Bitcoin (BTC) experienced a 5% increase after testing the $25,000 support level on Sept. 11. However, this breakout rally doesn’t necessarily indicate a victory for bulls. To put today’s price action in perspective, BTC has witnessed a 15% decline since July. In contrast, the S&P 500 index and gold have maintained relatively stable positions during this period.

This underperformance demonstrates that Bitcoin has struggled to gain momentum, despite significant catalysts such as Microstrategy’s plan to acquire an additional $750 million worth of BTC and the multiple requests for Bitcoin spot ETFs from trillion-dollar asset management firms. Still, according to Bitcoin derivatives, bulls are confident that $25,000 marked a bottom and opened room for further price gains.

Some argue that Bitcoin’s primary drivers for 2024 are still in play, specifically the prospects of a spot ETF and the reduction in supply following the April 2024 halving. Additionally, some of the cryptocurrency markets’ immediate risks have diminished following the U.S. Securities and Exchange Commission (SEC) experiencing partial losses in three separate cases involving Grayscale, Ripple and the decentralized exchange Uniswap.

On the other hand, bears have their own set of advantages, including the ongoing legal cases against leading exchanges like Binance and Coinbase. Moreover, there is the troubled financial situation of the Digital Currency Group (DCG) after one of its subsidiaries declared bankruptcy in January 2023. The group is burdened with debts exceeding $3.5 billion, potentially leading to the sale of funds managed by Grayscale, including the Grayscale Bitcoin Trust (GBTC).

Let’s look at derivatives metrics to understand better how professional traders are positioned in the current market conditions.

Bitcoin futures and options metrics held steady despite the correction

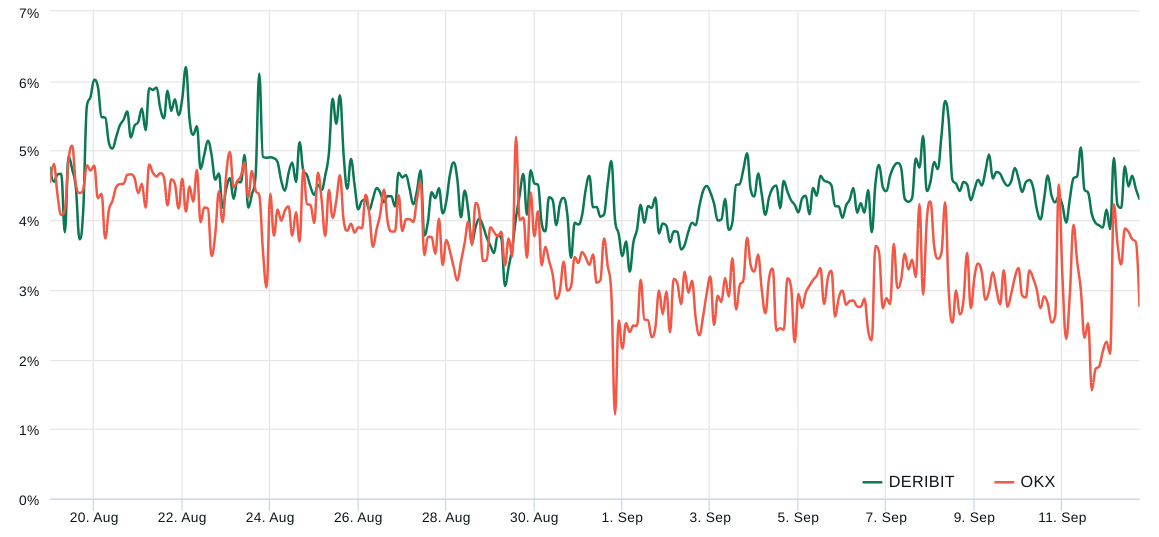

Bitcoin monthly futures typically trade at a slight premium to spot markets, indicating that sellers are asking for more money to delay settlement. As a result, BTC futures contracts should typically trade at a 5 to 10% annualized premium — a situation known as contango, which is not unique to crypto markets.

It’s worth noting that the demand for leveraged BTC long and short positions through futures contracts did not have a significant impact on the drop below the $25,000 mark…

Click Here to Read the Full Original Article at Cointelegraph.com News…