Bitcoin (BTC) marched to 17-month highs on Oct. 24 as exchange-traded fund (ETF) excitement boosted already bullish BTC price action.

Bitcoin ETF data listing hints at “time to shine”

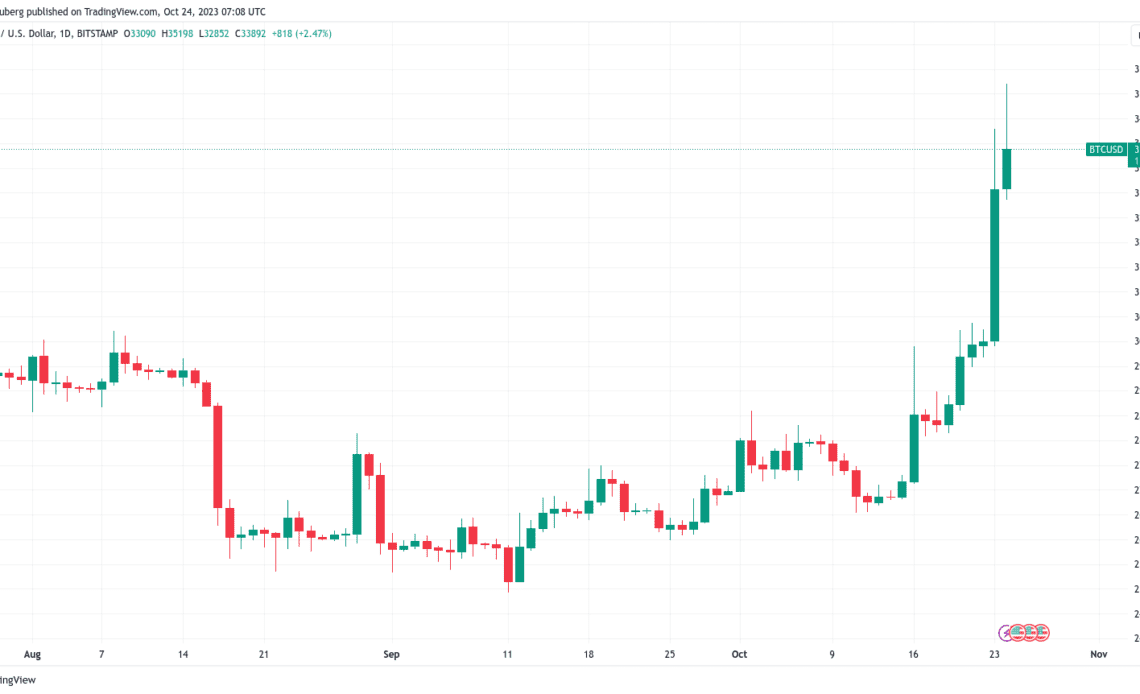

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $35,198 on Bitstamp before consolidating.

This represented 17% gains since the prior weekly close and Bitcoin’s highest levels since May 2022.

While back below $34,000 at the time of writing, the mood around the largest cryptocurrency was distinctly optimistic as debate swirled over the potential launch of a Bitcoin spot price ETF in the United States.

Long in the making, appetite for a launch — held back for years by U.S. regulators — was palpable after data for the iShares Spot Bitcoin ETF appeared on the website of the Depository Trust & Clearing Corporation, or DTCC, responsible for clearing NASDAQ trades.

While no official green light has yet been given, the event is increasingly viewed as a matter of time.

Good morning

– #Bitcoin hits $35,000 overnight and reaches new yearly high.

– Spot ETF has 99% chance to be approved.

– Matter of time until altcoins will be picking up pace.Great times.

— Michaël van de Poppe (@CryptoMichNL) October 24, 2023

As part of the response, public Bitcoin ETF worldwide saw the equivalent of 10% of the year-to-date total in inflows over a single 24-hour period, per data from Bloomberg.

“An SEC approval of the ETF would likely mean that many other Bitcoin ETF approvals are coming,” financial commentary resource The Kobeissi Letter meanwhile wrote in part of its own coverage.

Kobeissi noted that with the latest move, BTC/USD was up 107% year-to-date, adding $300 billion in market cap.

“As geopolitical tensions worsen, Bitcoin is also being viewed as a safe haven asset,” it concluded.

“Is Bitcoin finally getting its time to shine?”

BTC price taps last upside CME futures gap

Considering the prospects for BTC price going forward, a curious disconnect was apparent between traders and market trajectory.

Related: BTC price nears 2023 highs — 5 things to know in Bitcoin this week

Despite the highs, popular market participants on social media were highly cautious — and some conspicuously bearish.

Among them was popular trading account Ninja, which warned that no further CME Group Bitcoin futures gaps remained above spot price — only below.

With the wick near $36k, all CME gaps to the upside have been filled.

This only means…

Click Here to Read the Full Original Article at Cointelegraph.com News…