The price of Bitcoin (BTC) increased by 28% between March 12-14, reaching $26,500, its highest level since June 2022. Some may attribute the gains to the consumer price index’s (CPI) 6% year-over-year increase in February, even though the figure was in line with expectations.

The inflation metric reached its lowest level since September 2021, which is a positive development, but it does not validate the Federal Reserve’s attempt to reduce the metric to 2%. Most likely, risk markets, such as stocks and cryptocurrencies, soared after regional bank stocks recovered from their March 13 lows.

At 10:30 a.m. Eastern Time, First Republic Bank (FRC) shares were trading 54% higher, followed by Western Alliance Bancorporation (WAL) gaining 46% and KeyCorp (KEY) gaining 15%. The 30-year average mortgage rate decreased to 6.6% from 7.1% on March 7. Consequently, reduced mortgage rates have the potential to improve the housing market, which partially explains the rally.

The unexpected decline in mortgage rates may present an opportunity for price-sensitive homebuyers and homeowners waiting for a chance to lock in a lower rate. According to data from Realtor.com, a buyer of a median-priced home still faced a monthly mortgage payment that was 49% higher than it was one year prior.

Despite the possibility of a recession in the United States due to high interest rates, China’s economic outlook remains positive. Li Qiang addressed reporters on March 14 for the first time since assuming the position that oversees the State Council, China’s highest executive body. According to Qiang, non-state-owned enterprises in China will have greater room for development.

Let’s look at derivatives metrics to better understand how professional traders are positioned in the current market conditions.

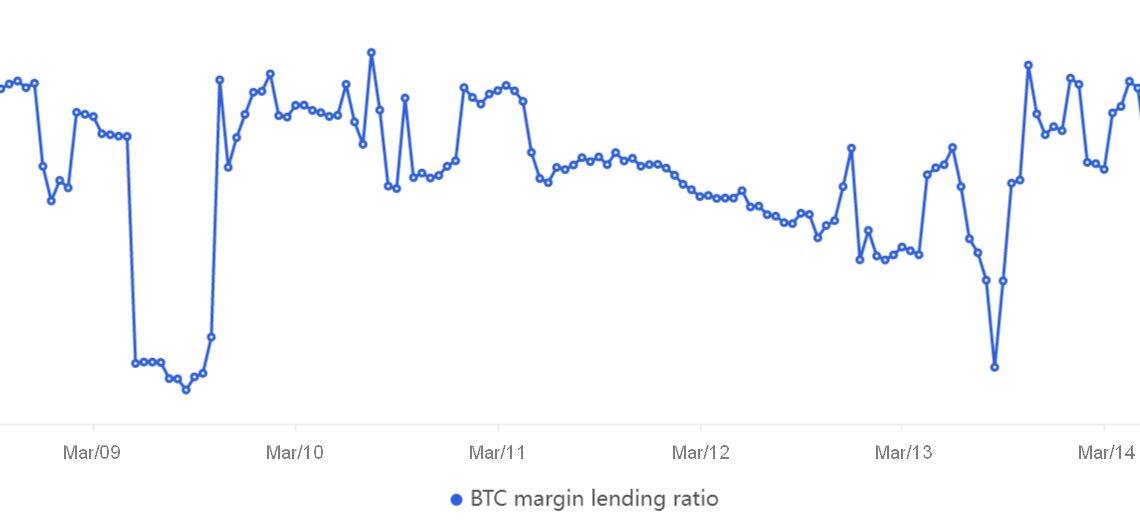

Bitcoin margin markets signaling a market deficiency

Margin markets provide insight into how professional traders are positioned because it allows investors to borrow cryptocurrency to leverage their positions.

For example, one can increase exposure by borrowing stablecoins and buying Bitcoin. On the other hand, borrowers of Bitcoin can only take short bets against the cryptocurrency.

Since March 13, OKX traders’ margin lending ratio has been above 35, indicating a significant mismatch in favor of Bitcoin longs. Readings above 40 are uncommon and driven by a high stablecoin borrowing cost of 25% per year.

One should refer to the BTC option…

Click Here to Read the Full Original Article at Cointelegraph.com News…