Bitcoin’s dominance of the crypto market has been on the rise. This naturally comes with every downtrend in the market because although bitcoin takes a hit, the altcoins always record the worse losses, leaving them with less dominance of the market. Bitcoin’s dominance has however not stopped here. It has now spilled onto the derivatives market where the dominance of the pioneer cryptocurrency is even more apparent.

Bitcoin Open Interest Surges

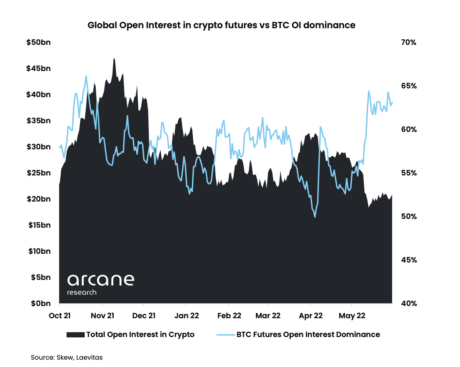

The general open interest in the crypto market has been on a decline since the market took a hit in December. This is currently sitting at about $25 billion for the total market, down almost 50% from its peak in November at around $48 billion. This mirrors what has taken place in the crypto market over the same time period. However, when it comes to open interest, bitcoin has not fared as badly as the others.

Related Reading | Bitcoin Exchange Outflows Suggest That Investors Are Starting To Accumulate

The digital asset now accounts for the majority of the global open interest in the crypto market. Bitcoin alone makes up 63% of all open interest in the market, meaning that the cryptocurrency commands more than $15 billion in open interest.

It is a step up from the month of April when Bitcoin’s open interest dominance had declined to 50%. With the recent increase in dominance, indicators point to a decrease in speculative interest when it comes to altcoins given their recent decline.

BTC dominates global open interest | Source: Arcane Research

This follows the general trend of the crypto market where bitcoin’s dominance has also grown, although by a smaller margin. If altcoins continue to perform badly, then BTC dominance may continue to rise over the next few weeks.

BTC Is Still King

Through the month of May, the losses in the crypto market have been apparent but some have provided more cover than others. Comparing the losses incurred by all the indexes for the month of May, bitcoin has proven to be the most…

Click Here to Read the Full Original Article at NewsBTC…