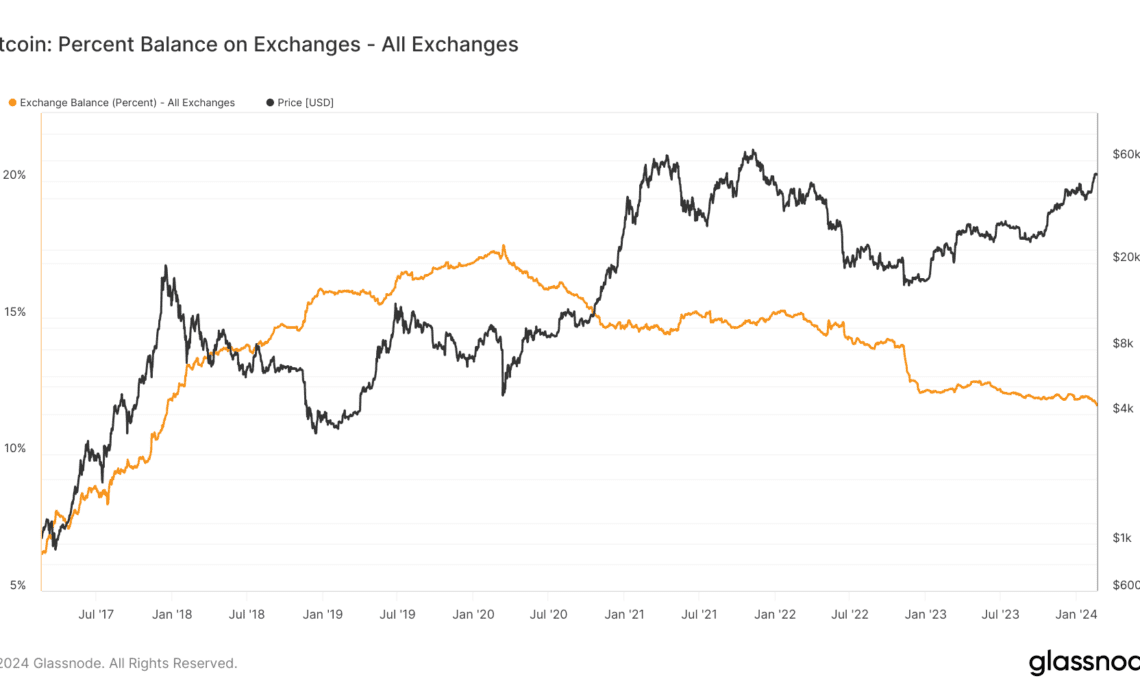

Since mid-March 2020, there has been a notable decline in the volume of Bitcoin stored in exchange wallets, marking a significant shift in investor behavior.

At the time, over 17% of Bitcoin’s total supply was housed on exchanges, a record high. This trend of declining exchange balances has continued unabated, even through Bitcoin’s 2021 bull run, which saw its price peak at $69,000 in November of that year.

This trajectory has extended into 2024, with CryptoSlate’s analysis of Glassnode data revealing a persistent decrease in Bitcoin holdings on exchanges.

From Jan. 1 to Feb. 19, the amount of Bitcoin in exchange wallets fell from 2.356 million BTC to 2.314 million, the lowest since April 2018. Meanwhile, the percentage of Bitcoin’s supply in exchange wallets decreased from 12.03% to 11.79%.

The diminishing presence of Bitcoin on exchanges suggests a growing preference among holders to transfer their assets away from these platforms. This movement may indicate a broader strategy shift towards long-term holding or a reaction to prevailing market conditions.

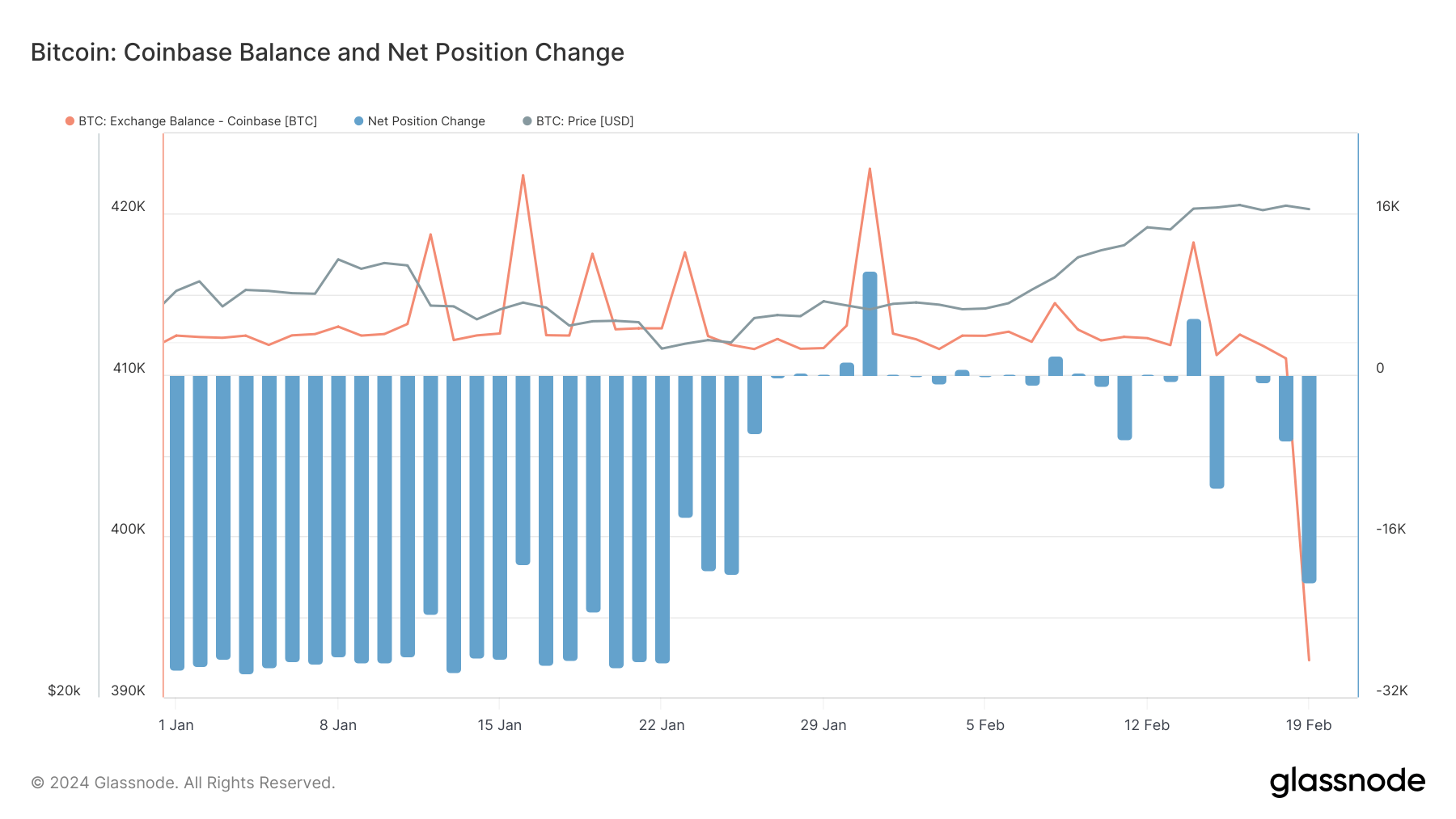

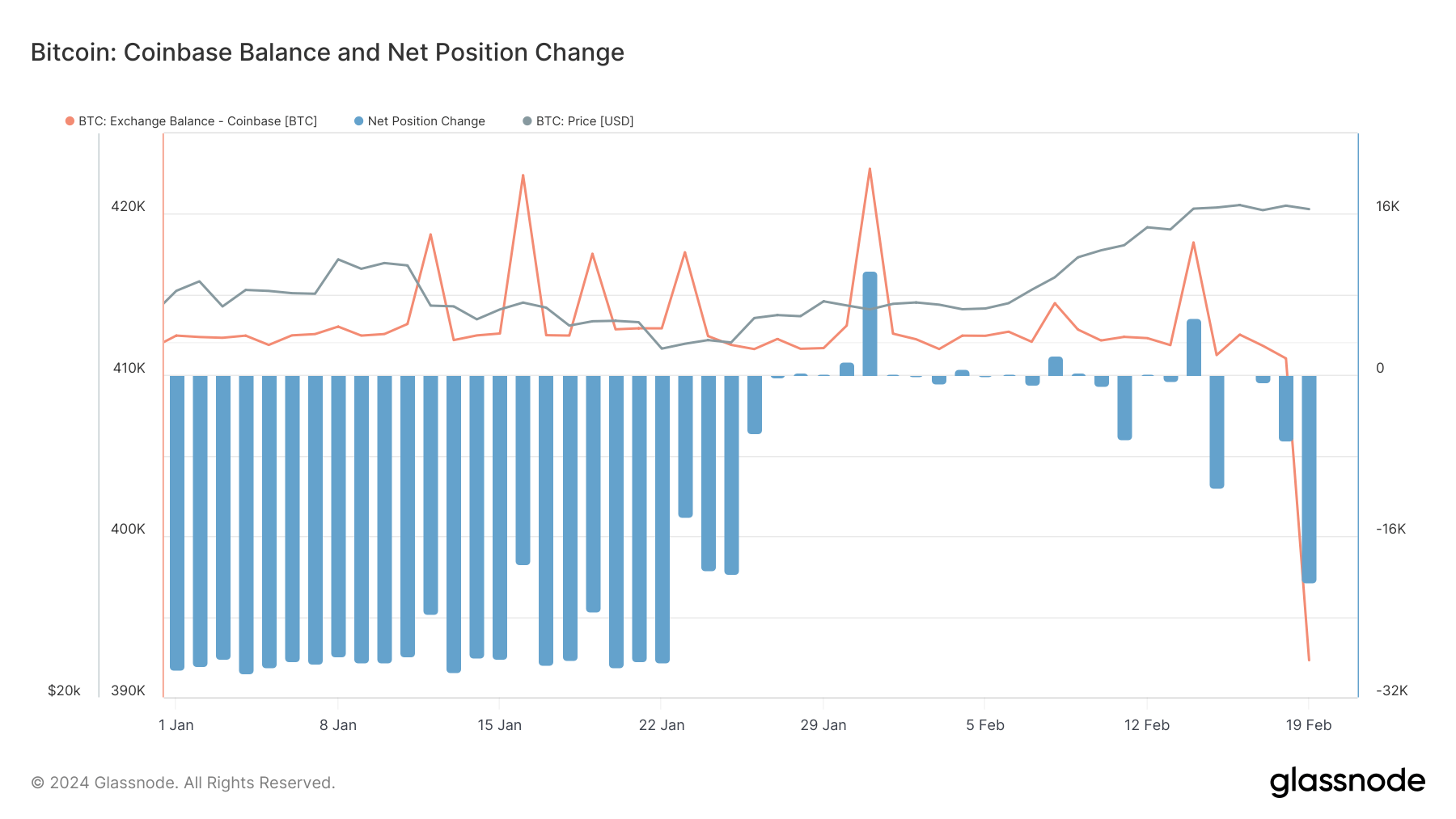

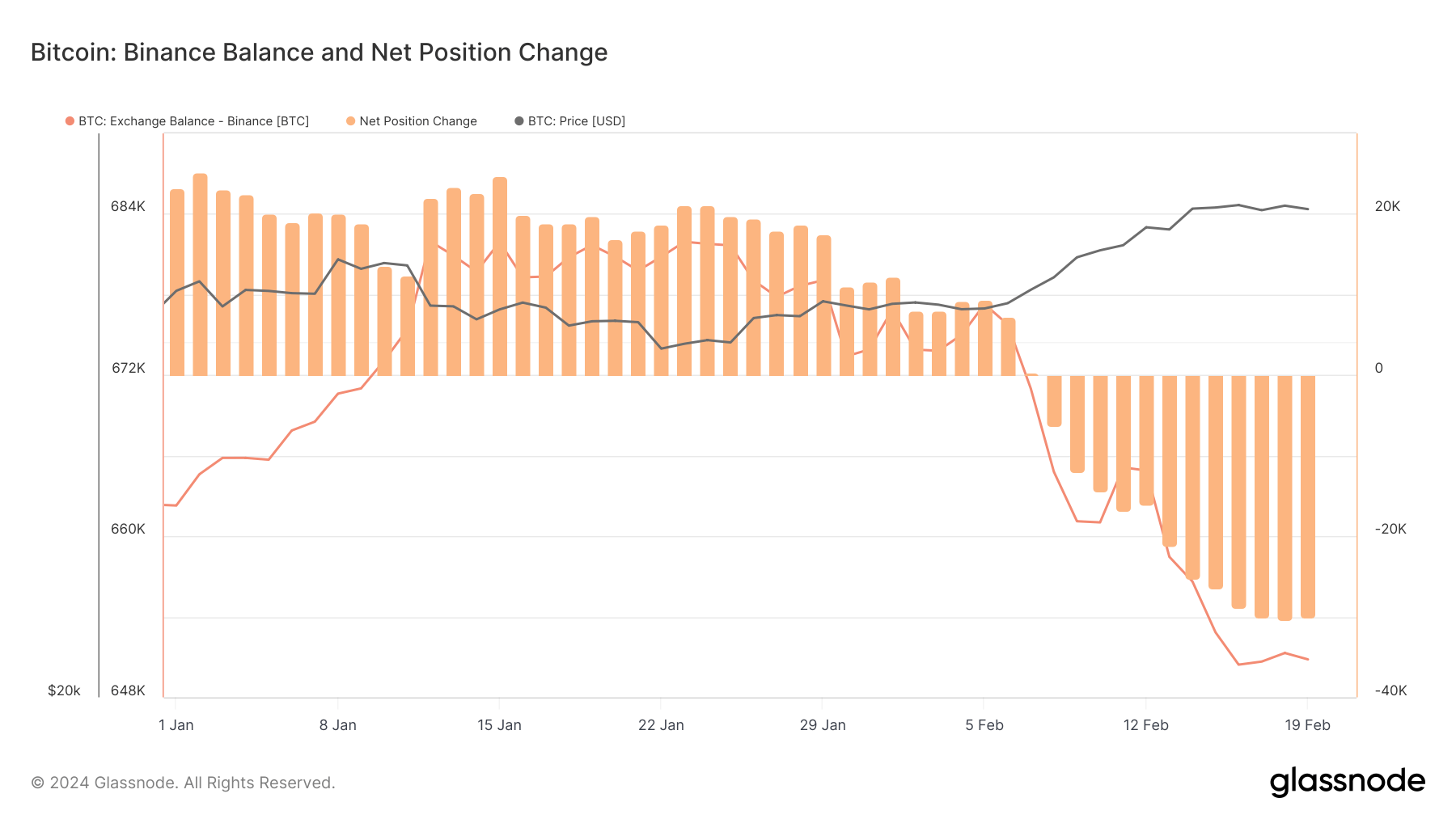

Examining specific exchanges reveals nuanced trends and exceptions within this broader pattern.

Coinbase experienced a marked reduction in its Bitcoin balance, shedding over 20,000 BTC from Jan.1 to Feb. 19, with consistent net outflows since the end of January.

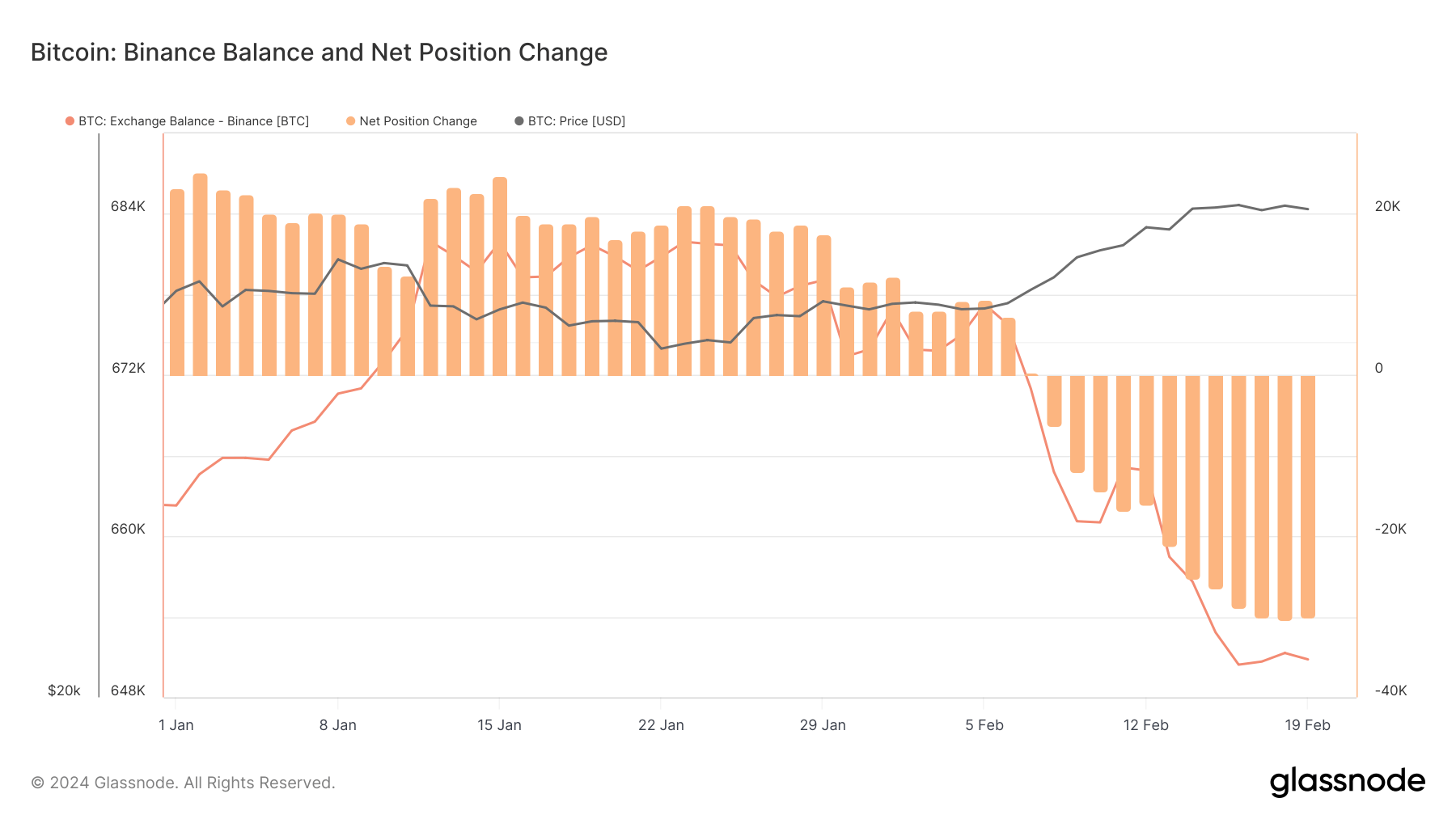

Binance also saw a notable reduction in its Bitcoin balance this year. The exchange’s balance initially increased until Jan. 26, when it began declining, with net outflows starting on Feb. 8.

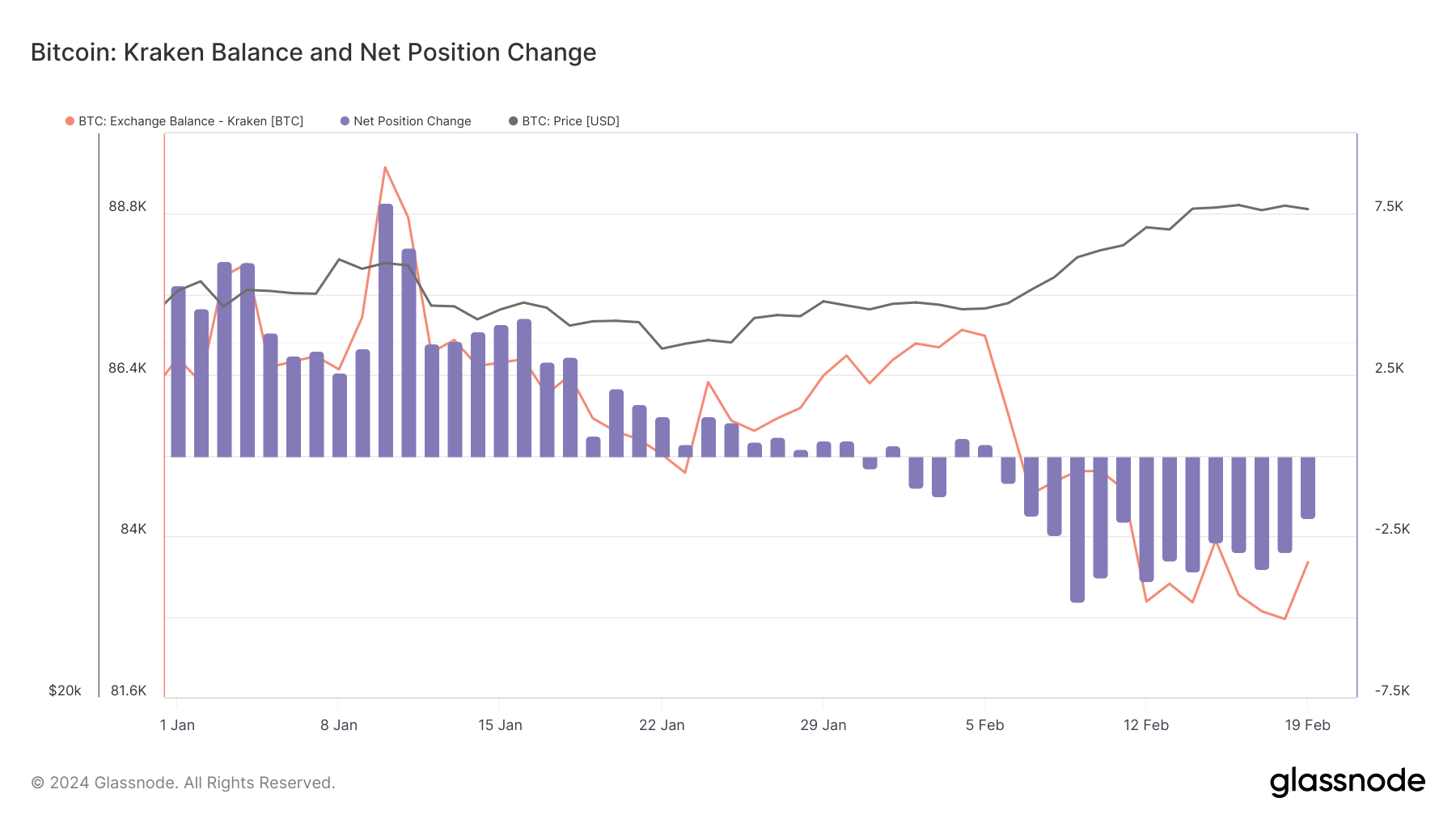

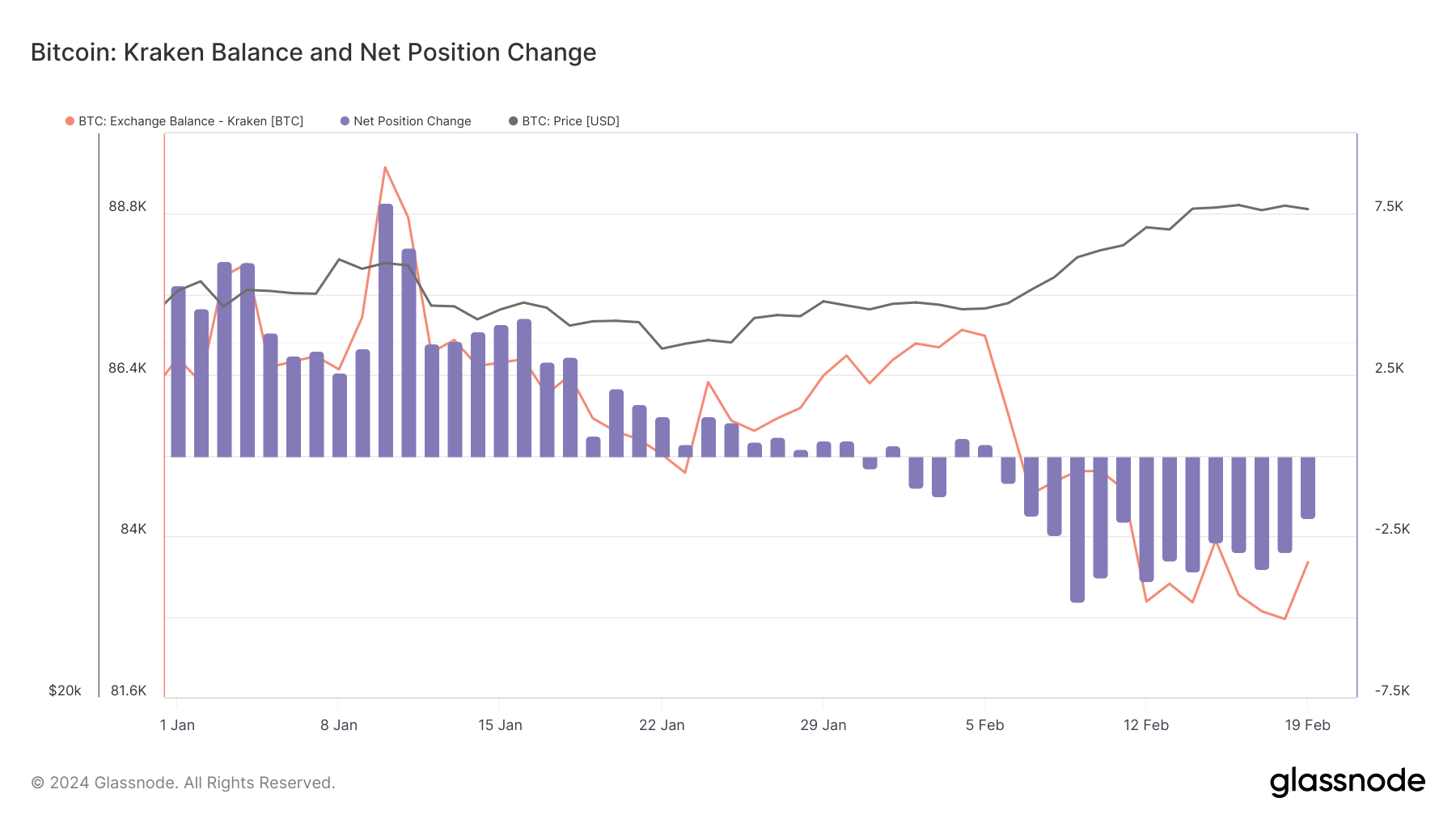

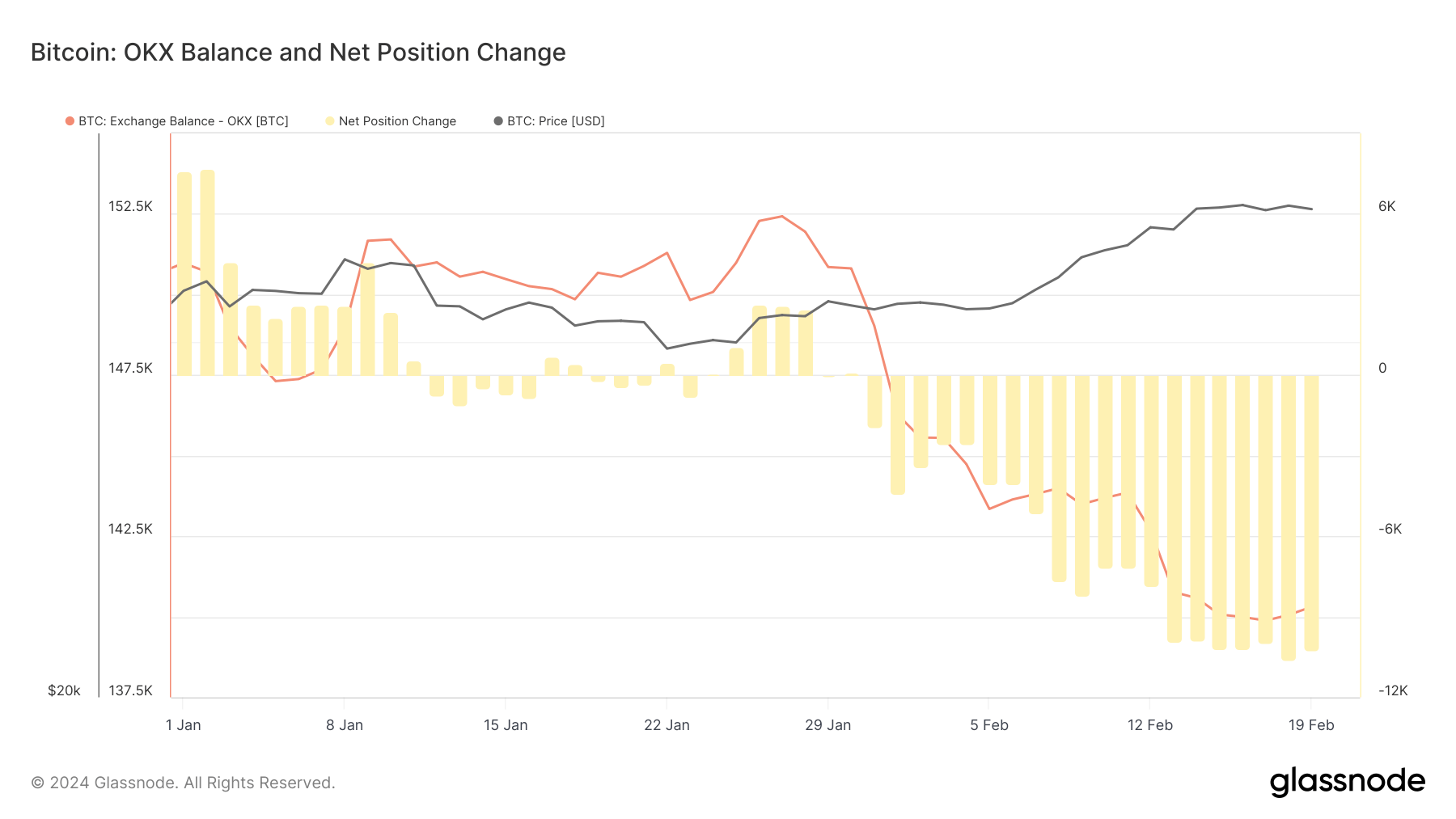

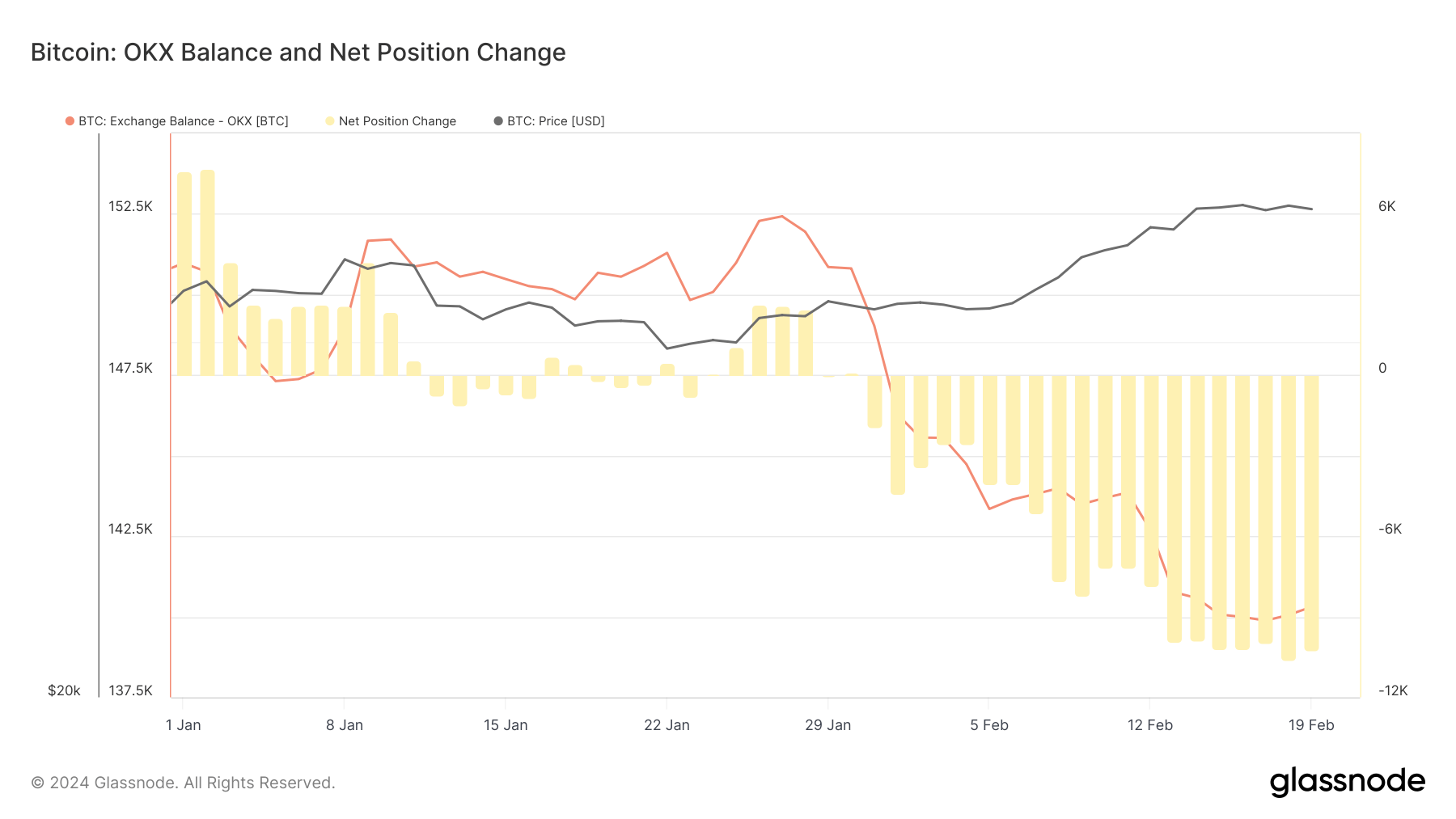

Kraken and OKX aligned with this trend, recording net outflows and a significant decrease in their Bitcoin balances.

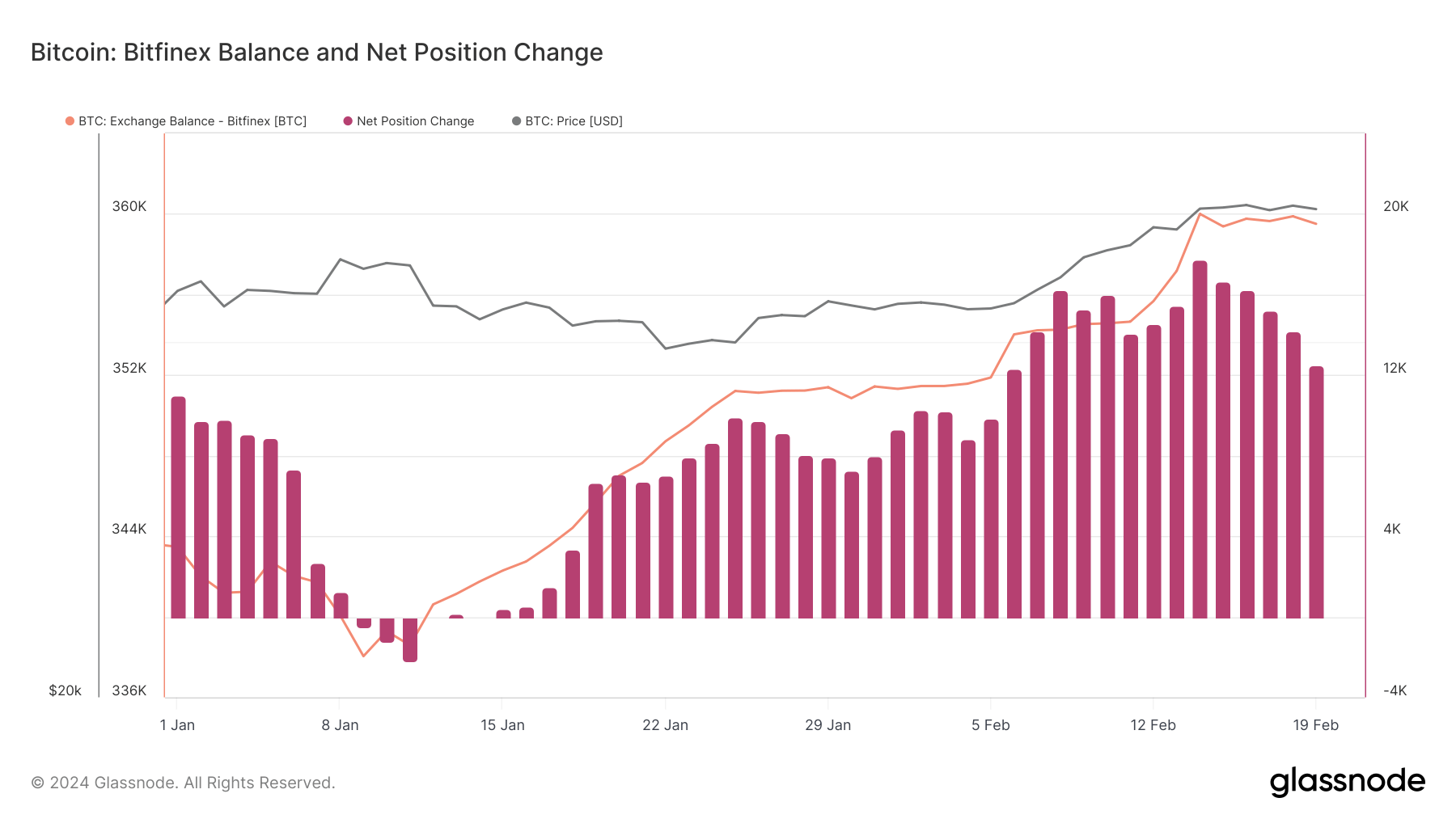

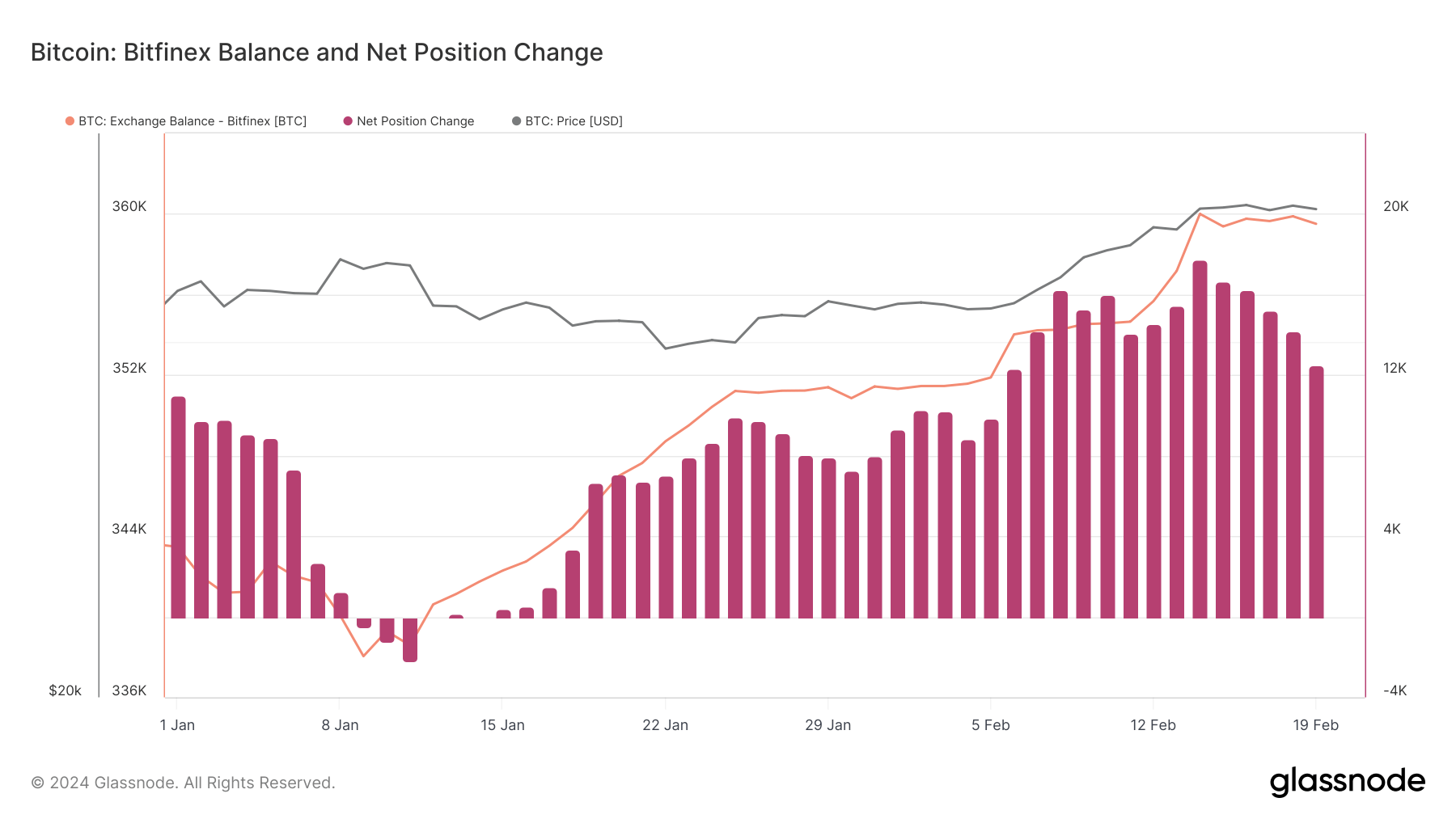

Contrary to the general trend, Bitfinex and Bittrex have seen net inflows since mid-January.

Bitfinex saw over 16,000 BTC added to its Bitcoin balance since the beginning of the year, helped by consistent net inflows since Jan. 15.

Bittrex also saw a…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…