Bitcoin, the leading cryptocurrency by market capitalization, has recently experienced a significant and sudden price correction, sparking debate among investors.

Concerns have surfaced about whether this downturn signals the conclusion of the current bull cycle or merely represents a temporary setback.

While short-term holders face losses, long-term metrics provide a broader perspective on Bitcoin’s trajectory, as analyzed by CryptoQuant’s Avocado Onchain in a recent report.

Opportunity Or End of The Bull Cycle?

According to Avocado Onchain, the realized price for investors who entered the market during Bitcoin’s recent peak at $98,000 places them in a loss-making position.

However, for those who invested between one to three months ago, the realized price is significantly lower at $71,000, offering a cushion against the current correction.

Avocado pointed out that historical patterns from Bitcoin’s 2021 bull cycle reveal similar alternations between record highs and sharp corrections, suggesting that these dips may not necessarily indicate the end of the cycle. Instead, they have historically been “opportunities” for market rebalancing and subsequent growth.

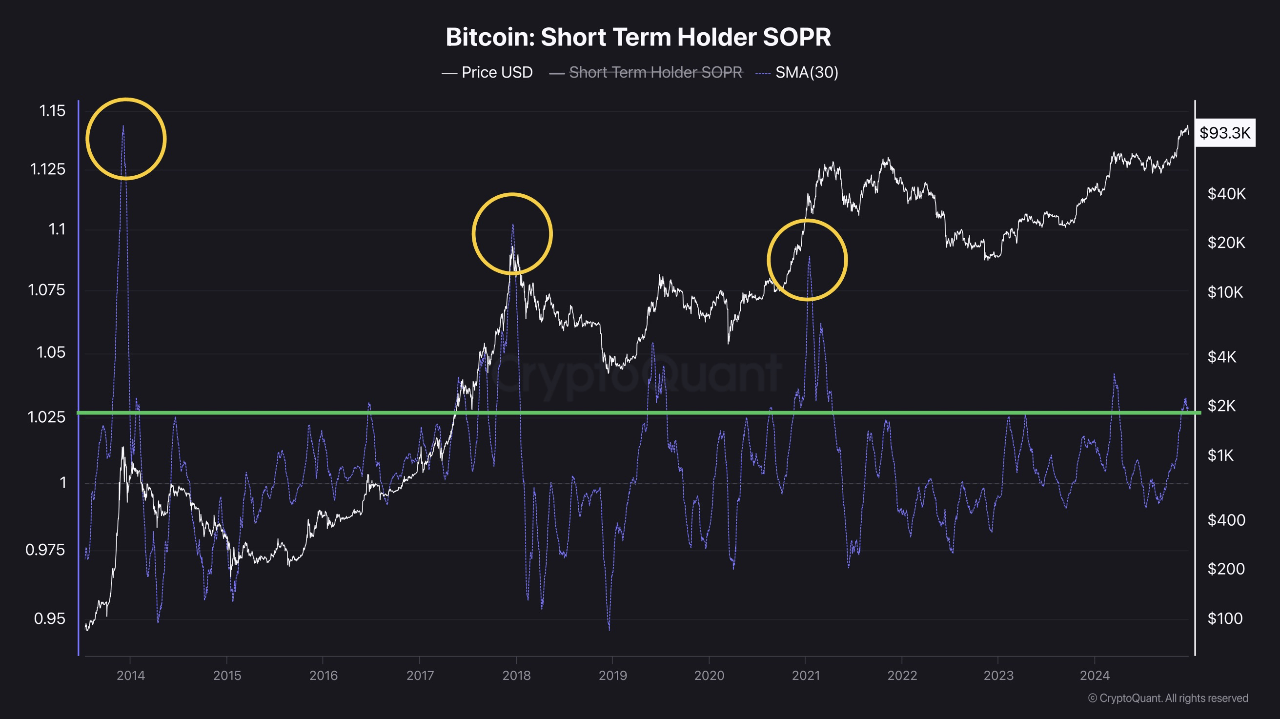

A key indicator analyzed is the 30-day moving average of the short-term SOPR (Spent Output Profit Ratio). This metric tracks whether recent market participants are selling at a profit or a loss.

The current SOPR data reveals that recent short-term inflows into Bitcoin have yet to result in substantial profit-taking. Unlike previous cycle peaks characterized by aggressive selling, the ongoing correction appears subdued, indicating that the market may still have room for upward movement.

Bitcoin Short-Term Dips vs. Long-Term Trends

Additionally, Avocado Onchain highlights the importance of distinguishing between short-term corrections and broader cycle trends. Bitcoin’s tendency to rebound after corrections in past bull cycles reinforces the notion that the current downturn might not mark the cycle’s end.

These insights align with the behaviour of long-term holders, who often use corrections to consolidate their positions, strengthening market resilience.

Avocado concluded the analysis, noting:

For investors who have yet to enter the market, this may be an excellent opportunity to buy Bitcoin at a discount. Instead of succumbing to panic selling during short-term downturns, adopting a long-term perspective and a dollar-cost averaging (DCA) strategy could be a more effective…

Click Here to Read the Full Original Article at NewsBTC…