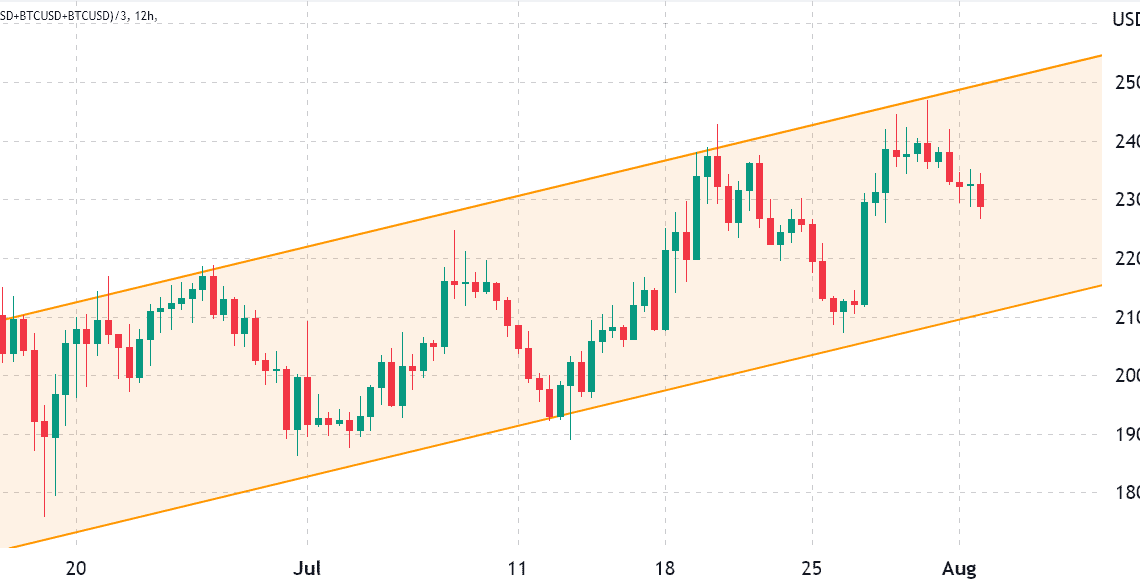

Bitcoin (BTC) has been trending up since mid-July, although the current ascending channel formation holds $21,100 support. This pattern has been holding for 45 days and could potentially drive BTC towards $26,000 by late August.

According to Bitcoin derivatives data, investors are pricing higher odds of a downturn, but recent improvements in global economic perspective might take the bears by surprise.

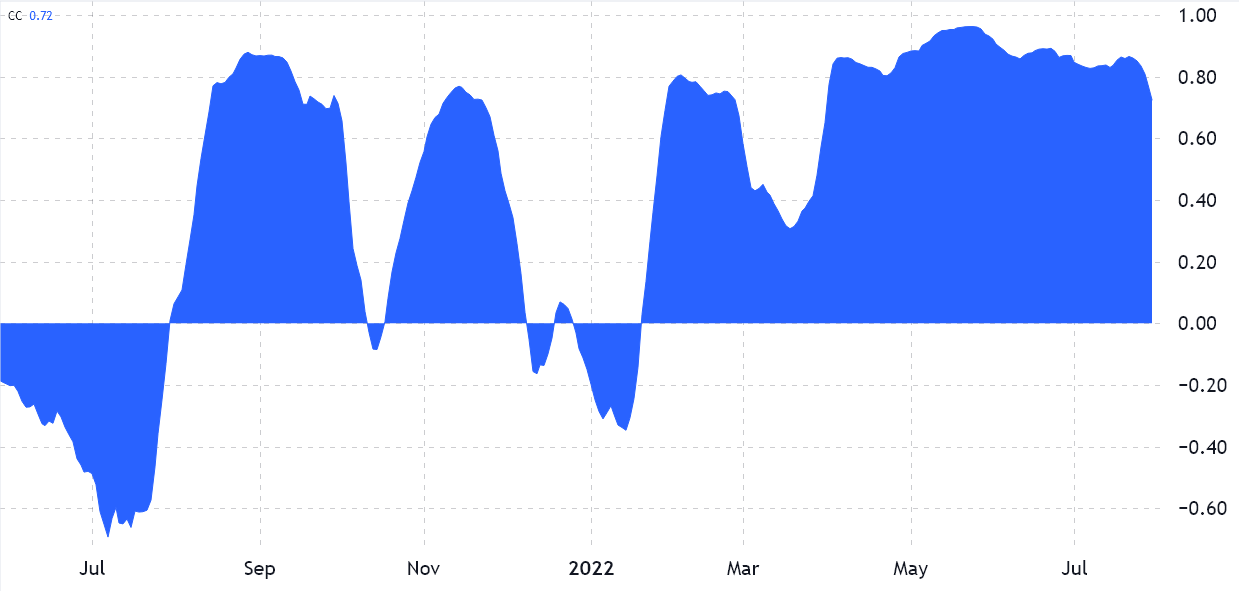

The correlation to traditional assets is the main source of investors’ distrust, especially when pricing in recession risks and tensions between the United States and China ahead of House Speaker Nancy Pelosi’s visit to Taiwan. According to CNBC, Chinese officials threatened to take action if Pelosi moved forward.

The U.S. Federal Reserve’s recent interest rate hikes to curb inflation brought further uncertainty for risk assets, limiting crypto price recovery. Investors are betting on a “soft landing,” meaning the central bank will be able to gradually revoke its stimulus activities without causing significant unemployment or recession.

The correlation metric ranges from a negative 1, meaning select markets move in opposite directions, to a positive 1, which reflects a perfect and symmetrical movement. A disparity or a lack of relationship between the two assets would be represented by 0.

As displayed above, the S&P 500 and Bitcoin 40-day correlation currently stands at 0.72, which has been the norm for the past four months.

On-chain analysis corroborates longer-term bear market

Blockchain analytics firm Glassnode’s “The Week On Chain” report from Aug. 1 highlighted Bitcoin’s weak transaction and the demand for block space resembling the 2018–19 bear market. The analysis suggests a trend-breaking pattern would be required to signal new investor intake:

“Active Addresses [14 days moving average] breaking above 950k would signal an uptick in on-chain activity, suggesting potential market strength and demand recovery.”

While blockchain metrics and flows are important, traders should also track how whales and market markers are positioned in the futures and options markets.

Bitcoin derivatives metrics show no signs of “fear” from pro traders

Retail traders usually avoid monthly futures due to their fixed settlement date and price difference from spot markets. On the other hand, arbitrage desks and professional traders opt for monthly contracts due to…

Click Here to Read the Full Original Article at Cointelegraph.com News…