The U.S. debt ceiling reached its $31.4 trillion limit on Jan. 19, prompting calls for radical action, even removing the ceiling altogether.

Bitcoin offers an alternative to the fiat system, which is destined to fail as a result of the inherent need to expand the money supply through money printing.

Although U.S. government BTC adoption will never likely happen, there exist several innovative solutions involving the use of Bitcoin to tackle runaway debt.

U.S. debt ceiling

The U.S. debt ceiling refers to a legislative cap on the national debt incurred by the U.S. Treasury. In other words, it limits the money the U.S. can borrow to service its bills.

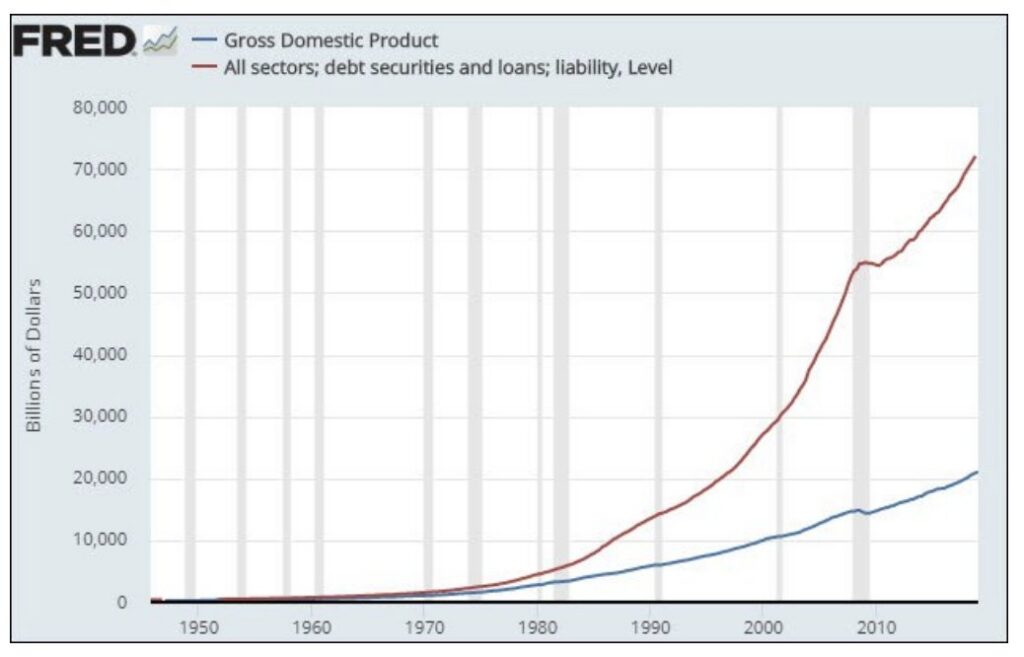

The chart below shows U.S. government liabilities far exceed Gross Domestic Product (GDP,) forcing the U.S. to raise additional funding through the sale of Treasury Bonds. However, it should be noted that the Second Liberty Bond Act (1917) prevents the sale of Treasury Bonds after hitting the debt ceiling limit.

Raising the debt ceiling requires bipartisan approval. Recent instances of approaching the debt limit in the past have been met with political posturing from both sides of the divide.

On Jan. 19, the $31.4 trillion ceiling was hit, promoting Treasury Secretary Janet Yellen to enact “extraordinary measures” by calling on Congress to raise the limit or suspend it temporarily to avoid a government shutdown.

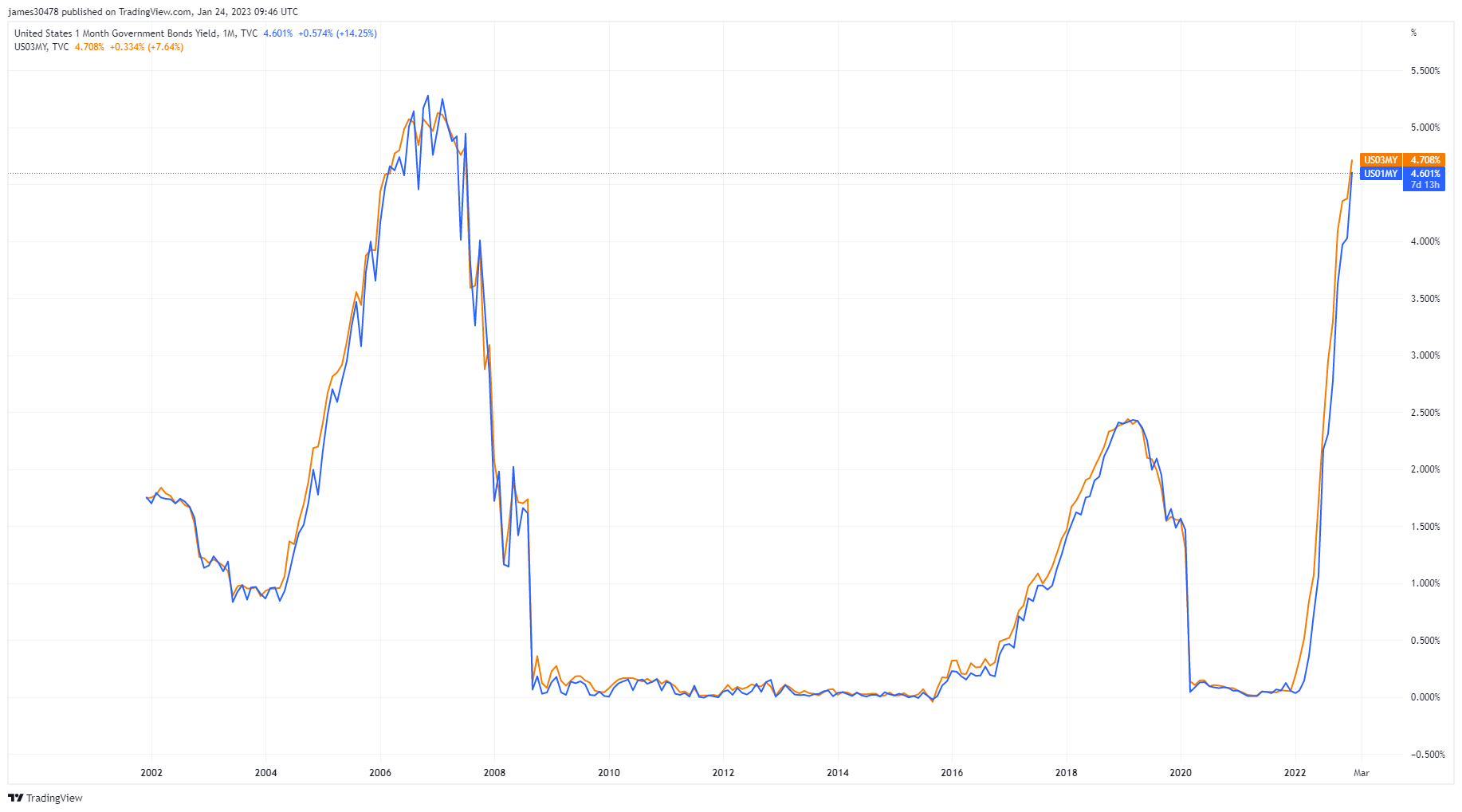

In the meantime, to keep the Treasury ticking over, Yellen announced she intends to issue around $335 billion in short-term bills to maintain government operations.

Failure to reach a timely agreement may mean economic catastrophe in delays to Social Security payments, unpaid military personnel, and severely impacting families who rely on benefits – not forgetting the potential impact on financial markets fearing a government default.

Bitcoin performance

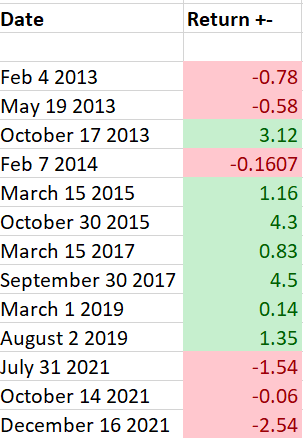

The table below documents the dates the U.S. debt ceiling was reached during Bitcoin’s history and the coin’s intraday performance on that day.

It shows a mixed result regarding whether debt ceiling crises trigger a positive or negative price performance. Of the 13 dates, seven yielded positive intraday returns, with Oct. 17, 2013, giving the best performance at 3.12% gains.

However, none of these events occurred under extreme economic conditions, including a high-interest rate and inflationary environment.

The U.S. is facing a dilemma in that the only feasible solution is to…

Click Here to Read the Full Original Article at Bitcoin (BTC) News | CryptoSlate…