While the U.S. Federal Reserve (FED) continues to monitor the overheated economy, the most likely scenario is further interest rate hikes to curb inflation. The unintended consequence is the heightened government debt cost, creating a bullish environment for scarce assets such as commodities, stock market and cryptocurrencies.

Bitcoin’s price gain practically extinguished bears expectation for a sub-$21,500 options expiry on Feb. 17, so their bets are unlikely to pay off as the deadline approaches.

Bitcoin investors’ primary concern is the possibility of further impacts from regulators following the staking rewards program by the Kraken exchange being halted by the U.S. Securities and Exchange Commission on Feb. 9 and the crackdown on Binance USD (BUSD) stablecoin issuing on Feb. 13.

Even if the newsflow remains negative, bulls still can profit in Friday’s Feb. 17 options expiry by keeping the BTC price above $22,500, but the situation can easily flip and favor bears.

Bears were not expecting the $22,000 level to hold

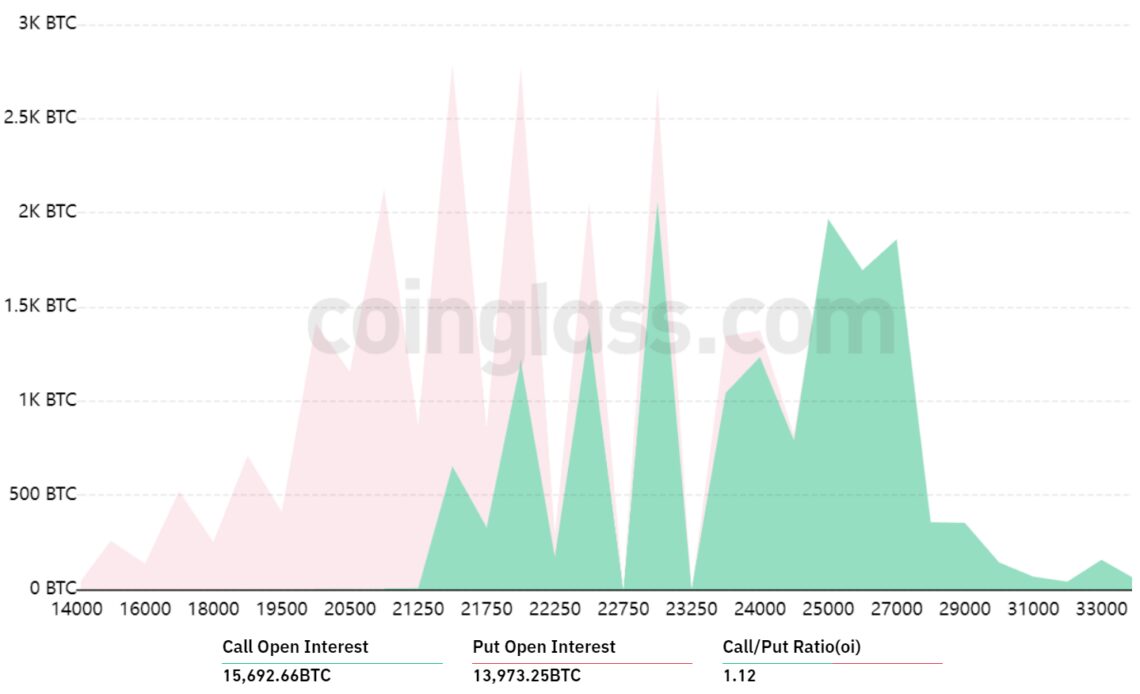

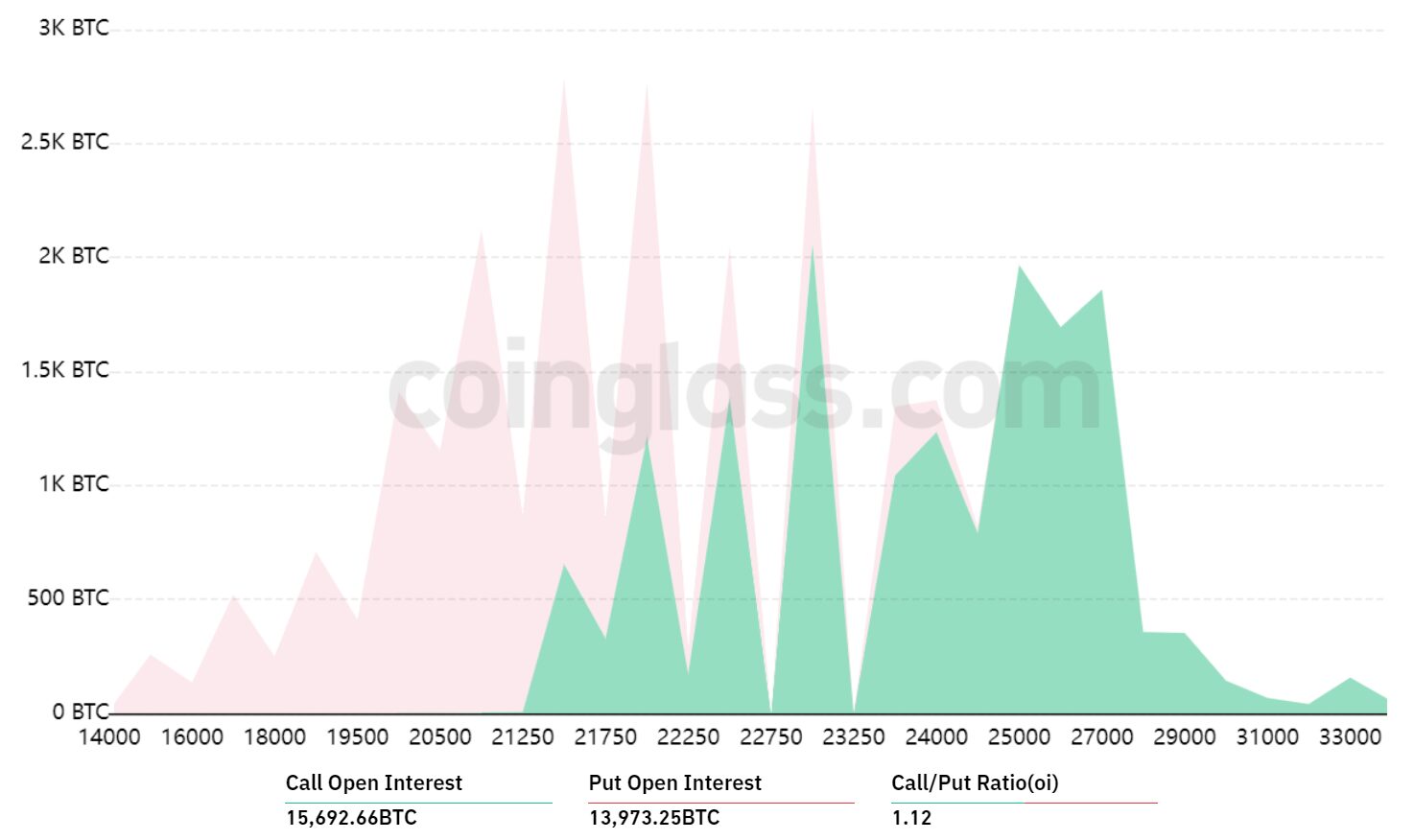

The open interest for the Feb. 17 options expiry is $675 million, but the actual figure will be lower since bears were expecting sub-$22,000 price levels. These traders became overconfident after Bitcoin traded below $21,500 on Feb. 13.

The 1.12 call-to-put ratio reflects the imbalance between the $355 million call (buy) open interest and the $320 million put (sell) options. If Bitcoin’s price remains near $22,700 at 8:00 am UTC on Feb. 17, only $24 million worth of these put (sell) options will be available. This difference happens because the right to sell Bitcoin at $21,000 or $22,000 is useless if BTC trades above that level on expiry.

Bulls aim for $23k to secure a $155 million profit

Below are the four most likely scenarios based on the current price action. The number of options contracts available on Feb. 17 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $21,000 and $22,000: 700 calls vs. 5,500 puts. The net result favors the put (bear) instruments by $100 million.

- Between $22,000 and $22,500: 1,800 calls vs. 1,500 puts. The net result is balanced between bears and bulls.

- Between $22,500 and $23,000: 3,800 calls vs. 1,100 puts. The net result favors the call (bull) instruments by $60 million.

- Between $23,000 and $24,000: 6,900 calls vs. 200 puts. The net result…

Click Here to Read the Full Original Article at Cointelegraph.com News…