Bitcoin (BTC) is flying out of crypto exchanges and into the wallets of long-term investors as the king crypto’s halving quickly approaches, reports analytics firm Glassnode.

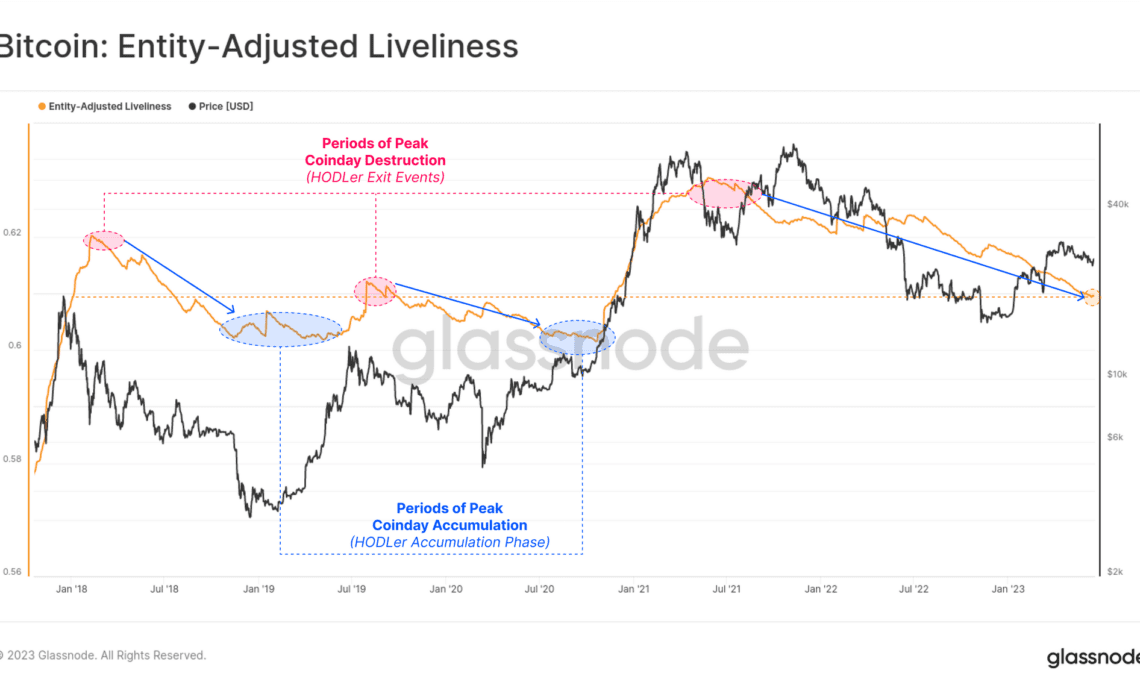

Glassnode says that a steady rate of BTC outflows from exchanges indicates a significant Bitcoin accumulation wave by HODLers, or entities with little history of selling.

“The undercurrent of BTC supply continues to flow out of exchanges, miners and whale wallets, and towards HODLer entities of all sizes at a healthy rate.”

According to the firm, similar accumulation phases preceded other Bitcoin bull market cycles.

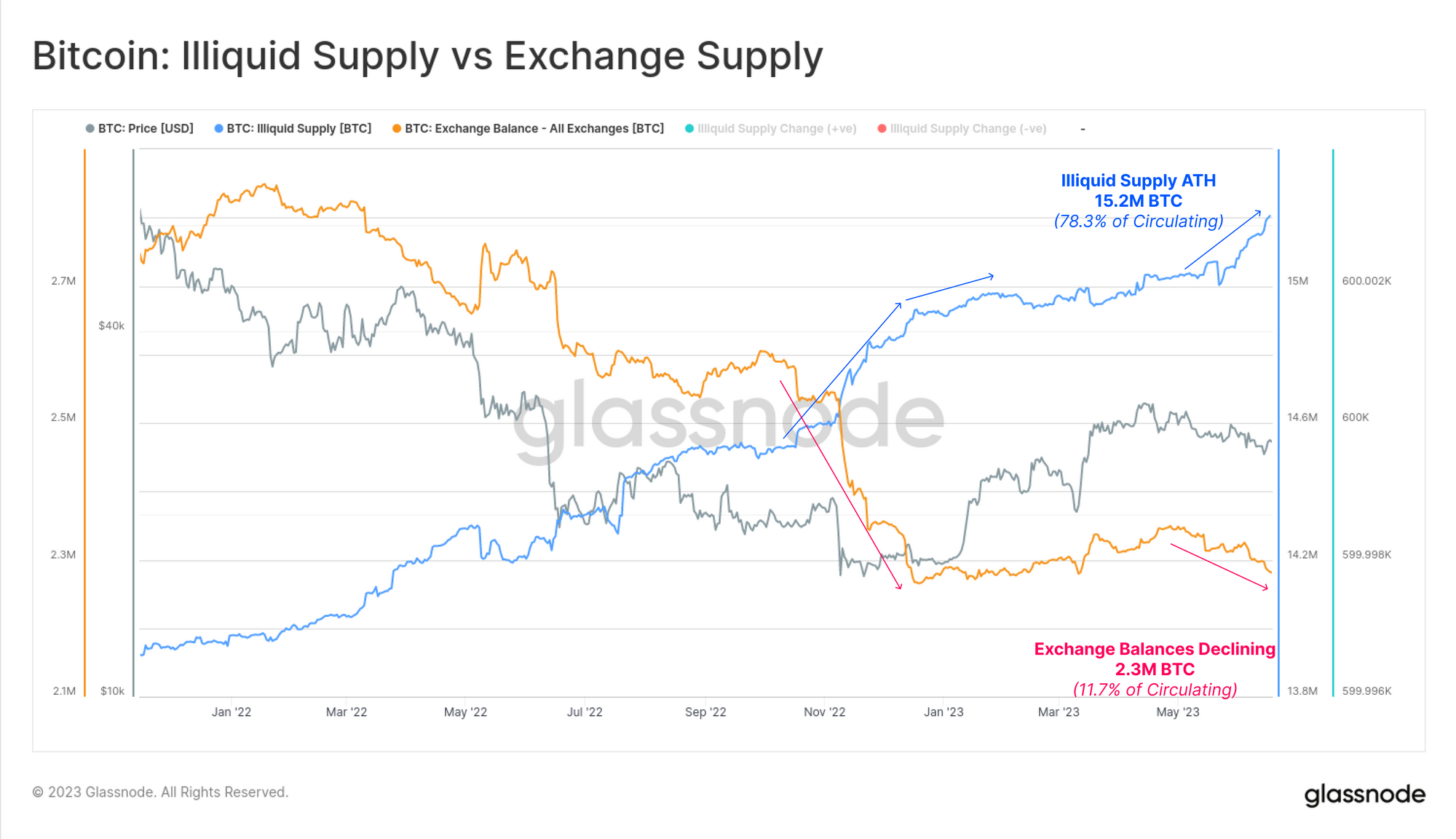

Glassnode’s data is also showing that Bitcoin’s illiquid supply has reached an all-time high (ATH).

Bitcoin’s illiquid supply is a term used to refer to the amount of BTC held by entities that historically always hold onto at least 75% of their coins.

“This observation is further supported by the divergence between exchange balances, and the volume of coins held in illiquid wallets, being those with little to no history of spending. Illiquid supply reached a new ATH of 15.2M BTC this week, whilst exchange balances have fallen to the lowest levels since Jan 2018 at 2.3M BTC.”

Bitcoin’s next halving event, which happens every four years and is estimated to take place on April 14 of next year, is when the amount of new BTC issued to miners will be reduced from 6.25 Bitcoin per block to 3.125 Bitcoin per block.

Bitcoin is trading for $26,423 at time of writing, sideways over the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/NextMarsMedia

Click Here to Read the Full Original Article at Bitcoin News – The Daily Hodl…