Bitcoin (BTC) price maintained the $30,000 support as lower-than-expected U.S. Consumer Price Index (CPI) data released on April 12. The official inflation rate for March increased 5% year on year, which was slightly less than the 5.1% consensus. It was the lowest reading since May 2021, but is still significantly higher than the Federal Reserve’s 2% target.

The data suggests that inflation is no longer the driving force behind Bitcoin’s rally and Investors’ focus shifted from the impact of inflationary pressure to potential recession risks after the banking crisis revealed how fragile the financial system was following the Federal Reserve’s twelve-month hike in interest rates from 0.10% to 4.85%.

Aside from the Silicon Valley Bank bankruptcy and the government-backed sale of Credit Suisse to UBS, several warning signs of a macroeconomic downturn have emerged.

The most recent ISM Purchasing Managers Index data fell to its lowest level since May 2020, indicating an economic contraction. According to Federal Reserve documents released on April 12, the aftermath of the U.S. banking crisis is likely to push the economy into a “mild recession” later this year. Because of the crisis, some have speculated that the Fed will hold off on raising interest rates, but officials affirmed that more effort is needed to keep inflation under control.

According to a Moody’s Analytics report, commercial real estate prices fell 1.6% in February, the most since the 2008 financial crisis. Furthermore, the national office vacancy rate reached 16.5%, indicating the severity of the economic difficulties that businesses are currently facing.

Whatever the reason for Bitcoin’s 50% rally between March 11 and April 11, it demonstrates resilience to FUD, including the SEC’s Wells Notice against Coinbase on March 22, and the CFTC filing a suit against Binance and its CEO Changpeng Zhao on March 27. By holding the $30,000 support, Bitcoin demonstrates that the positive momentum can continue regardless of whether inflation remains above 5%.

Bulls are better positioned for the weekly BTC options expiry

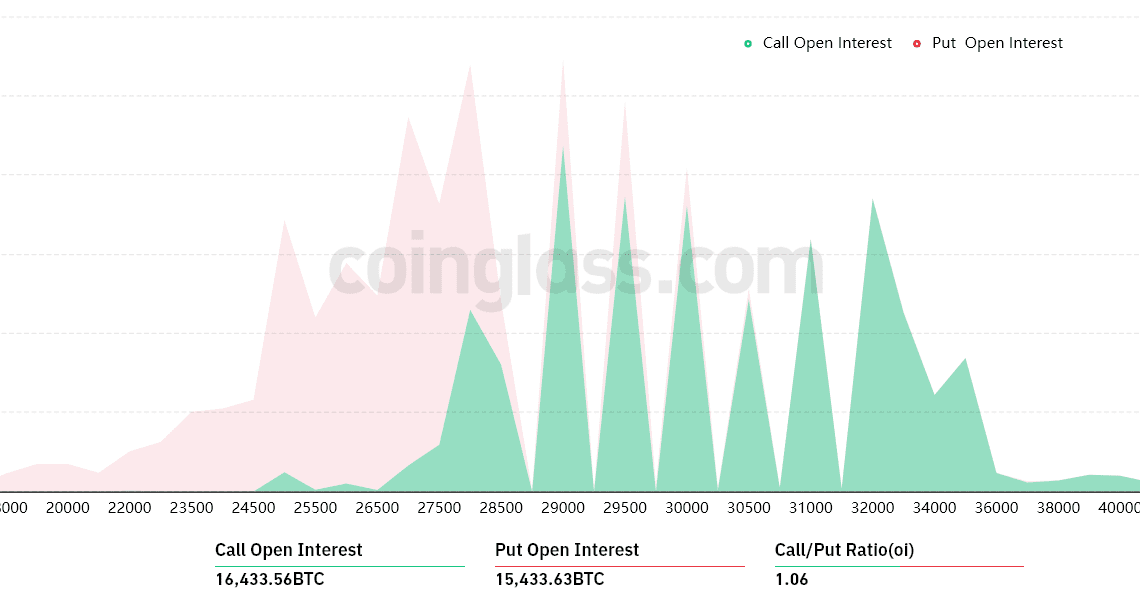

Not everyone is cheering the rally, particularly traders who have placed bearish bets using Bitcoin options. The April 14 open interest for BTC options expiry is $950 million, with $490 million in call (buy) options and $460 million in put (sell) options. Bears have been caught off guard, with less than 7% of their bets exceeding $29,000.

Click Here to Read the Full Original Article at Cointelegraph.com News…