Key points:

-

Continuation of Bitcoin’s consolidation seems likely in the near term, but the trend remains positive as long as the price remains above $110,530.

-

Charts for BNB, XLM, LTC, and ETC are looking positive.

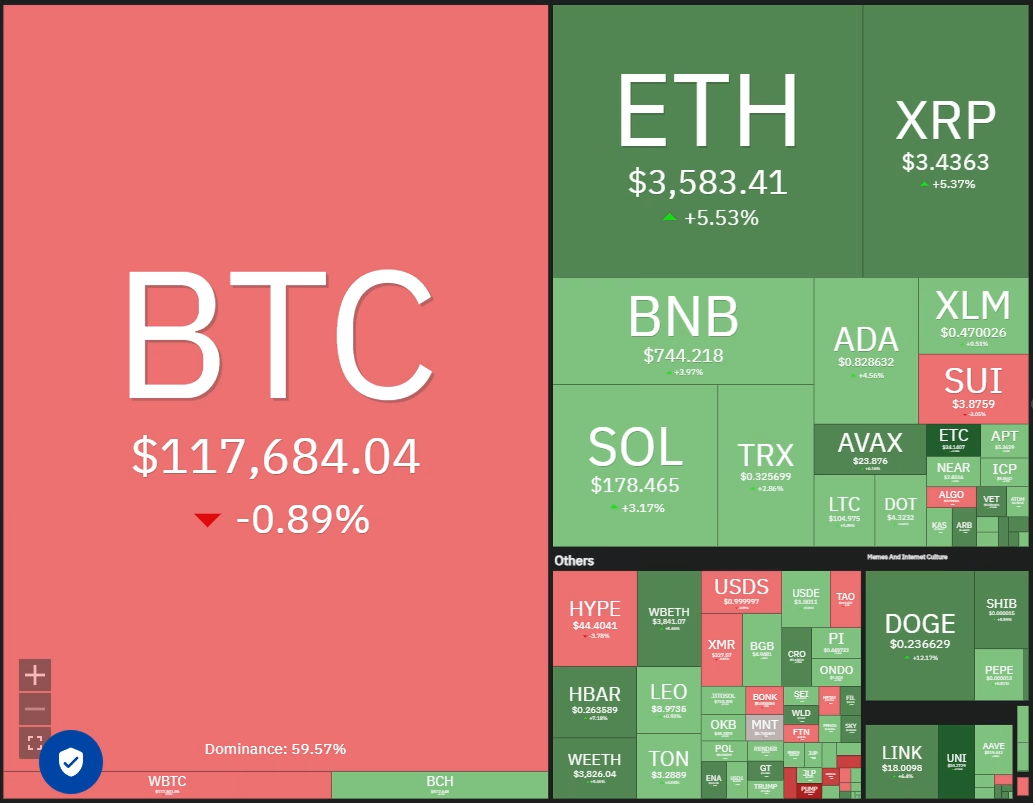

Bitcoin (BTC) remains in a consolidation phase as bears thwart the bulls’ attempt to sustain the price above $120,000. According to Fidelity Director of Global Macro Jurrien Timmer, BTC remains right in the middle of its adoption curve compared to internet adoption from past decades. That suggests BTC has more room to run.

BTC’s rally and the passing of three key pieces of legislation in the US House of Representatives have boosted sentiment in the cryptocurrency sector. That pushed the total cryptocurrency market capitalization to just under $4 trillion on Friday, according to CoinMarketCap. Since then, the market cap has cooled off to $3.85 trillion.

Ether (ETH) is leading the altcoins charge higher, signaling the start of an altseason. Although sharp rallies are common during bull markets, traders should be ready for frequent pullbacks during the up move. Hence, it is better to stick to sound money management principles rather than blindly chase prices higher.

Let’s analyze the charts of the top 5 cryptocurrencies that look strong on the charts.

Bitcoin price prediction

BTC’s shallow pullback suggests the bulls are in no hurry to book profits as they anticipate the uptrend to continue.

The upsloping 20-day exponential moving average ($113,984) and the relative strength index (RSI) in the positive territory indicate an advantage to buyers. If the bulls thrust the price above $123,218, the BTC/USDT pair could resume its uptrend. The pair could surge to $135,729 and thereafter to the pattern target of $150,000.

Time is running out for the bears. They will have to swiftly tug the price below the $110,530 support to get back into the game. That may tempt…

Click Here to Read the Full Original Article at Cointelegraph.com News…