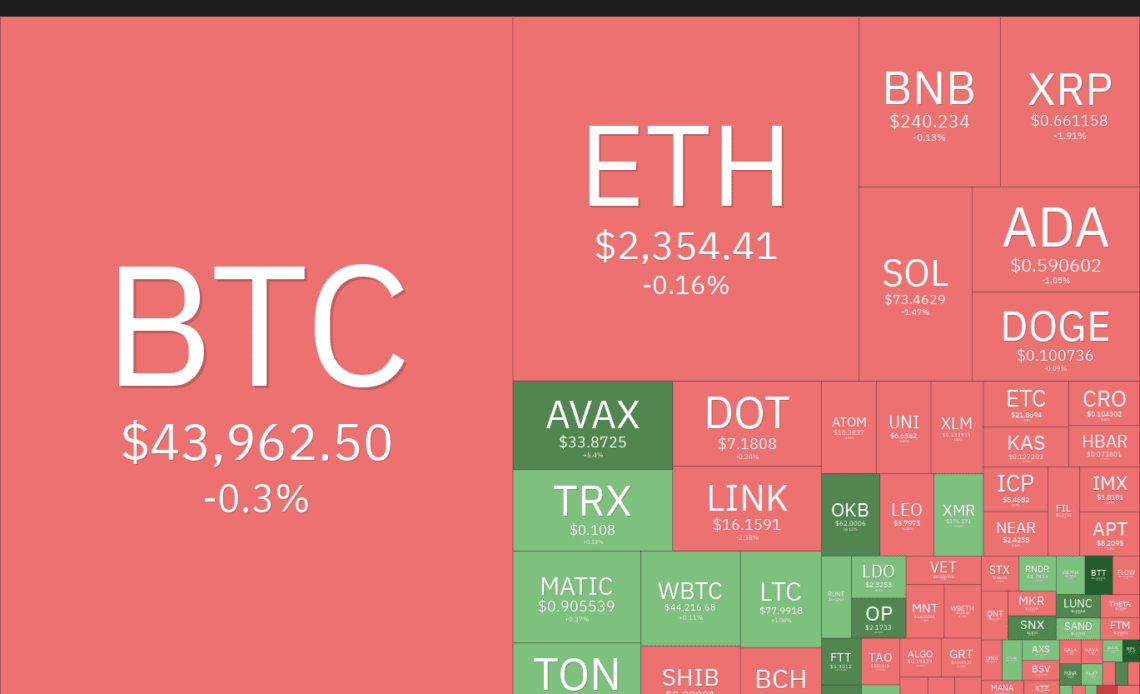

The S&P 500 Index (SPX) achieved its highest close of the year last week, and Bitcoin (BTC) also hit a new 52-week high, indicating that risky assets remain strong going into the final few days of the year.

Some analysts believe Bitcoin is done with its rally in the short term and may roll over. Popular analyst and social media commentator Matthew Hyland cautioned in a post on X (formerly Twitter) that a drop in Bitcoin’s dominance below 51.81% could signal that the uptrend has ended “along with a likely top put in.”

Usually, the first leg of the rally of a new bull market is driven by the leaders, but after a significant move, profit-booking sets in and traders start to look at alternative opportunities. Although Bitcoin has not rolled over, several altcoins have started to move higher, signaling a potential shift in interest.

Could Bitcoin continue its up-move and hit $48,000 in the next few days? Will that boost interest in select altcoins? Let’s look at the charts of the top 5 cryptocurrencies that may remain strong in the near term.

Bitcoin price analysis

Bitcoin has been consolidating in a tight range near the minor resistance at $44,700, indicating that the bulls are not rushing to the exit as they anticipate another leg higher.

The upsloping moving averages and the relative strength index (RSI) in the overbought zone indicate that bulls remain in command. If the price turns up from the current level and rises above $44,700, it will signal the resumption of the uptrend. The BTC/USDT pair could then climb to $48,000.

Conversely, if the price plunges below $42,821, the pair may slump to the 20-day exponential moving average ($40,608). This is a crucial level to keep an eye on because a bounce off it will suggest that the uptrend remains intact, but a tumble below it will indicate the start of a deeper correction toward the 50-day simple moving average ($37,152).

The 4-hour chart shows that the bulls are trying to sustain the price above the 20-EMA. If they can pull it off, the pair may rally above $44,700. The up-move could then surge to $48,000, which is likely to act as a formidable resistance.

Alternatively, if the price slides below the 20-EMA, it will suggest profit-booking by short-term traders. The pair could fall to the 38.2% Fibonacci retracement level of $41,993 and later to the 50% retracement level of…

Click Here to Read the Full Original Article at Cointelegraph.com News…