On a sure-to-be historic day for Bitcoin, I spent the morning looking back at historical data to see how impactful the first Gold ETF was at the time. We’ve seen plenty of analysts, including our own, talk about how Gold ETFs changed the landscape for the commodity, leading to outsized gains over the proceeding 20 years. Yet, what was it really like at the time? Did gold explode on day one, or did it take time? Let’s dig in.

First, let’s look at the timeline of the relevant exchange-traded products we will look at.

On Nov. 18, 2004, State Street Corporation launched SPDR Gold Shares (GLD), acquiring $114,920,000 in assets under management on launch and $1 billion in its first three trading days.

On Oct. 19, 2021, ProShares launched ProShares Bitcoin Strategy ETF (BITO), which had $570 million in inflows on day one, hitting $1 billion in assets the next day.

On Jan. 11, 2024, eleven spot Bitcoin ETFs will launch in the U.S. with $115.88 million under management via the sponsors’ seed funds. This means once they’ve taken $115 million in inflows, issuers like BlackRock, Ark, VanEck, and company will buy Bitcoin from the open market via Coinbase and Gemini, just like the rest of us.

Thus, before trading commences (removing Grayscale, which is converting its trust* into an ETF that already has $28.58 billion in AUM), the combined spot Bitcoin ETFs will have surpassed GLD’s day one trading. If we include Grayscale, spot Bitcoin ETFs have more assets under management than gold did for the first five years. GLD didn’t garner $29 billion in AUM until Feb. 12, 2009.

However, to be fair, it was no longer the only gold ETF by this point. BlackRock launched its iShares® COMEX® Gold Trust in 2005. Combined with GLD, gold ETFs reached an equivalent AUM around Feb. 10, 2009, with IAU obtaining $2 billion in assets by the end of Q1 2009.

By the end of 2009, three gold-backed ETFs were traded in the United States: ETFS Physical Swiss Gold Shares, SPDR Gold Shares, and iShares Comex Gold Trust.

| Company | Seed Investment ($M) |

|---|---|

| Bitwise | 20 |

| VanEck | 72.50 |

| Valkyrie | 0.52 |

| Franklin Templeton | 2.60 |

| WisdomTree | 4.95 |

| Invesco Galaxy | 4.85 |

| BlackRock | 10 |

| Ark | 0.46 |

| Grayscale | 2,858 |

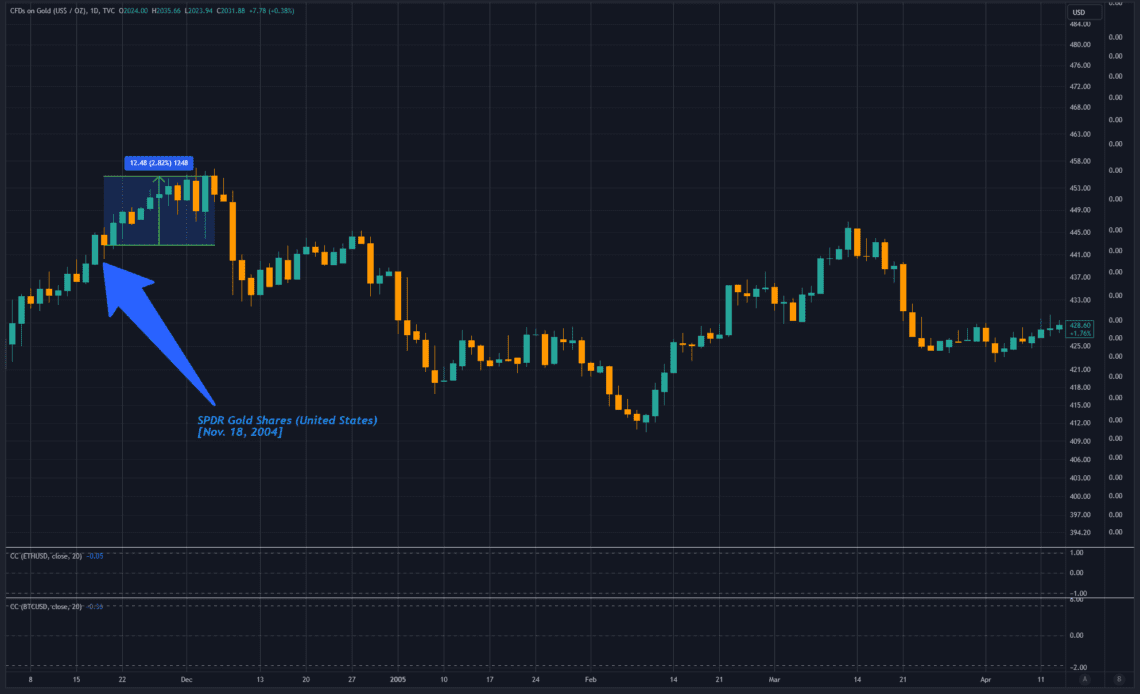

How did GLD trade at launch?

The first gold ETF was launched in the U.S. on Nov. 18, 2004, and within 12 days, the price of gold was up just 2.82%.

This marked a sixteen-year high for gold, which had not reached $453 per ounce since May 1988. However, it was not at an all-time high. In fact, it would…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…